Finally, on the last day of the regular session, both chambers of the Kansas Legislature passed Senate Substitute for HB 2036, providing major tax relief to taxpayers at all income levels.

The Senate voted first and passed HB 2036 on a 24-9 vote, with two Democrats present and passing and five Republicans absent. The House voted 119-0, with three Republicans and three Democrats absent. Governor Laura Kelly is expected to sign the measure with such overwhelming support.

The major components of House Bill 2036 are effective for the 2024 tax year and include:

- A two-tiered tax rate system that replaces the current three-rate system.

- The first $23,000 single / $46,000 married is taxed at 5.15%; all income above those levels is taxed at 5.55%.

- The single personal exemption jumps from $2,250 to $9,160; a married couple’s personal exemption goes from $4,500 (two @ $2,250 each) to $18,320 plus $2,320 for each dependent.

- The standard deductions both increase by 3%, to $3,605 single and $8,240 married.

- All Social Security benefits will be exempt from state taxation.

- The state sales tax on food will be eliminated on July 1st this year, six months earlier than expected

- The amount of residential property exempt from the statewide uniform school finance levy goes from$40,000 to $100,000 and the tax rate drops from 20 mills to 19.5 mills. The half-mill cut is offset by a transfer from the state general fund to the school fund.

- A reduction in the privilege tax rate paid by financial institutions.

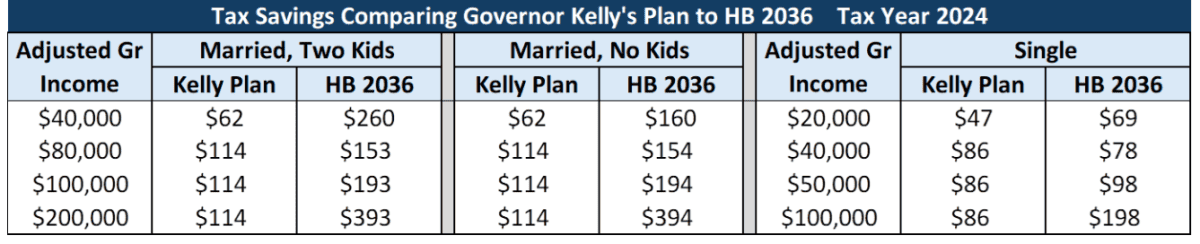

To illustrate the effects of HB 2036, this chart shows that nearly all taxpayers, regardless of income, will see greater savings with this compromise bill than with the governor’s original proposal that kept the three higher tax rates and only increased the standard deduction:

This table shows that lower-income Kansans will see a greater percentage reduction in their taxes; a family of four with Adjusted Gross Income of $40,000 would see a 36% decline in their tax liability, compared to just a 4% reduction if their AGI is $200,000.

The two-rate compromise in HB 2036 saves taxpayers more money overall than the original flat tax plan and the plan proposed by Governor Kelly.

Senate Assessment and Tax Committee Chair Caryn Tyson applauded legislators in both chambers who developed the bill, as well as those who voted for the bipartisan bill:

“The legislature overwhelming supported a compromised tax relief package that keeps the money where it belongs – with the people, instead of continuing to grow a budget surplus that has been reported to be over $4 billion. Out of 154 legislators who voted on the policy, only 11 did not vote “Yes”.

“The compromise eliminates state income tax on social security, provides some property tax relief, lowers income taxes by creating a two-rate structure and increasing exemptions to help families.”

Editors Note: Correction to reflect three Democrats were absent on the House vote, and 154 legislators voted on the policy,