Every state provides the same basket of services, but some of them have an efficient spending mentality and that allows them to have lower taxes. It’s not tourism, weather, or access to natural resources; it is efficient spending.

The more that a state chooses to spend on education, social services, transportation and other services, the more it must tax, and the differences are stark.

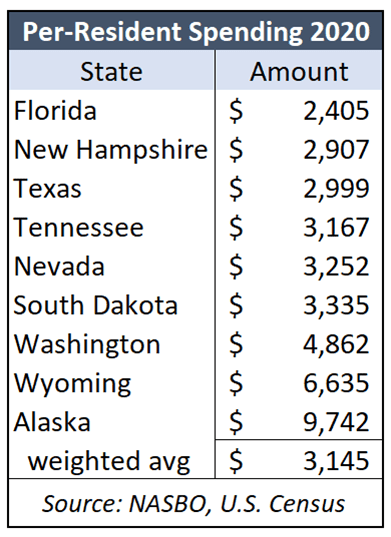

According to the National Association of State Budget Officers, the states with an income tax spent $4,771 per resident in 2020; that is 52% more than the states without an income tax, which spent $3,145 per resident.[i]

According to the National Association of State Budget Officers, the states with an income tax spent $4,771 per resident in 2020; that is 52% more than the states without an income tax, which spent $3,145 per resident.[i]

Florida has the lowest spending per resident ($2,405) among the nine states in the adjacent table that do not have an income tax. Kansas spent more than twice that amount, at $4,887 per resident.

To account for the possibility that some states push costs off on local government, we compare the ten states with the highest combined state and local tax burden with the ten lowest-burden states as determined by the Tax Foundation. That difference is 54% per resident ($5,365 vs. $3,473).

Kansas Policy Institute, the Sentinel’s parent company, has tracked state spending since 2012 in its annual Green Book publication, and the spending gaps have been consistently large.

It may be intuitive to assume that Florida’s Gulf Coast location is the reason it has no state income tax, but that is merely an assumption.

But the facts don’t stop media and other opponents of tax relief from denigrating attempts to provide tax relief in Kansas. Most recently, the Kansas Reflector published a column opposing efforts to reduce marginal income tax rates that made the geography argument and poo-pooed the competitive advantages of tax relief. Again, it is not geography or tourism; it’s efficient spending that allows some states to tax a lot less.

States that spend less, tax less…and grow more

When people and businesses pay less in taxes, there is more money left in the economy to create economic growth.

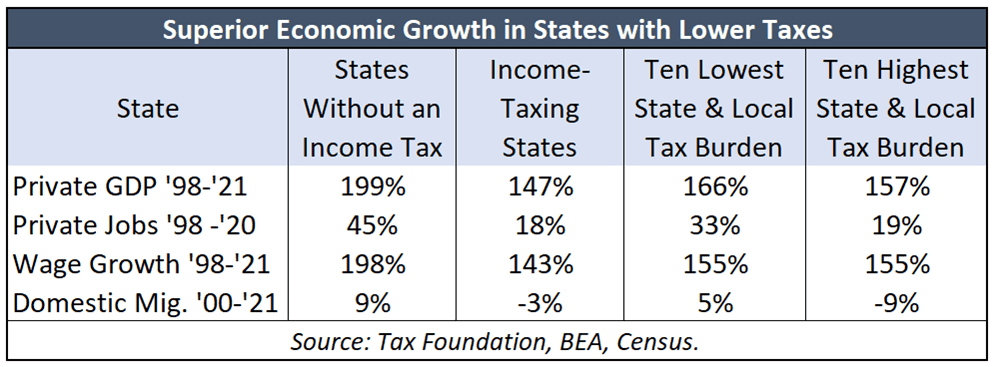

For example, private-sector employment jumped 45% between 1998 and 2020 in the states without an income tax but just 18% in the other states. The ten states with the lowest state and local tax burden added 33% more jobs versus 19% for the ten highest-burden states.

There are also significant differences in private sector GDP and wage distribution, especially for the states that don’t have an income tax.

There are also significant differences in private sector GDP and wage distribution, especially for the states that don’t have an income tax.

Domestic migration advantages – U.S. residents moving in and out of states – reflects a very important element of competitiveness. Many government officials defend profligate spending by claiming to have better quality services, but domestic migration patterns indicate that people believe states with lower taxes provide better value.

The nine states without an income tax had a net gain of 6.8 million residents between 2000 and 2021, and they came from states that tax income. Having nearly 7 million more residents equates to 9% of those states’ collective population. Only Alaska had a net loss on domestic migration among the states that don’t tax income. No one moves to South Dakota, Wyoming or New Hampshire for the weather, but those states each have net gains from domestic migration, while California and Hawaii have big losses.

Sure, Florida has a lot of tourism, and Texas has a lot of oil, but they could still have a high tax burden if they spent more. The economics are clear: states that spend less, tax less…and grow more.

_______

[i] Per-resident spending for groups of states is total spending for the group divided by total population for those states.