Tag: Tax Foundation

SB 259 promises income tax reductions based on increases in state revenue

Senate Bill 259 proposes a path to a flat income tax in Kansas based on increases in state revenues above…

SB 546 would end two business subsidies, cut corporate tax rate

Corporate income taxes in Kansas would be reduced to 5.75%, and two business subsidies — Promoting Employment Across Kansas (PEAK)…

SB 79 proposes theoretical property tax relief with a local earnings tax

A unique “tax swap”, allowing counties to institute an earnings tax, if approved by voters, to lessen some of the…

More efficient spending keeps taxes low in other states

Every state provides the same basket of services, but some of them have an efficient spending mentality and that allows…

Kelly’s ‘bring it on’ comment about recession is an affront to Kansans

There were 38,000 fewer Kansans working in May of this year, compared to January 2020. Business owners and individuals are…

SB 347: $1 billion+ taxpayer subsidy for one mystery company

Governor Laura Kelly and her Commerce Department are behind Senate Bill 347 (SB 347), which could provide more than $1…

Kansas can avoid potential $200 million tax hike on business

Citing information from the National Council on State Legislatures, the Tax Foundation says the Kansas unemployment trust fund is $196…

Kelly admin celebrates destructive business tax climate

Apparently desperate for some sort of win to distract from a moribund state economy, Kansas Governor Laura Kelly, in a…

Biden bailout (unconstitutionally) prohibits state tax cuts or rebates

Buried on page 579 of the $1.9 trillion so-called stimulus bill is a provision that prohibits state tax cuts between…

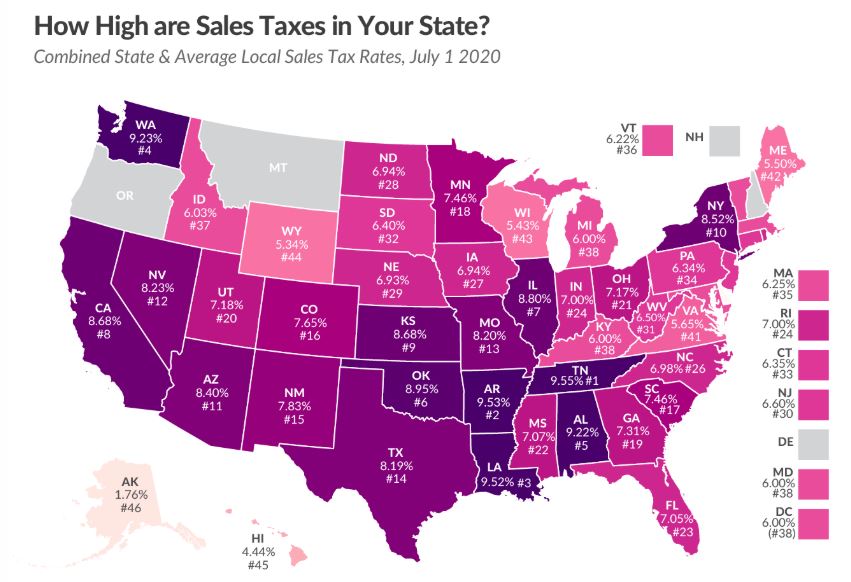

Kansas has 9th highest state and local sales tax rate

According to the Tax Foundation 2020 mid-year sales tax ranking, Kansas has the ninth-highest combined state and local sales tax…

Kansas drops to #34 in state business tax climate

Kansas dropped seven places in the Tax Foundation annual state business tax climate index. Kansas is in 34th place nationwide,…

Attorney General: Kelly administration risks lawsuits on remote sales tax policy

Kansas Attorney General Derek Schmidt issued a legal opinion on September 30, stating Governor Laura Kelly’s unilateral expansion of remote…

Gov. Kelly orders tax increase on remote sellers

For the third time in a matter of weeks, Gov. Laura Kelly has attempted to usurp the authority of the…

Kansas Sales Tax 8th Highest in the Nation

Kansas has the eighth highest state and local average sales tax rate, according to a new study from the Tax…

Tax Foundation Director Talks ‘Trump Windfall’ with Senate Committee

An economist at the Tax Foundation told the Kansas Senate Taxation committee states can lose competitive edge if they don’t…

Americans Will Spend More on Taxes than Groceries, Food, Housing Combined in 2018

As Americans scramble to meet the national deadline to pay their taxes this year, they’ll need to work through April…

31 States Have Higher Gasoline Taxes Than Kansas

Drivers pay less in gasoline taxes at Kansas pumps than they do in many other states, according to data released by the…