Overland Park City Council member Melissa Cheatham recently demonstrated why the Kansas Legislature passed the Truth in Taxation Act in 2021. The act was a response to voter outrage over local elected officials’ failure to be honest about the property tax hikes they impose.

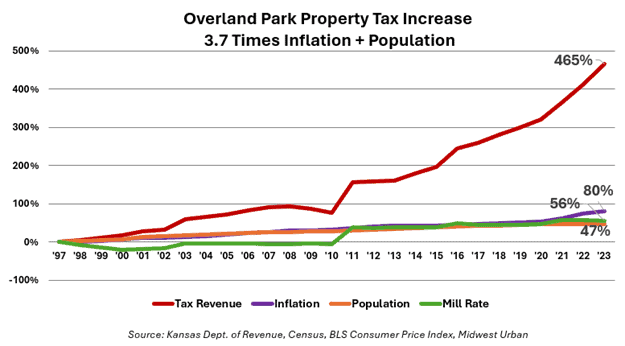

Chatham and fellow City Council member Drew Mitrisin spoke to a group of citizens at The Forum, a senior living facility in Overland Park. One of the participants, Thad Carver, asked them to explain why city property taxes have increased nearly four times as much as inflation and population since 1997.

Carver says Cheatham questioned the integrity of the statistics because, in her view, the source had a “point of view.” Carver got the chart from KansasOpenGov.org, which uses data from the Kansas Department of Revenue and is published by The Sentinel’s owner, Kansas Policy Institute.

Kansas Policy Institute does have a point of view – it’s called the truth. The Department of Revenue collects data from cities and counties, which shows that Overland Park’s property tax revenue increased by 465% since 1997.

Elected officials like Cheatham and Overland Park Mayor Curt Skoog use the ‘point of view’ excuse in hopes that taxpayers will only pay attention to changes in the mill rate. They like to say they are ‘holding the line’ on property tax while forcing property owners to write bigger checks each year.

Cheatham makes another false claim

Cheatham also told the crowd that the revenue-neutral provision of Truth in Taxation hamstrings the City Council because they cannot raise property taxes, but that is also not true. As Carver explained to the audience, the law merely requires that elected officials hold a public hearing and vote on the entire amount of the tax increase they impose; it places no limits on tax increases.

Each year, when new valuations are released, the County Clerk reduces the mill rate so that they will generate the same dollar amount of property tax. Elected officials can vote to keep the revenue-neutral rate or exceed it.

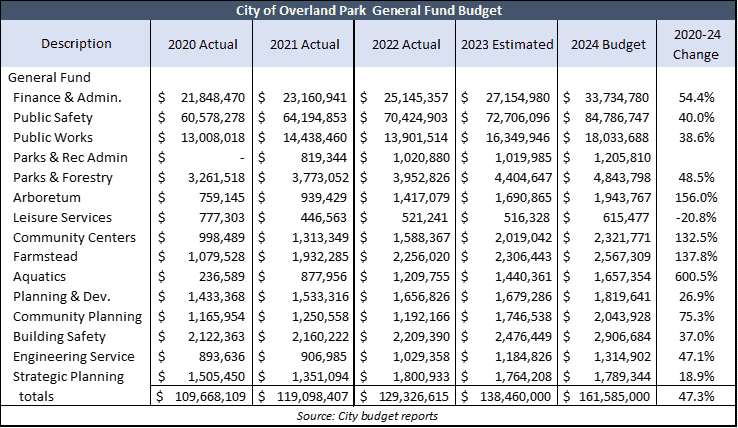

Mitrisin and Cheatham told the crowd they doubted they could ever vote to hold property taxes flat without compromising services, but their options to do so are endless.

General Fund spending jumped 47% over the last four years. By sharpening their pencils, elected officials could have held property tax revenue flat over that period and still had big spending increases.

The City could also choose to hold less money in reserve. This year’s General Fund budget shows a $93 million reserve to begin the year. Every entity needs some reserves, but $93 million is far more than necessary.

Elected officials like Cheatam and Mitrisin demonstrate why voters clamored for the Truth in Taxation / revenue-neutral legislation and why more accountability is needed.

Last year, The Kansas Senate passed a proposed constitutional amendment limiting the increase in assessed valuation to 4% annually. Elected officials who rely on double-digit valuation increases to impose big tax hikes could significantly increase the mill rate to make up the difference, but they would have to own it rather than hide behind valuation jumps.

Last year, The Kansas Senate passed a proposed constitutional amendment limiting the increase in assessed valuation to 4% annually. Elected officials who rely on double-digit valuation increases to impose big tax hikes could significantly increase the mill rate to make up the difference, but they would have to own it rather than hide behind valuation jumps.

This year, the House Taxation Committee held a hearing on the proposed amendment, but it didn’t get a vote in the full House and died with the conclusion of the regular legislative session. But there may still be a slight shot at it.

Now that Governor Kelly has called a special session for tax relief, the Legislature could start anew on a constitutional amendment. A two-thirds majority vote in both chambers would send the amendment straight to the ballot, denying Governor Kelly another tax veto and compelling elected officials like Melissa Cheatham to be more honest about tax hikes.