Tag: sales tax

Sedgwick County sales tax proposal would simply the tax shift burden and likely increase it

Sedgwick County is floating a new “property-tax relief” proposal that — while it would theoretically lower property taxes — would…

Former Manhattan mayor defends city’s taxes, salary increases

Manhattan city taxpayers have seen their property taxes increase by 25% since 2019. Since 1997, taxes increased by 351%; that…

Nearly 60% of Kansans favor single tax rate: poll

Americans for Prosperity – Kansas (AFP-KS) has released a poll showing a bipartisan coalition of taxpayers strongly supports replacing the…

Kelly administration wants $15 million to bail out failed incentive program

The Kelly administration is asking for approximately $15 million a year to prop up an incentive program that has shown…

Masterson vows override efforts on PBR, fairness vetoes

Senate President Ty Masterson criticized Governor Laura Kelly’s vetoes of the Parents’ Bill of Rights, Fairness in Women’s Sports Act,…

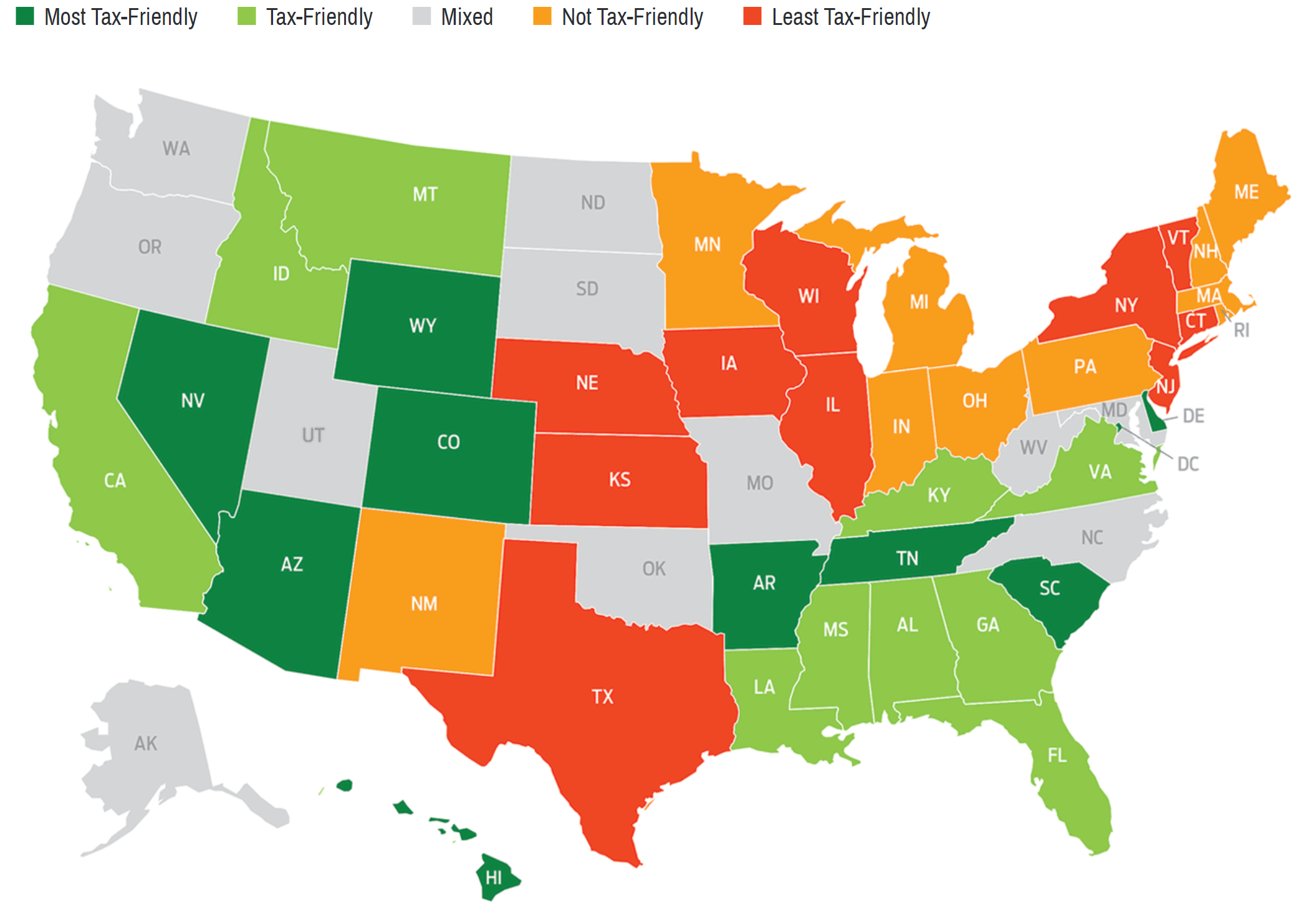

Kansas has 4th-worst tax environment for retirees in the nation

According to Kiplinger’s, Kansas is the fourth-worst state in the nation for retirees, based on each state’s tax scheme. According…

House tax committee chooses government interests over taxpayers

At Tuesday’s House Taxation Committee, Rep. Ken Corbet (R-Topeka) expressed frustration that the committee seems to favor government interests over…

Kansas drops to #34 in state business tax climate

Kansas dropped seven places in the Tax Foundation annual state business tax climate index. Kansas is in 34th place nationwide,…

Gov. Kelly’s illegal sales tax policy hurts small businesses nationwide

Kansas Governor Laura Kelly’s likely illegal attempt to collect sales tax on the first dollar of all internet and catalog sales…

Business leaders won’t rule out a tax increase for Wichita Riverfront project

The private organizations pushing the Riverfront Legacy Masterplan won’t rule out tax increases for changes to Century II and the…

Kansas Sales Tax 8th Highest in the Nation

Kansas has the eighth highest state and local average sales tax rate, according to a new study from the Tax…

Would Online Sales Tax Collections Be a Savior of Kansas’ Budget?

Lawmakers are banking on the U.S. Supreme Court overturning a 1992 decision, known as Quill, that limits the ability of…

KS Revenue Spikes; Officials Warn It’s Not a Windfall

Kansas collected $165 million more than expected in state revenues in January, but officials warn federal tax reform influenced the…

House Committee Considers Taxing Personal Services

Should services be taxed? And if so, which services? Lawmakers wrestled with those questions during a House Tax Committee hearing…