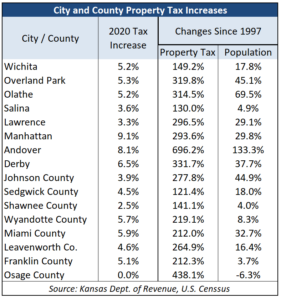

This year, many Kansas taxpayers will still see their property taxes go up, and in many cases, four to five times the rate of inflation. Indeed, Manhattan increased property taxes 9.1%, Andover went up 8.1%, Derby hiked  property tax by 6.5%, and Wichita, Overland Park, and Olathe increased taxes by more than 5%. Several counties are also imposing outsized increases, including Wyandotte (5.7%), Miami (5.9%), Franklin, (5.1%), Johnson, (3.9%), Sedgwick (4.5%), and Leavenworth (4.6%).

property tax by 6.5%, and Wichita, Overland Park, and Olathe increased taxes by more than 5%. Several counties are also imposing outsized increases, including Wyandotte (5.7%), Miami (5.9%), Franklin, (5.1%), Johnson, (3.9%), Sedgwick (4.5%), and Leavenworth (4.6%).

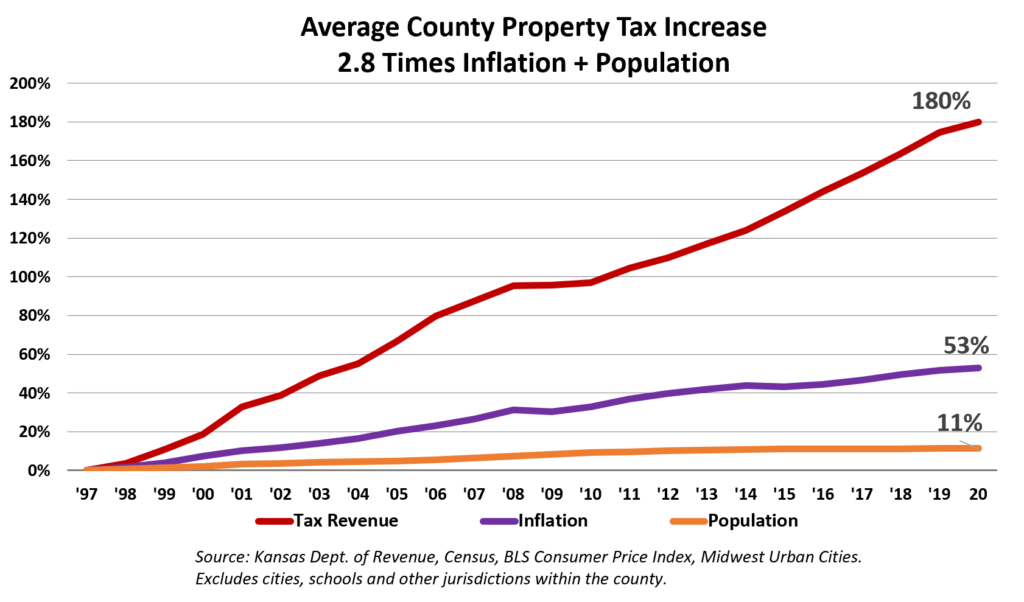

Property taxes for all counties increased 1.9% last year — the smallest county increase since the Great recession years of 2009-10, which was driven by a precipitous 54% drop in oil & gas valuations.

Property tax increases are provided by the Kansas Department of Revenue and published on KansasOpenGov.org; county information is here and data for the largest cities in Kansas is here. The data represents taxes imposed in 2020 that will be paid in 2021.

Since 1997, county property taxes collectively increased by 180%, or almost three times the combined rate of inflation (53%) and population (11%).

The largest cities in Kansas, which generally are not affected much by oil and gas valuations, imposed an average 4.2% property tax increase.

Many homeowners in some counties – especially those with mill levy increases to offset the drop in Oil & Gas valuations – got large tax increases. County and city mill levies are also on KansasOpenGov.org.

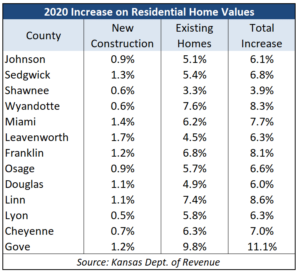

Many counties assessed large valuation increases on existing homes last year. Residential values in Johnson County, for example, increased 6.1% overall — 5.1% on existing homes and 0.9% attributed to new home construction. Other counties with large valuation increases on existing homes include Wyandotte County (7.6%), Franklin County (6.8%), Miami County (6.2%), Linn County (7.4%), Sedgwick County (5.4%), Gove County (9.8%), and Osage County (5.7%).

Many counties assessed large valuation increases on existing homes last year. Residential values in Johnson County, for example, increased 6.1% overall — 5.1% on existing homes and 0.9% attributed to new home construction. Other counties with large valuation increases on existing homes include Wyandotte County (7.6%), Franklin County (6.8%), Miami County (6.2%), Linn County (7.4%), Sedgwick County (5.4%), Gove County (9.8%), and Osage County (5.7%).

Truth in Taxation closes the ‘Honesty Gap’

Local officials have long maintained they have been “holding the line” on property taxes, referring only to mill levy changes, while ignoring the property tax hikes due to valuation changes. This has created an ‘honesty gap’ in taxpayers’ minds.

For example, Overland Park property taxes jumped 320% between 1997 and 2020, and the mill rate increased by 46%. The 274-point difference is the honesty gap.

In fact, some of the more populous counties have increased property taxes by more than 200 percent and some cities have raised taxes as much as 300 percent since 1997, and Osage County, which has seen a 6.3% population decrease, raised taxes 438% over the same time period.

Fortunately, 2020 was the last year for honesty gaps, thanks to new Truth in Taxation legislation just signed into law by Governor Kelly.

When new valuations are certified this year, mill levis will automatically be reduced so the new valuations generate the same dollar amount of property tax next year to every city, county, township, and school district as they are collecting this year. Any taxing authority that intends to increase its revenue-neutral mill levy must first notify citizens of their intent, hold a public hearing to take comments, and then vote on the entire tax increase they impose. No longer will local officials be able to pretend they are ‘holding the line’ on property taxes while collecting large increases from valuation changes.

Kelly vetoed a similar bill last year, but facing overwhelming Republican majorities in both Houses of the Kansas Legislature — as well as heavy support for the bill from her own party — Kelly likely signed, in part, to avoid an override.

The House passed Truth in Taxation in Senate Bill 13 by a vote of 120-3 with a few modifications to the Senate bill that passed in January. Senators concurred with the House bill by a 30-5 vote.

SB 13 was modeled after Truth in Taxation legislation in Utah and Tennessee, which have had property tax transparency in place for over 30 years. A collaborative effort organized by Senator Caryn Tyson in 2019 brought together legislators, policy experts, property owners, and local officials to craft a solution to a lack of transparency in property taxes. Kansas is now the third state in the nation with property tax transparency.

The bill does away with the property tax lid that ocal taxing entities have decried since its inception, even though it was largely ineffective thanks to a long list of loopholes and exemptions the Legislature gave them. The new Truth in Taxation law has no exemptions.

In 2020, the year Kelly vetoed a similar bill, a public opinion survey conducted on behalf of Kansas Policy Institute, which owns the Sentinel, showed broad bipartisan support for SB294, with 75 percent of respondents being in favor of requiring local officials to vote on the entire property tax they impose.

County commissions, city governing bodies, and school boards may still increase taxes as they see fit, but now they must be honest about the entire tax increases they impose.