Tag: revenue neutral

How politics derailed property tax relief in the 2025 Legislature

Republicans and Democrats began the 2025 legislative session with much swagger about passing meaningful property tax reform. However, they adjourned…

Vanity and desire to help local government stand in the way of property tax relief

Republicans and Democrats began the 2025 legislative session with much swagger about passing meaningful property tax reform. However, they adjourned…

(At least) a $61 million tax increase is coming if revenue-neutral is repealed

More than 2,300 local governments are not raising property taxes this year, and almost 500 more are raising taxes by…

Kansas House votes to increase property tax

Yes, the headline is correct. The Kansas House of Representatives today effectively voted to increase your property tax by again…

Senate Tax Committee preserves revenue-neutral, adds protest petition to control property tax increases

The Kansas Senate Committee on Assessment and Taxation restored the revenue-neutral transparency protections to a bill passed by the Kansas…

House tax committee hears proposal to repeal revenue-neutral; we have a better idea

The Truth in Taxation / Revenue-Neutral Act passed in 2021 is easily the most effective property tax protection that ever…

Software error causes Kansas counties to issue incorrect Revenue Neutral notices

As many as 80 of the 105 counties in Kansas sent out miscalculated revenue neutral notices to their taxpayers. The errors…

Lansing school board gets deceptive budget proposal from USD 469 Superintendent Marty Kobza

The August 26 budget hearing conducted by the USD 469 Lansing school board was loaded with deception and subterfuge, seemingly…

Lansing USD 469 school board to debate budget with a 24% property tax hike

USD 469 taxpayers will gather in Lansing to hear a presentation on the 2024-2025 budget that will exceed revenue-neutral. A…

Leavenworth, Lansing superintendents prepare deceptive property tax presentation

Leavenworth USD 453 Superintendent Dr. Kellen Adams and Lansing USD 469 Superintendent Marty Kobza will discuss property taxes before the…

Easton USD 449 gives taxpayers a win with revenue-neutral budget in upcoming school year

Despite ever-increasing property assessments statewide, school patrons in Leavenworth County’s Easton School District will not pay additional property taxes in…

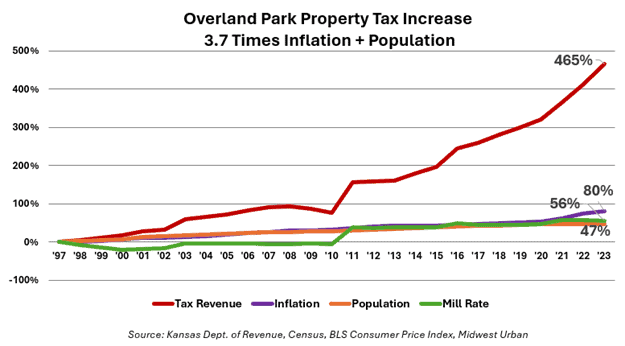

Overland Park Council member Melissa Cheatham deceives residents on property tax hike

Overland Park City Council member Melissa Cheatham recently demonstrated why the Kansas Legislature passed the Truth in Taxation Act in…

Switched vote insures Lansing school district patrons won’t see tax increase

The USD 469 Board of Education in Lansing has approved a budget for the 2023-2024 school year that will not…

USD 453 budget video makes deceptive property tax claims

New Leavenworth Superintendent Dr. Kellen Adams posted a recent video to justify the proposal for USD 453 to exceed the…

Revenue-Neutral hearing dates set across Kansas…here’s where you can attend

Your chance to tell elected officials what you think of property tax increases is coming up soon, and history indicates…

Missouri needs the revenue-neutral Truth in Taxation Act

The Jackson County (Missouri) Assessor’s office is taking a lot of heat for property tax increases over the last several…

Former Lansing school board member misleads community on revenue neutral

Former USD 469 Lansing school board member Beth Stevenson is telling the community that holding revenue neutral on local property…

Cherokee County reduces property tax while maintaining services

While many local government entities have steadily increased property tax, Cherokee County has reduced property tax revenue for two straight…

Leavenworth school board : No property tax increase this school year

The Leavenworth USD 453 Board of Education voted 4-3 not to impose a property tax increase on patrons for the…

Douglas County officials compete to see who can raise property tax the most

Douglas County residents are being hammered by government-spending-induced inflation. U.S. Census data show the county has almost 3,000 fewer residents…

Revenue-Neutral property tax hearings start August 20

Be on the lookout for your notice of revenue-neutral property tax hearings that start on August 20 and run through…

Leavenworth city officials: raise property tax or defund police

When Leavenworth residents asked city commissioners to hold property tax flat next year – like roughly 250 local jurisdictions are…