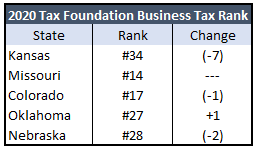

Kansas dropped seven places in the Tax Foundation annual state business tax climate index. Kansas is in 34th place nationwide, down from 27th place. The change puts Kansas  well below regional neighbors. Missouri has the best regional ranking at #14, followed by Colorado (#17), Oklahoma (#27), and Nebraska (#28).

well below regional neighbors. Missouri has the best regional ranking at #14, followed by Colorado (#17), Oklahoma (#27), and Nebraska (#28).

According to the Tax Foundation, the state’s aggressive stance on tax increases last year caused the 7-position drop to #34. “Through a combination of legislative inaction, vetoes, and agency actions, Kansas has taken an aggressive stance on the taxation of international income and is moving forward with sales tax collection requirements for remote sellers without adopting a safe harbor for small sellers.”

The legislature did take action, however. Governor Kelly and her Department of Revenue are really to blame for twice vetoing legislation that would have prevented the taxation of international income, allowed individuals to itemize deductions, and implemented the remote sales tax safe-harbor provisions.

The sales tax collection requirement referred to is the Kelly administration collection of sales tax for any sales to Kansas residents. The Sentinel reported on the impact of this policy on small businesses nationwide since August. The whole issue was triggered by a Supreme Court ruling. The majority of states as a result of the ruling are not taking the aggressive stance and this played into the Tax Foundations ranking.

Michael Austin, Director of the Center for Entrepreneurial Government at the Kansas Policy Institute, the parent company of the Sentinel, says the ranking from the Tax Foundation is consistent with Kansas’ reliance on tax revenue due to excessive spending.

“This is another sign Kansas desperately needs to catch up with the rest of the country. Under Kansas’ current tax code, businesses have another incentive to keep profits and business activity outside of state borders. That’s less capital investment, job creation, consumer purchases & incoming residents.“

The Tax Foundation is very familiar with the Kansas tax code. In December the Tax Foundation in partnership with the Kansas Chamber produced a Kansas Tax Modernization plan. As reported by the Sentinel, the report underlines the issues that dovetail with issues presented with the State Business Tax Climate index.