Kansas Governor Laura Kelly’s veto of HB 2036 was entirely predictable. We’ve heard the same excuses as she vetoed every income tax bill placed on her desk since 2019 – it’s not affordable, it gives too much relief to the wrong people, yada yada yada. She professes to want to give Kansans “meaningful tax relief,” claims to be fiscally responsible, and is a middle-of-the-road compromiser.

And every time she repeats that tune, I’m reminded of a different song by Sheryl Crow. The chorus to “Say What You Want” goes like this:

(Say, say what you want to)

Even though you never mean it

(Say, say what you want to)

Ain’t got time to be wasting time

(Say, say what you want to)

We had our chance, now we’re gonna blow it

(Say, say what you want to)

If this is America, you’d never know it

Kelly’s claim that HB 2036 is too expensive is bogus, and she knows it. After four years, the state would still have $2.5 billion in reserves.

She says a bill that reduces the income tax for a single person earning $50,000 by $98 is “too expensive,” but her initial plan would only save that person $86.

While $98 is too expensive for one taxpayer, Governor Kelly and Lt. Governor David Toland had no financial concern, giving $829 million to Panasonic and billions in other subsidies to a relative handful of businesses.

Kelly’s HB 2036 veto message says, “Kansans need meaningful sales, property, and income tax relief,” but she clearly doesn’t mean it.

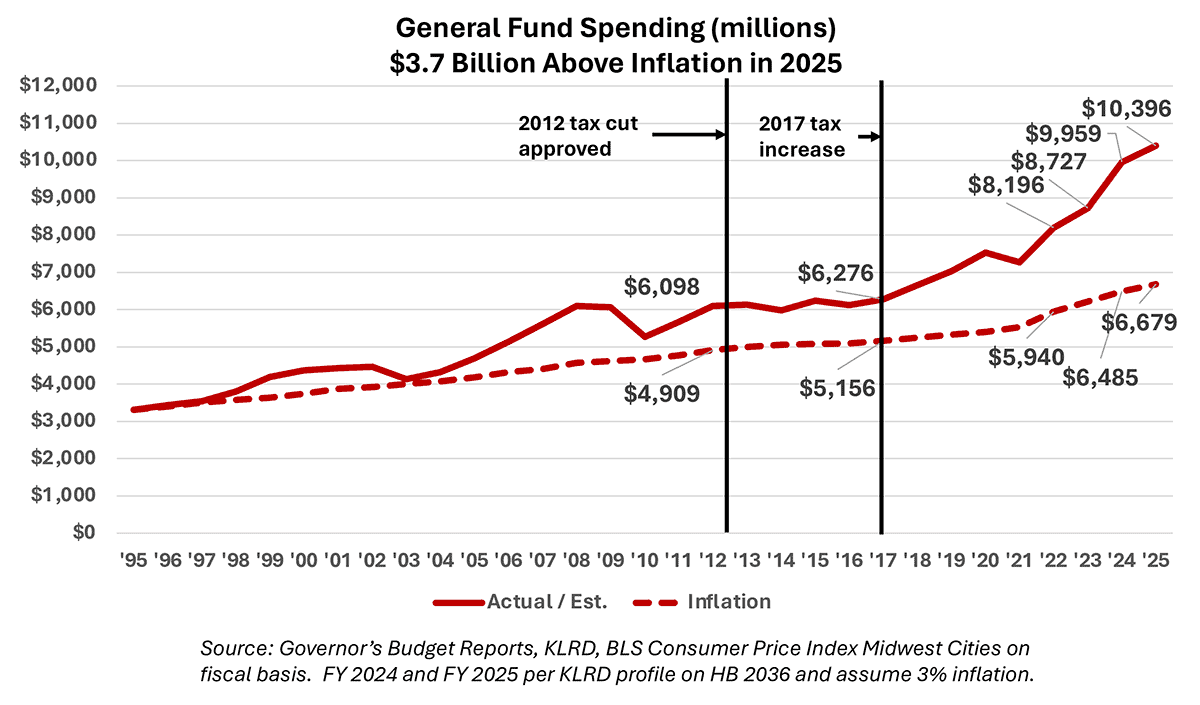

She says she is fiscally responsible (over and over and over again) while spending like a drunken sailor. General Fund spending has jumped 56% since Governor Kelly took office, from $6.649 billion in FY 2018 to $10.396 billion for FY 2025. Spending was $1.2 billion above long-term inflation in FY 2018 and will be $3.7 billion higher next year.

To be fair, Kelly had a lot of help exploding the budget from Republicans and Democrats.

Just say what you mean about vetoing HB 2036, Governor

Please, Governor Kelly, just say what you really mean about your veto of HB 2036.

- You want to be able to spend a lot more.

- You want to take more money from individuals and give away millions in ‘look-what-we-did-vote-for-Toland-in-two-years subsidies.’

- You would raise income taxes if you could get away with it (“maintaining a three-tier tax system is incredibly important going forward; if anything, I want more tiers.”

- You are anything but a ‘middle-of-the-road’ compromise-oriented person. The Legislature wanted one tax rate, but you wanted three. They sent you a two-rate plan that cost much less than they wanted and passed with overwhelming bi-partisan support (unanimous in the House), and you threw it in their face. You want three rates, and it’s your way or the highway.

- You aren’t serious about providing meaningful tax relief.

The Kelly/Toland plan of huge handouts to a few businesses and peanuts to the peasants is an economic disaster. The most recent (2021) IRS data shows Kansas had a net loss of $364 in Adjusted Gross Income from people moving to states with a lower tax burden. Conversely, Kansas had a net gain of $129 million AGI from people moving here from states with higher tax burdens.

The Tax Foundation says 32 states have a lower tax burden than Kansas, and the IRS data shows people voting with their feet for a better economic deal. Only Nebraska and Iowa had higher burdens in the Tax Foundation’s review of 2022 data, but both states cut income tax last year. Kansas is now likely the most expensive state in the region for people, and Governor Kelly wants to make it worse (“If anything, I want more tiers”).

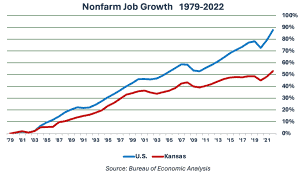

The economic data clearly shows the need for tax relief. Kansas is in its fifth decade of economic stagnation and falling farther behind national average increases in job growth, population, and economic activity (GDP).

The economic data clearly shows the need for tax relief. Kansas is in its fifth decade of economic stagnation and falling farther behind national average increases in job growth, population, and economic activity (GDP).

Our Green Book research shows that states with lower tax burdens have superior economic growth. To put that in perspective, there would be 451,000 more jobs in Kansas today if nonfarm employment had grown at the national average since 1979.

So, Governor Kelly, you can keep saying what you want about vetoing HB 2036, but we know you don’t mean it.