A new conservative majority on the Shawnee City Council flexed its muscle and recently approved a cut of two mills in the city’s property tax rate, ignoring a staff recommendation of a reduction of one-half of a mill. Coupled with large valuation changes, the staff’s proposed 9% property tax hike is knocked down to a 2.6% increase.

Last November, voters sent newcomers Tony Gillette, Angela Steins, and Jacklynn Walters to City Hall, giving the city, in the opinion of one observer, “the only conservative-majority council in Johnson County.”

The rate cut was approved after a lively debate among council members in which Mayor Michelle Distler sided with City Manager Nolan Sunderman on the 0.5 mill reduction, which would have increased taxes some 9.0%. Distler favored the larger increase as a hedge against an impending recession. The mayor angered some council members who supported the larger cut by suggesting they list projects they would propose cutting to offset the decrease in city revenues. But Councilman Jenkins and others pointed out the city’s large cash reserves of some 46%, or about $40 million, as proof the city could afford the smaller increase. Council member Jill Chalfie was the lone dissenting vote.

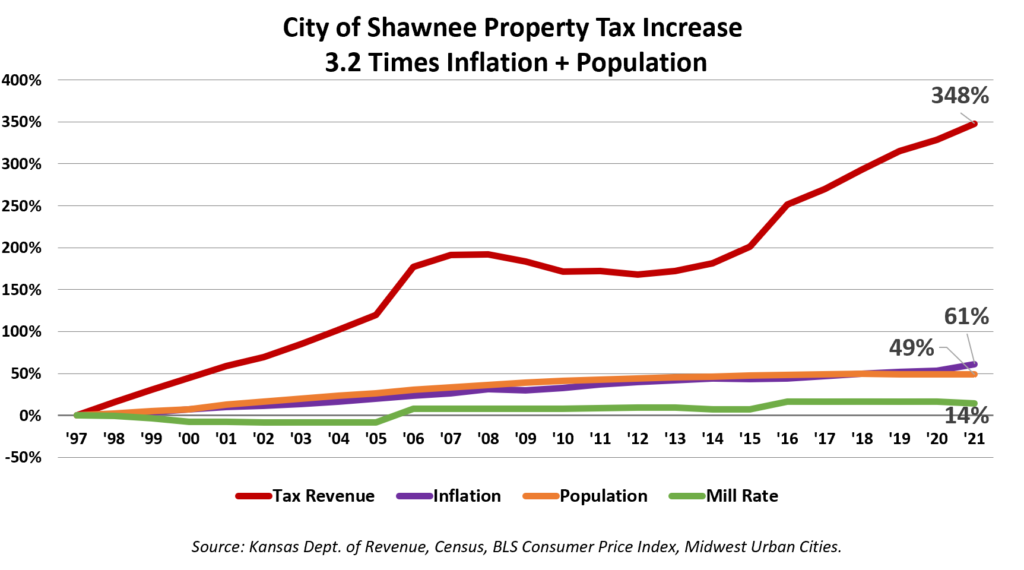

Outsized tax increases in prior years contributed to the large cash reserve. Shawnee has increased its property tax revenue by 348% since 1997, which is more than three times the combined increase in inflation and population.

Despite the cut in the mill levy, Shawnee is still above its “Revenue Neutral Rate”. The RNR is set each year by the county clerk so that new valuations produce the same dollar amount of property tax. If taxes are to be increased, a public hearing is required as well as a vote by the city council to authorize the higher amount. RNR is part of the “Truth in Taxation” law passed in 2021 by the state legislature to provide more transparency and accountability in government taxing and spending.

This year, Shawnee’s RNR is 23.393 mills. One mill is equal to $1 of taxation for every $1,000 of assessed valuation. With its two-mill cut, Shawnee stands at 24.004 mills, a 2.6% increase over last year, requiring a public hearing and vote.

City Manager Sunderman points to three factors pushing the city over the RNR this year:

- Taxes on new construction

- Property that previously had its taxes abated, or forgiven, for a period of time and now has been re-added to the tax rolls

- Inflation

Sunderman ignored a major factor pushing his proposed property tax hike, however; residential valuations in Johnson County shot up more than 10%.

Sunderman and other city officials promise to seek help from the state legislature next year to exempt the first two factors from RNR calculations and have the state set a target for the inflation rate. In their opinion, these changes would provide a more realistic picture of property taxation.

But their opinion, which would obscure the real property tax increase, reflects the reason Truth in Taxation was overwhelmingly approved by the Legislature. Citizens are fed up with local officials not telling the truth about property tax increases.

The city’s public hearing on the new mill levy will be on September 12 at 6:00 PM at Shawnee City Hall