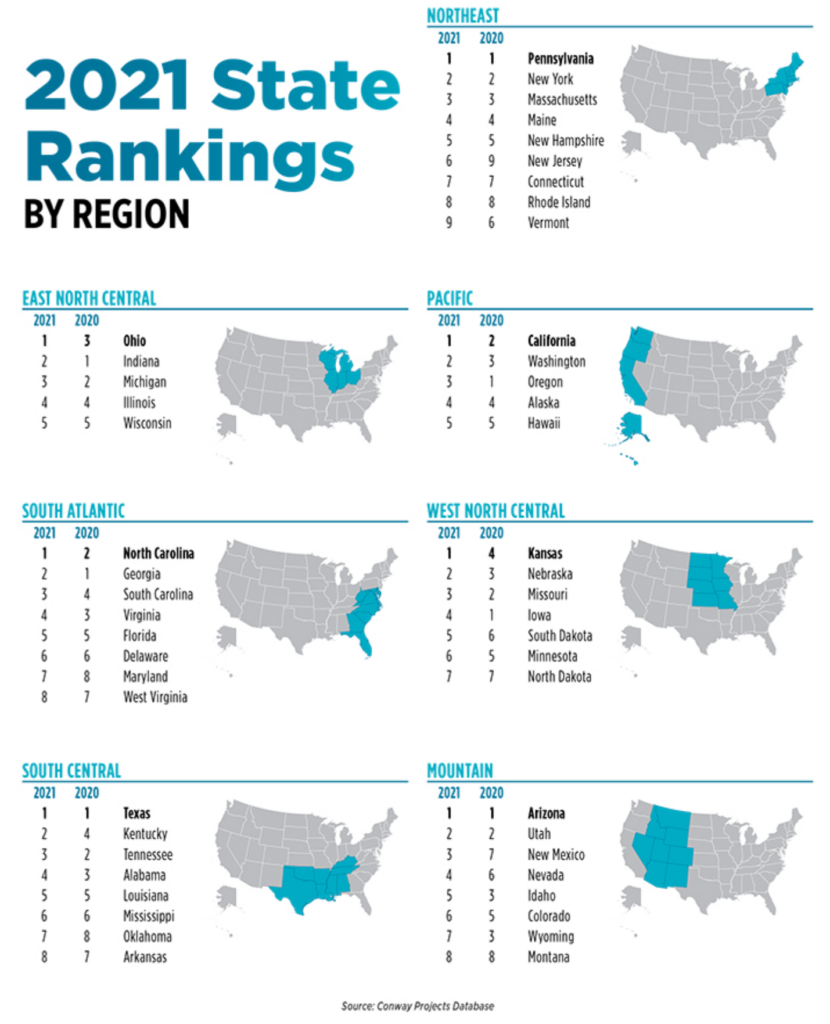

Apparently desperate for some sort of win to distract from a moribund state economy, Kansas Governor Laura Kelly, in a release, is touting an award from Site Selector magazine as having the top business climate in the West North Central region of the United States in 2021.

That’s akin to a child getting a D on an exam, but proudly claiming to have the best grade in the sixth row of the classroom.

Bragging about sub-par performance for personal gain is one thing, but, in this case, Governor Kelly and Lt. Gov. David Toland are celebrating policies that damage the vast majority of businesses in Kansas. The #1 business tax climate ranking in the West North Central Region comes from a magazine whose subscribers are interested in which states provide the best incentives, but the Tax Foundation says incentives are part of the reason that Kansas has the worst business tax climate on mature businesses.

The Tax Foundation says, “Tax burdens in Kansas are slightly below average for new firms — and among the lowest in the nation for new manufacturers and distribution centers — but Kansas ranks worst in the nation for mature firms.”

Kansas gives very generous incentives to new businesses, under the Promoting Employment Across Kansas — or PEAK act — however once those incentives expire, business taxes go up and become a disincentive to remain in Kansas. An academic study found that PEAK doesn’t work, and another study showed that STAR bonds, another incentive deal favored by the Kelly administration, do not create net new jobs.

Site Selection’s top ten states nationwide for business tax climate are North Carolina, Georgia, Texas, Ohio, Indiana, Kentucky, South Carolina, Arizona, Tennessee, and Michigan. No states in the West North Central region, the Northeast, or the Pacific region made the top ten. Three top-ten states are ranked #3 in their regions, indicating that Kansas is likely in the middle of the pack for site selectors – as the Tax Foundation said.

But mainstream media dutifully repeats proclamations from a Democratic governor, and the Kelly administration took the opportunity to pat itself on the back.

“This honor is the direct result of Governor Kelly’s commitment to our state’s economy,” Lieutenant Governor and Commerce Secretary David Toland said in the release. “Kansas is rapidly building a national, and international, reputation for innovation, strategic investment, economic growth and prosperity – all of which will continue to bring more businesses to our state. The Kelly administration’s approach to economic development is creating momentum that will last well into the future, and people around the world are noticing.”

High taxes and high utility rates harm business and employees

As reported in Kansas Policy Institute’s 2021 Green Book, the Sunflower State has some of the highest effective property tax rates in the nation. Kansas has the worst rate on rural commercial property, the third-highest effective rate on rural industrial property, and the 11th-highest on urban commercial property. Kansas Policy Institute owns the Sentinel.

Kansas is also massively over-governed, having the third-highest number of government employees per capita.

Kiplinger’s says Kansas has the fourth-worst tax environment for retirees in the nation and the Tax Foundation says Kansas has the 9th highest state and local sales tax rate in the nation. A rate study commissioned by the Kansas Corporation Commission found that electric rates are 25 percent higher than surrounding states — in part because of, yet again, higher taxes.

Kelly admin won’t substantiate investment, job claims

In the release, Kelly claims that “since 2019, Kansas has seen nearly $6 billion in new business dollars invested in the state, and nearly 26,000 jobs.”

However, earlier this year, the Sentinel tried to get the Kelly administration to substantiate just the claims of $2 billion in new investment and “8,100 jobs created or saved.”

The administration declined to provide transparent information for 2019 or 2020. Claims of “jobs created or saved” are easy to make, and very difficult to disprove if there is no corroborating information and, indeed, apparently the administration is simply taking the employers’ word for it.

Meanwhile, Kansas lost private-sector jobs in April and may not reach pre-pandemic employment levels until some time next year. United Van Lines says Kansas is the sixth most departed state in the nation, and a February report from the Bureau of Economic Analysis shows Kansas ranks near the bottom of states in real (inflation-adjusted) personal income growth for the third quarter of 2020 compared to a year ago.

But Kelly and Toand will tell you they are creating a great business tax climate.