While Governor Kelly’s handpicked Tax Council recommends adding a fourth income tax bracket as suggested by her Council on Racial Equity & Justice, Mississippi has chosen to move from a “progressive” tax system to a flat tax.

Mississippi is the third state to do so this year alone — and becomes the 12th state to have done so. In early March, Iowa passed a historic tax reform package that consolidated its nine individual income tax brackets — with a top rate of 8.53% — into a flat rate of 3.9%. Under the budget deal struck in 2021, Arizona will gradually reduce its rate to 2.5%, and, thanks to a recent court decision overturning Proposition 208 from the November 2020 election, Arizona’s top personal income tax bracket will be eliminated, making it a flat rate.

The Mississippi legislature passed a plan to flatten the state’s income tax and lower the rate to 4% from 5%.

According to a release from the American Legislative Exchange Council, Mississippi Speaker of the House Philip Gunn called the plan “a huge win” for the state, indicating it is “a bold first step” on the “path to continued elimination of the personal income tax.”

What’s the difference?

The federal government — and most states, including Kansas — use a progressive system, in which those with higher incomes pay a higher rate than those with lower incomes.

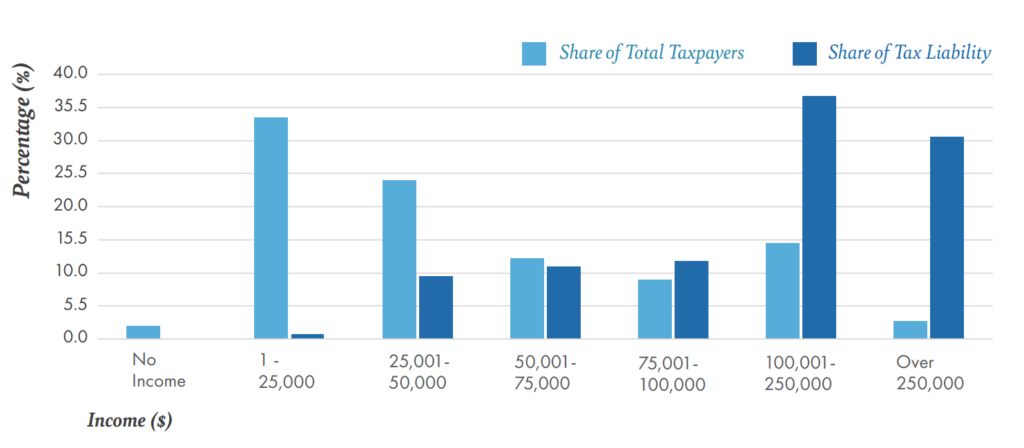

The bottom 50% of wage earners pay little or no income tax at all. For example, Kelly’s Tax Council report includes a chart showing that people with income below $50,000 account for 61% of total Adjusted Gross Income but only pay about 10% of the total income tax liability.

However, in a flat tax system, all taxpayers pay the same effective rate.

High wage-earners — who already bear the majority of the tax burden — would continue to pay more in absolute dollars than those who earn less but not as a percentage of income.

Under the current system, a point is reached at which taxation actively discourages further income growth — i.e., getting “bumped” into a higher bracket.

A flat tax ensures everyone has “skin in the game” and necessarily reduces a complicated tax code and form, eliminating “loopholes” and tax breaks — the current federal tax code, including statutes, regulations, and case law, runs to some 70,000 pages — and also reduces bureaucracy as a legion of tax agents are no longer needed.

Kansas tax climate destructive to growth

According to a report by the Tax Foundation, Kansas has the highest effective tax rates in the nation on mature businesses, with an effective tax rate of 64.4 percent, almost three times the national average.

This is the result of average corporate income and unemployment insurance taxes combined with some of the nation’s highest sales and property taxes for firms of this type, as data center equipment is included in both tax bases. The state uses evenly-weighted three-factor apportionment, sources service income based on performance cost, and imposes a throwback rule. Tax burdens in Kansas fall very unequally on different firm types and on new versus mature operations.

For example, the new data center’s 64.4 percent tax rate, or the mature distribution center’s 65.7 percent rate, contrasts with a 2.9 percent effective tax rate on new capital-intensive manufacturing. Meanwhile, the mature capital-intensive manufacturing firm experiences a 28.1 percent effective tax rate (worst in the nation), almost 10 times the burden on the new firm, which experiences the second-best effective rate in the nation.

Moreover, property taxes in Kansas have increased 180% since 1997, creating one of the highest rates in the nation.

ALEC’s annual “Rich States, Poor States” report says this creates pressure for residents to flee to areas where taxes are far less burdensome.

“Utah, at the top of the rankings for the 14th year in a row, solidified its well-deserved first place spot this year by prioritizing sound economic policy,” said ALEC chief economist and report co-author Jonathan Williams. “Utah has an incredibly strong track record of pro-taxpayer reforms in recent years, including the adoption of a flat personal income tax rate, pension reform for its previously endangered system, and the state’s innovative approach to property tax reform.”