Tag: property tax

“Scoop and Score” makes false claim, won’t substantiate rosy economic impact of bringing the Chiefs to Kansas

Much like quarterbacks use the “silent count” in noisy situations near vocal opponents, the organizers of “Scoop and Score” working…

Johnson County hires Government Relations Coordinator as taxpayer-funded lobbyist

Johnson County has hired a Government Relations Coordinator at a salary of $122,000 per year. The new position increases county…

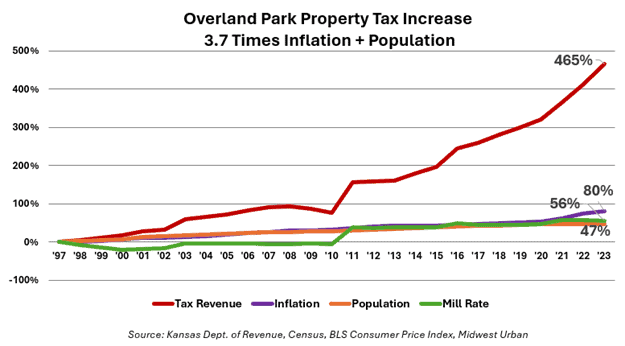

Overland Park Council member Melissa Cheatham deceives residents on property tax hike

Overland Park City Council member Melissa Cheatham recently demonstrated why the Kansas Legislature passed the Truth in Taxation Act in…

Most Kansas cities lost population over the last three years

Most of the largest cities in Kansas have lost population over the last three years. According to data from the…

Former Manhattan mayor defends city’s taxes, salary increases

Manhattan city taxpayers have seen their property taxes increase by 25% since 2019. Since 1997, taxes increased by 351%; that…

Nearly 60% of Kansans favor single tax rate: poll

Americans for Prosperity – Kansas (AFP-KS) has released a poll showing a bipartisan coalition of taxpayers strongly supports replacing the…

Democrats push property tax hike on cars, farms, businesses

With the legislative session just around the corner, Kansas House Democrats are pushing a big property tax increase on cars…

Clerical error saves Merriam residents $1 million in property tax

Merriam residents recently received a postcard informing them of a “clerical error” that will reduce property tax revenue next year.…

House Speaker Hawkins plans to reduce property tax next year

Vowing that “we’re going to give tax relief”, Kansas House Speaker Dan Hawkins floated a property tax cut proposal to…

Former Lansing school board member misleads community on revenue neutral

Former USD 469 Lansing school board member Beth Stevenson is telling the community that holding revenue neutral on local property…

Flat tax in SB 169 is good for Kansas taxpayers

by Grover Norquist and Dave Trabert It was clear from the very beginning. Despite winning reelection on a message of…

Cherokee County reduces property tax while maintaining services

While many local government entities have steadily increased property tax, Cherokee County has reduced property tax revenue for two straight…

Kansas Legislature passes $1.4 billion tax relief bill in SB 169

Unless Governor Laura Kelly wields her veto pen on SB 169, Kansas taxpayers can look forward to $1.4 billion in…

Douglas County officials consider reparations program to address homelessness

The Douglas County Commission has been presented a 5-year Strategic Plan to address homelessness in the county that includes a…

Change in median sales price distorts Johnson County valuations

Johnson County recently announced a 12% increase in residential property values for 2023, which officials say is justified because the…

SB 79 proposes theoretical property tax relief with a local earnings tax

A unique “tax swap”, allowing counties to institute an earnings tax, if approved by voters, to lessen some of the…

Tax fairness, profitability at the heart of the debate over HB 2062

The House Taxation Committee hearing on HB 2062 featured the relatively-new idea of car sharing and an established rental car…

Reps. Miller and Amyx propose $700 million property tax hike

At a press conference earlier this week, Reps. Vic Miller (D-Topeka) and Mike Amyx (D-Lawrence) announced a plan to save…

Leavenworth school board : No property tax increase this school year

The Leavenworth USD 453 Board of Education voted 4-3 not to impose a property tax increase on patrons for the…

Most elected officials in Sedgwick County propose big property tax hikes

Sedgwick County residents are being hammered by government-spending-induced inflation. U.S. Census data show the county lost population last year, and…

Elected officials use residential valuation spike to hide property tax increases

The Wyandotte County 2023 budget presentation touts a half-mill reduction as property tax “savings” and “tax relief,” but in reality,…

Shawnee City Council overrules mayor, staff in property tax increase

A new conservative majority on the Shawnee City Council flexed its muscle and recently approved a cut of two mills…

Big property tax hikes proposed by most officials in Johnson County

As if past property tax increases that far exceed the change in inflation and population aren’t bad enough, most elected…

Leavenworth Co. superintendents reluctant to discuss property tax with county

Leavenworth County commissioners sought a meeting with public school superintendents and school board members to discuss property tax and mil…