When was the last time you saw a Kansas newspaper or TV station publish bad news about economic conditions in the state? When clamoring for tax increases during the Brownback years, media almost joyously announced any negative news that could be found about Kansas trailing national averages in jobs, GDP and personal income. (‘See – he cut taxes and look what happened’).

The Sentinel has written about personal income trends, population declines, and sluggish growth in GDP, but mainstream media has shown little to no interest in those matters following 2017 passage of the largest tax increase in state history, even though economic stagnation continues as it has for most of the last four decades.

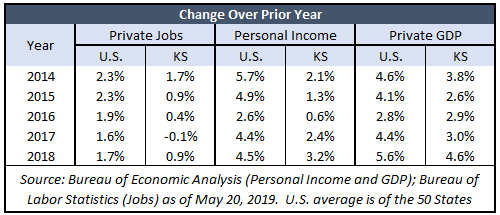

Kansas was one of only six states that lost private sector jobs in 2017 while the 50-state average was a gain of 1.6 percent. Last year’s gain of 0.9 percent was just about half of  the 50-state average of 1.7 percent, and job growth over the last two years was ranked 44th among the states.

the 50-state average of 1.7 percent, and job growth over the last two years was ranked 44th among the states.

“It’s a slow march downhill compared to our peer states and neighboring states — let alone states like Texas and Florida,” says Alan Cobb, president of the Kansas Chamber.

Personal income increased 2.4 percent in 2017 in the Sunflower State, while the 50-state average was 4.4 percent. Kansas trailed again in 2018, growing 3.2 percent versus the national average of 4.5 percent. Over the last two years, Kansas was therefore ranked 49th among the 50 states with only North Dakota faring worse.

Kansas was a little closer to the 50-state average for private sector GDP over the last two years, ranking 39th. Kansas grew 4.6 percent and 3.0 percent over the last two years, respectively, compared to the 50-state average of 5.6 percent and 4.4 percent. Personal income and GDP data is not adjusted for inflation.

Cobb notes that below-average increases in personal income and slower than normal private sector growth aren’t the only sobering metrics. Kansas is losing people. More people are moving out of the Sunflower State than moving in, and two of the state’s largest metro areas, Wichita and Topeka, are losing population.

“It’s not atrophy. It’s just flat, and that’s not good,” he says.

What’s at stake

Consistent, unbiased journalism is not just a matter of media integrity. A barrage of reporting on negative economic conditions that essentially disappears after taxes are increased sends a message that the state’s budget problems are solved. That message was reinforced when governors Jeff Colyer and Laura Kelly said spending could be significantly increased without tax increases, even though the facts clearly showed otherwise and still do.

According to Jonathan Williams, chief economist and vice president of the American Legislative Exchange Council (ALEC), higher taxes often result in sluggish job growth and out-migration.

“Based on economic evidence and plain, old experience across the states, we know that higher taxes are going to be damaging for a state’s economic health,” Williams says.

A new budget projection from Kansas Legislative Research that complies with statutory spending limits shows taxpayers are facing a $1.4 billion deficit over the next four years. Filling that hole with taxes is unlikely to add up to economic prosperity, says Michael Austin, director of the Center for Entrepreneurial Government at Kansas Policy Institute. (KPI owns The Sentinel).

“The focus should be on the spending side. What we have unfortunately realized in Kansas is, we don’t have a revenue problem. We have a spending problem,” Austin says.

He recalls the state lowering sales tax rates only to increase them later and dropping income tax rates only to roll those back a few years later again. Kansas is hauling in record amounts of revenue today, and still the current budget trajectory shows a deficit next year.

“Even though we’ve had three straight tax increases–and I include Kelly’s veto of the last tax reform bill–we still don’t have enough money to cover the shortfall,” Austin says. “I wouldn’t be surprised if that’s going to mean another tax increase down the road.”

Williams hopes voters are paying attention, but he isn’t counting on mainstream media to help put to rest the myth that tax cuts are what caused Kansas growth to lag.

“There are a lot of bad headlines and fake news reports about the Kansas tax experiment out there, but these numbers should correct that narrative,” he says. “…For liberal journalists and pundits out there still trying to make this case, even though they know that the evidence shows spending was the ultimate problem, they’re really intellectually dishonest.”