People across the nation who are opposed to letting citizens keep more of their hard-earned money have repeatedly pointed to the 2012 Kansas tax plan as their primary example of why tax cuts don’t work. Media and some legislators are now spreading false claims to derail much-needed tax relief for Kansans this year, and two former Kansas legislators doing the same with other states considering tax relief.

Don Hineman, a former legislator, and Duane Goossen, a former legislator and state budget director, are advising other states against tax relief by consciously distorting the truth about the 2012 Kansas tax plan. They were guest speakers at a recent event hosted by the left-leaning West Virginia Center on Budget & Policy; a guest column by Hineman was also published in Montana newspapers.

Montana Governor Greg Gianforte and West Virginia Governor Jim Justice are proposing tax relief for citizens, so Hineman and Goossen seem to be doing what they can to discourage legislators, even if they have to bend the truth.

It would take too much space to unravel everything Hineman and Goossen said that was wrong, but here are some highlights.

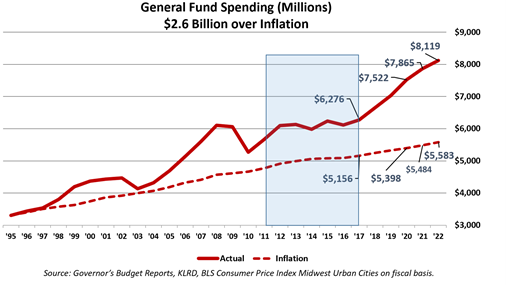

State spending increased

General Fund spending wasn’t cut with a “meat cleaver” as Hineman claimed, it increased and set several new records between 2012 and 2017 when legislators (including Hineman) imposed the largest tax increase in state history.

Legislators approved a nearly $400 million spending hike in FY 2012 (the same year they approved tax cuts) and then set new spending records in FY 2013, FY 2015, and FY 2017.

Contrary to other myths that Hineman and Goossen spread, legislators in West Virginia and Montana should also know that:

Higher education funding ‘cuts’ didn’t cause tuition increases. Total higher education funding was $739 million in FY 2012 and never fell below that level through FY 2017. There were tuition increases but the average increase between FY 2012 and FY 2017 was lower than over the previous five years.

Legislators declined many opportunities to reduce costs. Year after year, Democrats and the many moderate Republicans declined opportunities to reduce costs. Governor Brownback talked about reducing per-resident spending by eliminating unnecessary spending, but he didn’t propose anything to do so. And despite their fiduciary responsibility to balance the budget, Democrats and moderate Republicans didn’t propose any spending reductions or tax increases to do so; they wanted Brownback’s plan to fail. They preferred to put Kansans through several years of budget misery so they could eventually raise taxes on individuals and businesses.

School district cash reserves were not “captured” as Hineman claimed. The Legislature made it easier for school districts to spend cash reserves in some dedicated accounts, but it was strictly voluntary. Operating cash reserves increased from $892 million to $928 million between 2012 and 2017; reserves were just shy of $1 billion at the start of this school year.

Brownback didn’t say tax reform would pay for itself

Hineman and Goossen both falsely claimed Gov. Brownback said tax cuts would “pay for themselves.” That myth was also routinely perpetrated by media and others, but it was just another attempt to discredit Brownback and tax relief. The governor infamously said tax relief would be a “shot of adrenaline” to the state economy, but that was just overly-exuberant promotion of his plan.

It was well-known in 2012 that the state would face deficits within two years if spending wasn’t reduced. Brownback rejected a cost-saving plan presented by his budget director in 2012 that would have balanced the budget. Kansas Policy Institute (the Sentinel’s owner) published a dynamic analysis in 2012 that showed small revenue gains from increased economic activity but showed spending still needed to be reduced by about 8% over two or three years to balance the budget.

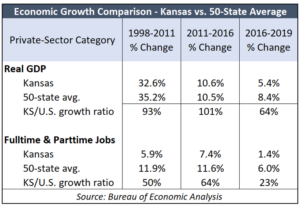

Economic performance slightly improved during tax cut years

In another claim by Hineman that belies reality, he said, “economic growth that eluded us is once again bubbling up.”

Bureau of Economic Analysis data shows Kansas is in its fifth straight decade of economic stagnation, trailing the nation in economic activity and job growth since the early 1980s. The gaps narrowed slightly between 2011 and 2016 but have grown wider since taxes were increased in 2017.

Real (inflation-adjusted) private-sector GDP in Kansas grew at 93% of the 50-state average between 1998 and 2011 (32.6% vs. 35.2%). Over the next five years, with tax relief announced, Kansas was at 101% of the 50-state average. Since massive tax increases, Kansas is at 64% of the average between 2016 and 2019 (5.4% vs. 8.4%)

Real (inflation-adjusted) private-sector GDP in Kansas grew at 93% of the 50-state average between 1998 and 2011 (32.6% vs. 35.2%). Over the next five years, with tax relief announced, Kansas was at 101% of the 50-state average. Since massive tax increases, Kansas is at 64% of the average between 2016 and 2019 (5.4% vs. 8.4%)

Changes in the total number of full-time and part-time private-sector jobs follow the same pattern. Kansas was at half of the 50-state average between 1998 and 2011 (5.9% vs. 11.9%), then improved to 64% of the average between 2011 and 2016 and has been at only 23% of the average between 2016 and 2019 (1.4% vs. 6%).

What was Really the Matter with the Kansas Tax Plan

A lot of the claims about the 2012 Kansas tax plan are based on incomplete or inaccurate data but Kansas did have serious budget challenges…and most of that was avoidable. Kansas Policy Institute published a book entitled What was Really the Matter with the Kansas Tax Plan in 2018, to chronicle the history of the tax relief effort from inception to destruction and help elected officials learn from the mistakes made in Kansas.

Goossen and Hineman got one thing right, however; don’t be like Kansas and make foolish mistakes.

Goossen and Hineman got one thing right, however; don’t be like Kansas and make foolish mistakes.

As stated in What was Really the Matter with the Kansas Tax Plan, no state should cut taxes and increase spending. Successful tax relief can be accomplished with a plan to balance the budget by operating more efficiently and with honest messaging that sets realistic expectations and shows how budgets can be balanced by making better use of taxpayer dollars.