Your chance to tell elected officials what you think of property tax increases is coming up soon, and history indicates it is worth your time to attend the revenue-neutral public hearings.

The Kansas Truth in Taxation Act, also known as the revenue-neutral law, went into effect in 2021. Each year after appraised values are set, mill rates are reduced so that the new valuations deliver the same dollar amount of property tax as budgeted the year before — hence the name ‘revenue-neutral.’ If a local taxing authority wants to collect more property tax revenue, it must notify taxpayers of the intent in writing, hold a public hearing to take comments, and then take a roll call vote to approve the entire tax increase imposed.

The Kansas Truth in Taxation Act, also known as the revenue-neutral law, went into effect in 2021. Each year after appraised values are set, mill rates are reduced so that the new valuations deliver the same dollar amount of property tax as budgeted the year before — hence the name ‘revenue-neutral.’ If a local taxing authority wants to collect more property tax revenue, it must notify taxpayers of the intent in writing, hold a public hearing to take comments, and then take a roll call vote to approve the entire tax increase imposed.

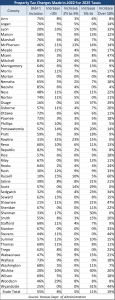

In 2021, about 52% of all local taxing authorities decided to not increase property tax. Last year, 56% decided to not increase taxes; 13% imposed less than a 5% increase, 11% had increases between 5% and 10%, and 19% imposed tax hikes greater than 10% (Atchison County is excluded because the County Clerk has not provided complete information as required in state law).

All Greeley County taxing authorities decided to hold tax revenue flat for 2023, and at least 80% of all taxing authorites didn’t increase taxes in ten other counties. The complete database is available on KansasOpenGov.org.

The 2023 Revenue-Neutral hearings are scheduled between August 20 and September 20. Hearing dates and times for the counties that have responded to Open Records requests are listed here on KansasOpenGov, and the list will be updated as county clerks comply with KORA requests.

In its two years, “Truth in Taxation” has been shown to be effective in restricting tax and spending increases in many local governments. Elected officials can certainly  adjust spending to avoid property tax hikes if they want.

adjust spending to avoid property tax hikes if they want.

Kansas Senate Tax Committee Chair Caryn Tyson of Parker applauds the two-year-old law:

“The revenue neutral rate law requires your government to give you a clear picture on how they are increasing your property taxes.”

Some counties work hard to be transparent with taxpayers, but not all.

Tyson says she has seen some of the written notices use tiny fonts to make the notices hard to read, perhaps hoping to keep attendance low at the public hearings.

” You shouldn’t need a magnifying glass and a lawyer to decipher the revenue neutral rate letter,” commented Tyson.

KansasOpenGov also has historical lists of mill rates and property taxes for all 105 counties and 47 cities. County information can be found here, and city reports are here.