Property tax transparency is working even better than proponents hoped, with 52% of local taxing authorities in Kansas deciding to not increase taxes this year. With 3,780 local taxing authorities reporting, 1,951 decided to not exceed their revenue-neutral rate in accordance with Truth in Taxation legislation. Another 482 entities are imposing less than 2% increases.

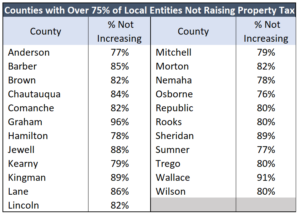

The statewide average is 52% not raising property tax, but 23 counties have more than 75% of local authorities not raising property tax this year. More than 90% of local taxing authorities in Graham County and Wallace County decided to hold property tax revenue flat this year. Several other counties are at 80% or more – Barber, Brown, Chautauqua, Jewell, Kingman, Lane, Morton, Republic, Rooks, Sheridan, Trego, and Wilson.

The statewide average is 52% not raising property tax, but 23 counties have more than 75% of local authorities not raising property tax this year. More than 90% of local taxing authorities in Graham County and Wallace County decided to hold property tax revenue flat this year. Several other counties are at 80% or more – Barber, Brown, Chautauqua, Jewell, Kingman, Lane, Morton, Republic, Rooks, Sheridan, Trego, and Wilson.

Generally speaking, officials in the smaller counties were much better at finding efficiencies to hold down property tax than their counterparts in the larger counties.

Only 22% of taxing authorities in Johnson County aren’t raising taxes, just 14% in Sedgwick County and only 13% in Shawnee County.

The Sentinel’s owner, Kansas Policy Institute, gathered the information in Open Records requests and published the results for each county at KansasOpenGov.org.

Truth in Taxation addresses major taxpayer frustration

Truth in Taxation applies to all local taxing authorities – cities, counties, townships, school districts, community colleges, fire districts, cemetery districts, and other special taxing districts. Taxpayers were extremely frustrated by local officials not being honest about the tax increases they were imposing.

Overland Park Mayor Curt Skoog, in a classic example of deception, called this year’s 10% tax hike “modest” because he would only acknowledge a mill levy change as a tax increase while ignoring millions more being collected because of valuation increases. Skoog didn’t refute the accuracy of the increase shown in the city’s budget, but merely said, “The percentages you hear tossed around today come from a certain perspective.” That “perspective” was the truth.

Each year, the mill levy is reduced so that the new valuations provide the same dollar amount of property tax to each local entity – that’s called the revenue-neutral rate. If elected officials want more money, they must notify taxpayers of their intent, hold a hearing to hear taxpayers’ thoughts, and then vote on the entire increase they impose.

Senator Caryn Tyson, Chair of the Senate Assessment and Taxation Committee, assembled a coalition of stakeholders to find solutions for many shortcomings in the state’s property tax laws. Local officials, property owners, state legislators, and policy experts settled on a package of more than a dozen reforms, with Truth in Taxation at the top of the list.

“I am honored to have led the effort in passing Senate Bill 13, property tax transparency, that will save Kansas taxpayers hundreds of millions of dollars over time. Senate Bill 13 makes sure taxpayers are informed and gives taxpayers a public hearing if their local government is trying to raise property taxes.”

Senate Bill 13 passed with near-unanimous support in the House and Senate in 2021, and immediately went into effect. Tyson says keeping the legislation clean, with none of the loopholes or exceptions that local officials requested, is the only way to deliver the honesty demanded by taxpayers.

“If the Legislature granted exceptions for inflation or any kind of growth factor, the recorded votes would not have been a true reflection of the property tax increases. Local officials can make their case for tax increases by being transparent with taxpayers.”