Last night’s Overland Park revenue neutral hearing showed why Kansans support the new Truth in Taxation law. Taxpayers are fed up with local officials not being honest about property tax increases and treating them like yokels who aren’t capable of making intelligent decisions, and that is exactly how most Overland Park city council members acted.

On a scale of one to four Pinocchios, city council earned at least five for their false and misleading claims. They have a 10% property tax increase in next year’s budget on page 21. Yet several council members called it “modest” and spoke only of the mill rate increase over this year. Councilman Curt Skoog said, “The percentages you hear tossed around today come from a certain perspective.” That’s right, Mr. Skoog; they come from the perspective of the truths buried in the city budget that you and others refuse to acknowledge.

On a scale of one to four Pinocchios, city council earned at least five for their false and misleading claims. They have a 10% property tax increase in next year’s budget on page 21. Yet several council members called it “modest” and spoke only of the mill rate increase over this year. Councilman Curt Skoog said, “The percentages you hear tossed around today come from a certain perspective.” That’s right, Mr. Skoog; they come from the perspective of the truths buried in the city budget that you and others refuse to acknowledge.

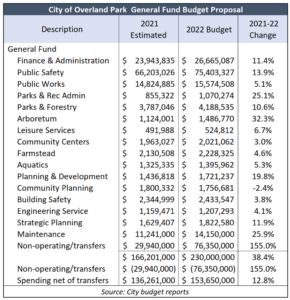

Spending is portrayed as a small increase over this year’s budget, but Overland Park is spending much less than budgeted this year; the increases over actual spending are quite large.

Finance & Administration is going up 11.4%. Parks & Rec Administration is jumping 25.1%. Other outsized increases include Arboretum (32%), Planning & Development (20%), and Strategic Planning 12%.

Finance & Administration is going up 11.4%. Parks & Rec Administration is jumping 25.1%. Other outsized increases include Arboretum (32%), Planning & Development (20%), and Strategic Planning 12%.

I spoke at the RNR hearing and shared these increases. No one said a word about the increases while I was allowed to respond, but later, Councilman Jim Kite referred to the truth as “misinformation.” No City Council member refuted the actual spending increases; they just object to the taxpayers hearing the truth.

Council and city officials pitched their so-called modest property tax increase as being necessary to pay for a new mental health unit in the police department and two other new initiatives. But that’s just how they choose to sell their proposal to the public. The truth is they could fund those new initiatives and eliminate the property tax increase by trimming a bit of unnecessary spending. For example, General Fund spending would still be increasing 8% if the entire tax hike was removed from that fund, and there would still be a $45 million increase in funds being transferred out of the General Fund to be spent elsewhere.

Residents’ concerns dismissed by city council

Five other residents spoke at the RNR hearing and several council members said they took their concerns “seriously.” But their actions and for several, their smug, condescending attitudes toward the speakers showed how they really feel about public concerns.

Councilmember Stacie Gram said as many people want their property taxes increased as those who say their taxes are too high. She believes the city “prudently” spends money and they “need” the property tax increase.

Carol Merritt said many of the 30,000 retirees living in the city cannot afford a 10% property tax increase.

“They are going to have to sell their homes and they paid and paid and paid property taxes for 30 years. I think we need to give them a little break, don’t you? It’s just not right.”

Deborah Dennis said, “People are being priced out of their homes by high taxes. Our tax payment is over half our house payment right now. The elderly can’t afford to live in their homes.”

Earl Long told council members that they “should do a little belt-tightening like everybody else.”

Only Council members Scott Hamblin and Faris Farassati displayed genuine concern for taxpayers; they were also the only two members who voted against the 10% property tax increase.

Lack of transparency on the tax increase came up several times. Scott Mosher said public forums don’t do much good because the facts aren’t readily available to the public.

“Where is the information, other than maybe on the website or hidden in the budget, where an average person who works 60 hours a week trying to make it with COVID…where are they going to get that information? I would like to know what each councilman has done to educate their constituency about Truth in Taxation.”

Mayor Carl Gerlach later read off a list of communications that he said explained Truth in Taxation, but most of them were about the budget or agenda items. He didn’t cite any example of city officials telling the truth – that they are going to take in 10% more property tax dollars.

We wrote to Mayor Gerlach and the communications department, inquiring whether any of the communications on that list said the city is proposing a 10% tax increase.

At this writing, there has been no reply.

Councilmember Paul Lyons said he believes that a tax increase is “the right thing to do.” He condescendingly forgave residents for not understanding the revenue neutral issue, calling it “complicated.” It’s not.

Another of his statements caused much eye-rolling in the audience.

“I respectfully disagree with most of the comments I heard tonight, objecting to us proceeding…with a rate that is higher than last year’s property tax. It’s a conservative budget.”

Overland Park’s 10% property tax increase comes on the heels of a 320% increase since 1997. The prior years’ hikes are more than triple the combination of inflation and population growth.

Several council members actually blamed citizens for the property tax increase, saying resident demand for services is high. But they probably didn’t ask taxpayers if they are willing to pay higher taxes for those services. A few years ago, Johnson County Commission Chair Ed Eilert used the same ‘taxpayer demand’ excuse for a big tax increase he rammed through. Eilert didn’t mention, however, that the community survey showing appreciation for services also said taxpayers were not willing to pay higher taxes.

Taxpayers deserve honesty from elected officials, and they deserve to be treated with respect. The treatment they received last night from most of the Overland Park council members was repugnant and taxpayers are owed a public apology at the next council meeting.