Tag: property tax

Dark store theory: counties break the law, threaten residential property tax hike

Even the name — dark store theory — sounds ominous. With the willing participation of local media, some local officials…

Leavenworth city officials: raise property tax or defund police

When Leavenworth residents asked city commissioners to hold property tax flat next year – like roughly 250 local jurisdictions are…

Overland Park’s lower mill rate doesn’t equate to efficiency

Several Overland Park city council members last week justified voting for a 10% property tax increase by noting that their…

Prairie Village officials cause housing to be less affordable

Every time a government entity creates or contributes to a problem, the proposed solution is inevitably more government. The City…

Overland Park city council won’t be honest with citizens

Last night’s Overland Park revenue neutral hearing showed why Kansans support the new Truth in Taxation law. Taxpayers are fed…

Olathe proposes 9% property tax hike despite $97 million in reserve

The Olathe proposed 2022 budget includes $97 million remaining in reserves in funds that receive property tax, a 9% increase…

Go to RNR hearings and demand lower property tax

There will be a lot of RNR hearings coming in the next four weeks where local officials will try to…

Truth in Taxation is already saving millions in property tax

Now that local officials have to be honest about the entire property tax increase they impose on residents and businesses,…

Overland Park wastes $800,000 on mini-roundabouts

The late Milton Friedman could have been thinking about the City of Overland Park when he said, “when a man…

Finney County sales tax isn’t providing property tax relief

The ¼ cent sales tax that was pitched to Finney County voters isn’t living up to its promised “property tax…

Feds hope to back door Medicaid expansion in Kansas

A bill that would be a back-door way to expand Medicaid in Kansas and eleven other states that have so…

Overland Park 2022 budget: deceit and a 10% property tax hike

Overland Park residents this summer will be invited to attend the city’s first Truth in Taxation hearing where city officials…

Appraisers hiked Kansas home values 5% last year

County appraisers hiked home values by 5.2% last year across Kansas. The average increase on homes that existed the prior…

Pay increases, 9% property tax hike in Manhattan

Data from the Kansas Department of Revenue shows the City of Manhattan raised property tax by 9% last year, and…

Wyandotte County officials won’t discuss 2020 pay increases

While many residents were struggling to pay bills last year, some of the highest-paid employees of the Unified Government of…

Biden bailout (unconstitutionally) prohibits state tax cuts or rebates

Buried on page 579 of the $1.9 trillion so-called stimulus bill is a provision that prohibits state tax cuts between…

Kelly nominee may legislate from the bench to raise property tax

Johnson County Commission Chairman Ed Eilert and Rep. Stephanie Clayton, an Overland Park Democrat, have called on Kansas Governor Laura…

Gallagher issues ‘threat’ to Senator over property tax legislation

Miami County commissioner Danny Gallagher issued what Kansas State Sen. Molly Baumgardner calls a thinly-veiled threat in retaliation over her…

Kansas Reflector legislative coverage puts media bias on full display

Media bias comes in many flavors; making outright false claims, slipping editorial statements in news stories to push a political…

Election puts liberty-centric reforms on the agenda in Kansas

There’s good news on the horizon for Kansas voters who want less government control over their lives and constitutional liberty…

Public outcry over Johnson County’s 5% property tax increase

Residents gave Johnson County commissioners an earful at the August 12 public hearing on the county’s 2021 budget proposal, which…

7 Kansas counties have more government jobs than private jobs

The Kansas Department of Labor just released data showing seven counties had more government jobs than private-sector workers in the…

Cities, counties use your money to fight property tax relief

City and county officials often justify tax increases as being necessary to provide services demanded by residents. But if they…

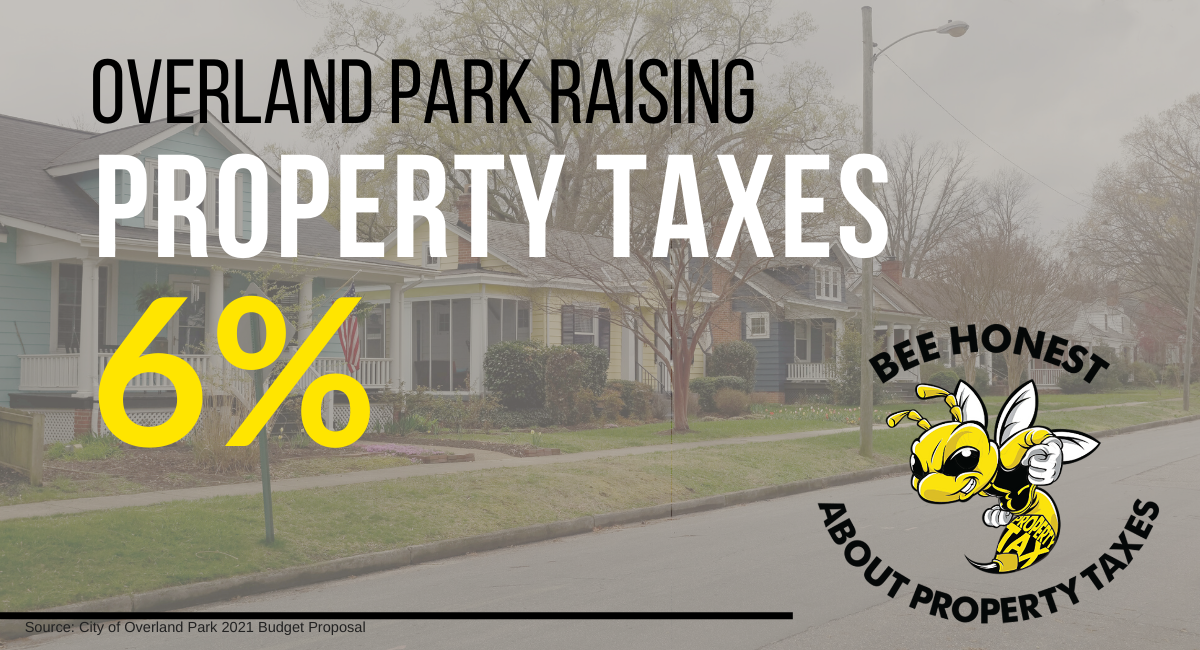

Overland Park proposes 6% property tax increase

The City of Overland Park is proposing a 6.2% property tax hike next year, according to their proposed 2021 budget. …