The Kansas City Star earlier this month deceived readers about education, and now the Kansas Reflector is making false claims about education savings accounts and the flat tax proposal.

A Kansas Reflector editorial says the flat tax plan “benefits the wealthy at the expense of everyone else.” That’s not true because ‘everyone else’ would not pay more income tax to ‘benefit the wealthy;’ everyone gets a tax reduction under the flat tax proposals.

House Bill 2061 exempts the first $15,000 (single) and $30,000 (married) from income tax. Currently, that income is taxed at 3.1%, and since zero is less than 3.1%, that is a tax reduction. The next $15,000 single /$30,000 married is currently taxed at 5.25%, and income above those levels is taxed at 5.7%. The flat tax proposal taxes all income above the $15k/$30k level at 5%, so again, all of that income is taxed less.

The Senate bill, SB 169, takes a slightly different approach. An income tax rate of 4.75% is charged to taxable income in excess of $10,450 for joint returns and $5,225 for single individuals. Exempting the first $5,225 single / $10,450 married ensures that everyone pays less tax.

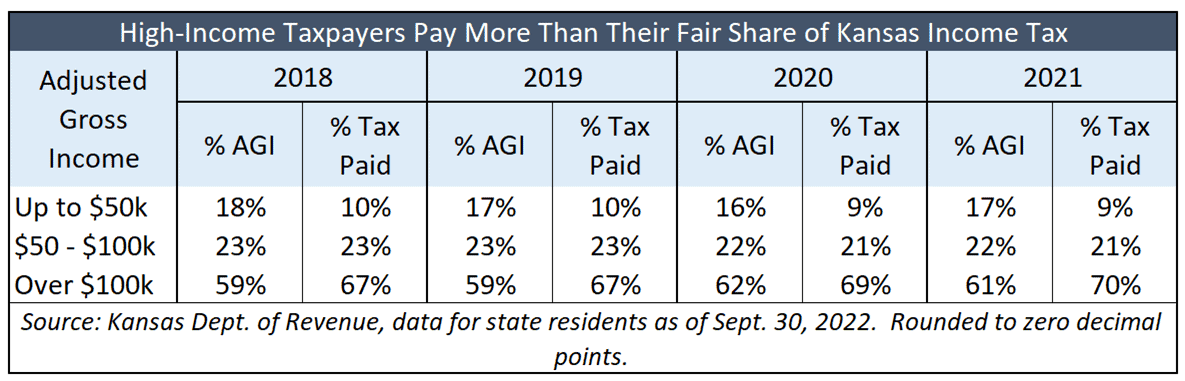

The savings are smaller for people with lower incomes, but that is because people with higher incomes are paying a larger portion of the total income tax. For example, resident taxpayers with adjusted gross income below $50,000 account for 17% of total AGI, but they only pay 9% of the total resident income tax. Taxpayers with Incomes above $100,000 account for 61% of total resident income, but they pay 70% of the income tax.

The savings are smaller for people with lower incomes, but that is because people with higher incomes are paying a larger portion of the total income tax. For example, resident taxpayers with adjusted gross income below $50,000 account for 17% of total AGI, but they only pay 9% of the total resident income tax. Taxpayers with Incomes above $100,000 account for 61% of total resident income, but they pay 70% of the income tax.

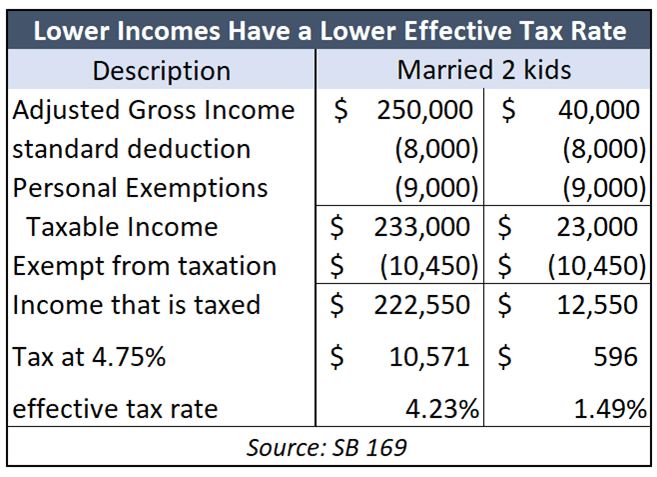

Further, people with lower incomes will still pay a lower effective tax rate because a larger portion of their income is exempt from taxation.  The adjacent example, using the parameters of SB 169, compares the results for a family of four with adjusted gross incomes of $250,000 and $40,000. Both families get a standard deduction of $8,000 and personal exemptions totaling $9,000 ( four at $2,250 each). They also have the first $10,450 exempt from the 4.75% income tax.

The adjacent example, using the parameters of SB 169, compares the results for a family of four with adjusted gross incomes of $250,000 and $40,000. Both families get a standard deduction of $8,000 and personal exemptions totaling $9,000 ( four at $2,250 each). They also have the first $10,450 exempt from the 4.75% income tax.

The family with the higher income would pay $10,571 in tax, with an effective tax rate of 4.23% (tax divided by gross income). But the effective tax rate on the lower income is just 1.49%. So while the tax rate is the same for everyone, the mechanism in SB 169 still results in progressive effective tax rates.

Education savings accounts are not tax credits

The Reflector column calls the education savings account plan now in House Substitute for SB 83 a voucher tax credit, which is simply not true; there are no tax credits associated with the ESA plan in House Substitute for SB 83.

To be fair, the Reflector relied on the Institute on Taxation and Economic Policy (ITEP) for its ESA analysis, and ITEP is notorious for using flawed methodology and refusing to substantiate its claims. Still, a simple reading of the bill shows tax credits are not included, and there is no mention of tax credits in the Reflector’s news coverage of House Substitute for SB 83.

The Reflector tried to make the case that ESAs will primarily benefit “the wealthy,” and that is also not true. First of all, the ESAs are not available to wealthy people. They are primarily available to families that qualify for free or reduced lunch or have income below a percentage of the federal poverty level (FPL):

- Fall 2024 and beyond: Public school students eligible for free/reduced lunch or score Level 1 on the state assessment (no limit on these students and income limit)

- Fall 2024: Non public school students who are below 300% FPL – up to 2,000 students

- Fall 2025: Non public school students who are below 400% FPL – up to 4,000 students

- Fall 2026: Non public school students who are below 400% FPL – up to 8,000 students

- Fall 2027: Non public school students who are below 600% FPL – no limit on enrollment

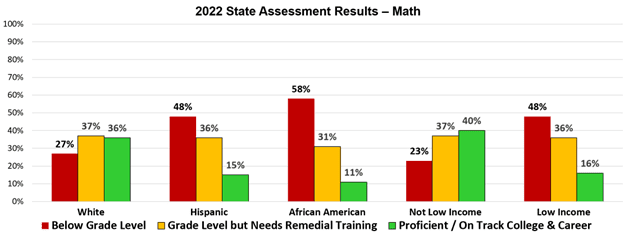

If the Kansas Reflector and others in the media care about the well-being of low-income families, they would be advocating for the ESA plan. Nearly half of low-income students are below grade level in math, and only 16% are proficient, compared to 23% and 40%, respectively, for their more affluent peers. Similarly large achievement gaps exist in English language arts.

The achievement gaps for low-income kids are getting worse, and school districts won’t even follow state laws designed to close those gaps.

To paraphrase former Arizona Governor Doug Ducey, politicians, and their media allies stood in schoolhouse doorways 50 years ago to prevent poor kids from entering. Today, union-backed politicians and their media allies stand in the schoolhouse doors and won’t let poor kids out.

And they won’t let the facts get in their way.

(editor’s note: the original verstion of this column did clearly indicate that non puplic school students are eligible to particate in the phased in schedule.)