Data provided by the Kansas Public Employees Retirement System shows Kansas has 3,778 KPERS ‘millionaires’ – state and local government retirees who will collect at least $1 million in pension benefits over their first 20 years of retirement. That is an increase of 429 over last year. The complete list of KPERS ‘millionaires’ can be found at KansasOpenGov.org.

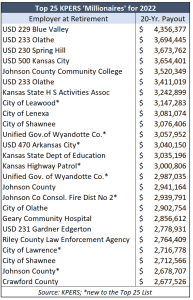

Education officials top the list of the 25 highest payouts, with the first seven positions and ten total slots. Seven retired from local school districts and one each from Johnson County Community College, the high school athletic association, and the Department of Education. Six of the top 25 retired from cities, and seven are from county employment.

Education officials top the list of the 25 highest payouts, with the first seven positions and ten total slots. Seven retired from local school districts and one each from Johnson County Community College, the high school athletic association, and the Department of Education. Six of the top 25 retired from cities, and seven are from county employment.

State law prohibits KPERS from releasing names, but it’s a pretty safe bet that the first four on the list are superintendents because they are the highest paid. Pensions are based on a final average salary over the previous few years and years of service.

The superintendent at the top of the list, who will collect $4.4 million in the first 20 years of retirement, is probably Tom Trigg. He ‘retired’ from Blue Valley in 2015 and has since been superintendent in Highland Park, Texas. His annual pension from Kansas is $217,819.

The second and sixth slots come from the Olathe school district, most likely superintendents John Allison and Marlin Berry.

The third-highest 20-year payout probably goes to USD 230 Spring Hill Superintendent Bart Goering, who will collect $3.7 million. Retired superintendent Cynthia Lane of USD 500 Kansas City, who oversaw perhaps the lowest-achieving district in Kansas, is probably the third-highest retiree and will also collect $3.7 million.

There are eight new retirees on the Top 25 list this year – two from the Unified Government of Wyandotte County and one each from Leawood, USD 470 Arkansas City, Kansas Highway Patrol, Johnson County Fire District #2, Lawrence, and Johnson County.

With 1,096 KPERS ‘millionaires, local school districts have the most of all employer categories. Cities have 940, counties have 807, and there are 619 KPERS ‘millionaires’ from state agencies. The balance comes from community colleges and a variety of local agencies.

Government retirees in Kansas get an extra benefit in not having to pay state income tax on their pensions. They pay income tax on their own contributions, but they are never taxed on the contributions from taxpayers.