The Jackson County (Missouri) Assessor’s office is taking a lot of heat for property tax increases over the last several years, and this year’s tax notices have people worried about being taxed out of their homes. Jackson County Director of Assessment Gail McCann Beatty told FOX4 News the average increase would be around 30%, but the Kansas City Star reports valuations on some homes have more than doubled because they have been undervalued for years.

Kansas City Mayor Quentin Lucas told KMBC-TV he hopes that Jackson County “can find a way to stagger these types of increases to work with people who are going to have very real challenges” but Lucas is merely trying to shift the blame for tax hikes; he surely knows state law requires properties to be appraised at market value. Lucas and other elected officials in Jackson County can find the real culprit in the mirror because their actions set mill rates that determine how much property tax a homeowner must pay.

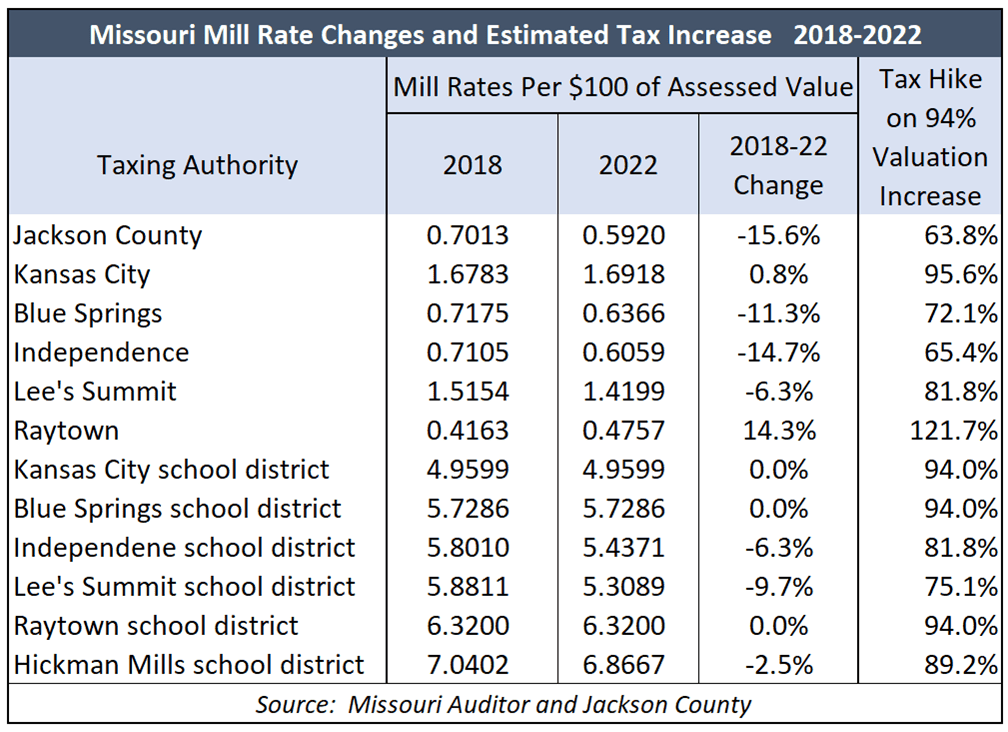

Instead of reducing the mill rate to offset a large portion of the valuation increases, the Kansas City Legislature increased it about 1% since 2018. That is a conscious decision to take advantage of taxpayers so the city can spend more.

Some elected officials in Jackson County reduced mill rates a bit, but they still imposed large tax increases on their constituents.

Calculating the damage to taxpayers

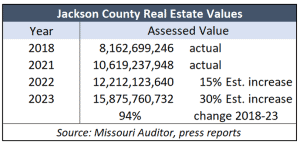

A report from the Missouri Auditor shows a 30% increase in real estate assessed valuation from 2018 to 2021. Data for subsequent years has not been published, but let’s use a conservative estimate of 15% for 2022 and the 30% average for 2023.

That results in a 94% increase in real estate assessed valuations over the last five years. Many homeowners have experienced much higher increases, but the tax hikes in the table below imposed by elected officials are based on the average change in values.

That results in a 94% increase in real estate assessed valuations over the last five years. Many homeowners have experienced much higher increases, but the tax hikes in the table below imposed by elected officials are based on the average change in values.

Now let’s assume that officials in each taxing authority in the adjacent table hold the mill levy flat in 2023. The impact in each taxing district is calculated using this formula:

Assessed valuation increase + [2018-22 mill rate change x (1 + assessed valuation increase)] = property tax increase (hat tip to my high school algebra teacher).

A homeowner in Kansas City whose valuation jumped 94% over the last five years would pay 95.6% more in property tax than in 2018. The Jackson County mill rate is 15.6% lower than in 2018, but the county would still collect 64% more in property tax revenue.

The mill rate in Raytown jumped 14%, so the city would reap almost a 122% tax hike on real estate. The school districts of Kansas City, Blue Springs, and Raytown would have the same mill rate as in 2018, so they would ‘only’ get a 94% tax increase.

Elected officials know what they have done to taxpayers – they see the evidence in the budgets they approve – but they will likely continue to blame the county assessor and laugh all the way to the bank. So Missouri state legislators will have to step in with a solution that is helping taxpayers in Kansas and other states.

Revenue-neutral Truth in Taxation Act

The Kansas Legislature in 2021 passed the Truth in Taxation Act, which requires elected officials to have a recorded vote on the tax increase they impose. As new valuations come in each year, mill rates are automatically reduced to what is called the revenue-neutral rate, which will produce the same dollar amount of property tax as the previous valuations. Elected officials that want to collect more tax dollars must notify each taxpayer in writing of their intent, hold a public hearing to get citizens’ input, and then vote for the entire tax increase they impose.

Forcing elected officials to be honest resulted in 52% of all taxing authorities in Kansas to adopt their revenue-neutral rate in 2021 (for taxes due in 2022). The final tally for taxes due in 2023 isn’t in yet (four counties still haven’t finalized results) but 57% of those reporting held their revenue-neutral rates.

Elected officials in Overland Park, Johnson County, and other places still have a ‘let-them-eat-cake’ attitude, imposing 10% tax hikes, but public pressure is making a difference across most of the state. Legislators in Nebraska and Iowa saw the results in Kansas and passed their own versions of truth in taxation legislation.

Missouri legislators should do the same.