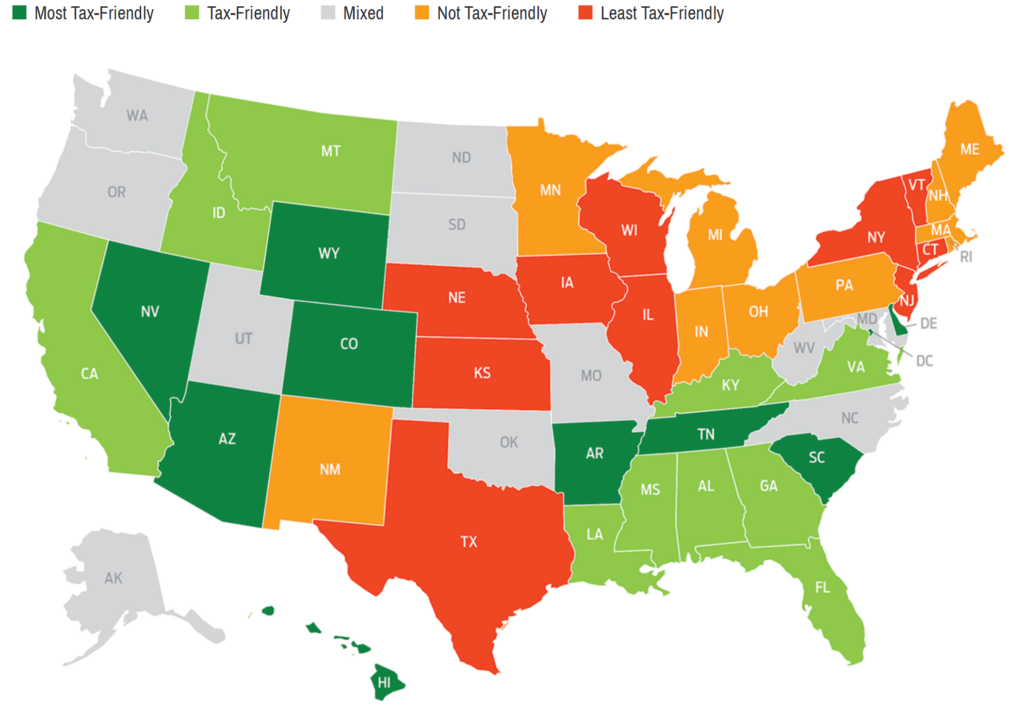

According to Kiplinger’s, Kansas is the fourth-worst state in the nation for retirees, based on each state’s tax scheme.

According to the report, with a state income tax ranging from 3.1% to 5.7%, an average combined state and local sales tax rate of 8.69%, and a median property tax rate of $1,369 per $100,000 of assessed home value, Kansas has the dubious distinction of ranking worse than New York, which comes in at 9th-worst, and Vermont as sixth-worst with a steep top income tax rate of 8.75%.

The only states ranking worse than Kansas are Connecticut, Illinois, and New Jersey.

While Kansas does not have an estate or inheritance tax, distributions from private retirement plans (including IRAs and 401(k) plans) and out-of-state public pensions are fully taxed. Kansas also taxes Social Security benefits received by residents with a federal adjusted gross income of $75,000 or more. Only military, federal government retirement payments, and participants in Kansas Public Employees Retirement System (KPERS) pensions are exempt from state income taxes.

Moreover, Kansas has the ninth-highest combined sales tax in the nation, and property taxes are well above the national average, with the state coming in 15th.

Property taxes in Kansas, as noted, are the 15th highest in the nation, and indeed increased by 151% between 1997 and 2018, or more than three times the inflation rate of 50%. Property tax for local government (cities, counties, townships, etc.) totaled $2.7 billion in 2018, or about 54% of all property tax. Local government also imposed the largest increase, averaging 168%.

Spending pushing taxes higher

Dave Trabert, CEO of Kansas Policy Institute (the Sentinel’s owner) said late last year that tax rates are a direct reflection of how much cities, counties, and states choose to spend.

“Every state provides the same basic services, but those that spend more have to tax more. For example, the states with an income tax spent 55% more per resident in 2018 than the states without an income tax. Our 2020 Green Book shows Kansas spent 40% more per resident than the states without an income tax.”

KPI’s Green Book shows Kansas has some of the highest effective property tax rates in the nation, which Trabert also attributes to excessive local government spending.

“Local sales tax and property tax rates are unnecessarily high because Kansas is massively over-governed. Kansas has 36% more local government employees per capita than the national average.”

Residents leaving

Added to this is an annual study by United Van Lines, which shows Kansas is the sixth-most moved out of state in the nation, and nearly a quarter of the people who left the state did so to retire elsewhere — presumably to places friendlier to retirees.

The only states with more net loss than Kansas were some familiar names — New Jersey, New York, Illinois, Connecticut, and California. North Dakota is an outlier, in seventh as a low tax state, but the collapse of the oil market thanks to pandemic restrictions likely exacerbated out-migration there. Rounding out the ten worst were Massachusetts, Ohio, and Maryland.

Utility rates a factor

Kiplinger only examined the tax landscape, but electric rates are another exacerbating factor for retirees, particularly in rural areas.

According to a recent study of 2018 energy prices prepared by London Economics for the Kansas Legislature, Kansas has some of the highest electricity prices in the region — particularly among co-ops.

“The average electricity prices in Kansas were higher by 20% to 36% than the regional average, depending on customer type,” the study read. The largest difference to the regional average (36%) was for industrial customers. Co-ops in Kansas also have the highest average electricity price for commercial customers in the region.