A unique “tax swap”, allowing counties to institute an earnings tax, if approved by voters, to lessen some of the property tax burden in Kansas, was the focus of a recent hearing before the Senate Committee on Assessment and Taxation.

The legislation would effectively grant counties “home rule”, empowering them to determine their local affairs and government, an authority currently reserved only for cities and towns.

Patterned after similar taxes assessed in St. Louis and Kansas City, Missouri, SB 79 would levy an earnings tax on:

- All individuals employed or working within such county; and

- All resident individuals of such county who are employed or working outside such county.

The rate of any earnings tax pursuant could not exceed 1% per annum, and the revenue derived from the earnings tax would be pledged for general county purposes. At least 50% of the revenue derived from the earnings tax would have to be credited in the county budget to reduce the amount of revenue otherwise necessary to be derived from the ad valorem property tax.

Wyandotte County Sen. David Haley testified the bill would correct an imbalance in the contributions among workers in his county:

“In my county specifically, 30 percent live in our county, and 70 percent don’t, and if, in fact, there was some revenue derived, it’s anticipated that would help us with what would be approximately two-thirds of our real property tax load. It’s a tremendous opportunity.”

Leavenworth County Commissioner Jeff Culbertson testified SB 79 would alleviate a unique issue in his county:

“Leavenworth County has a special disadvantage using property tax to pay our bills since we are 35% tax-exempt with Fort Leavenworth, the prisons, schools, churches, all in our County. There are 90,000 people in Leavenworth County, but only 30,000 parcels are paying all the property taxes, so a few people are paying a lot. If you go to an income tax or a sales tax, you get more people paying a little; moreover, the people making more money can afford to pay more taxes, but the people making less money will pay less. Property tax systems do not care how much money you make.”

In an interview later, Culbertson added:

“I’ve been pushing for years to get weight off property taxes and put onto earnings and sales tax instead. That’s what the LAVTRF (Local Ad Valorem Tax Reduction Fund) was designed to do. I don’t agree with things in this bill; like it should require 100% go towards property tax relief. But even though I don’t agree with everything in this bill, it’s a step in the right direction.”

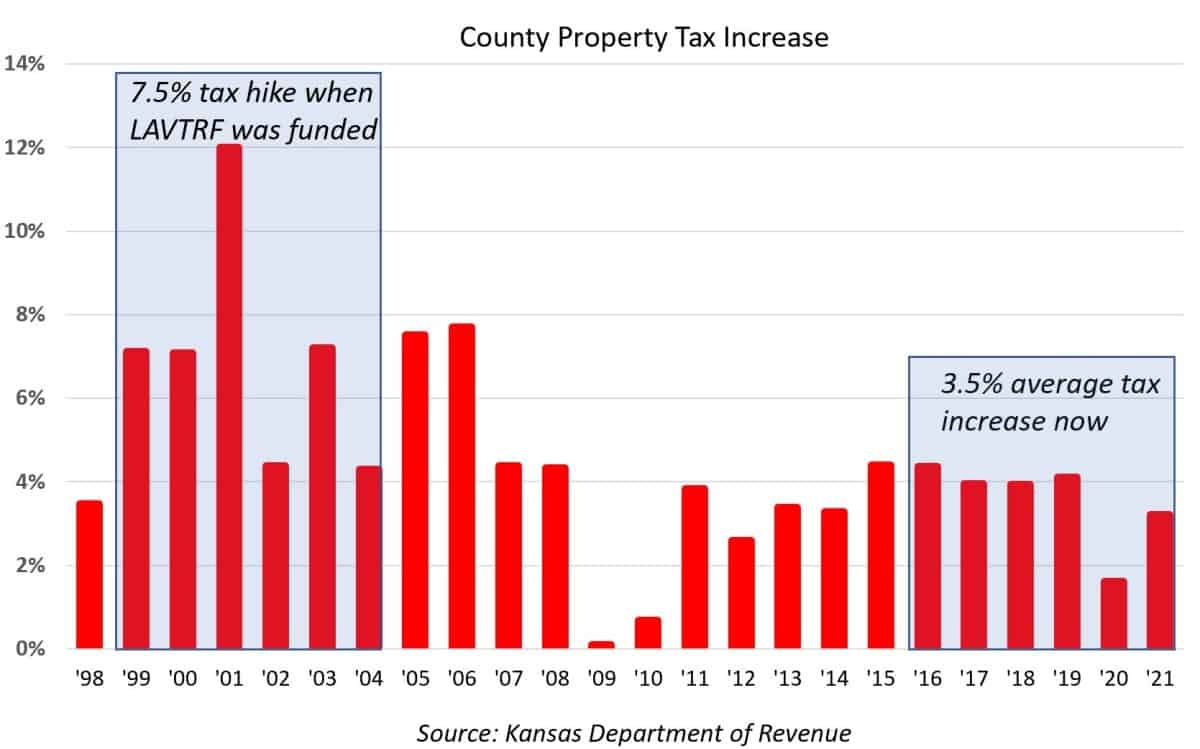

The LAVTRF may have been intended to reduce property tax, but it didn’t. The chart below shows county property taxes increased by an average of 7.5% in the last six years the program was funded. Now, the six-year average is just 3.5%. Opponents of SB 79 fear that counties will still find a way to keep property taxes high and also create a less competitive environment by imposing an earnings tax.

Katherine Loughead of the Tax Foundation also believes SB 79 is the wrong approach to property tax relief:

“A tax swap that eliminates or drastically reduces reliance on property taxes and instead authorizes new local income taxes, and substantially higher sales tax rates would greatly disrupt the revenue system in Kansas while making local revenue streams far more volatile.

“Every state in the country uses property taxes as a local revenue source because property taxes are the most stable source of revenue and because local real property taxes paid relate closely with local benefits received. Revenue stability is critical for local governments because counties and cities must fund a certain basic level of services each year regardless of how much revenue is generated. Compared to state governments, local governments typically have less flexibility to reduce spending in lean revenue years because certain essential services—like water and sewer services, garbage removal, snow removal, and many others—must occur regardless of how much revenue is generated. Compared to property taxes, local income taxes generate a substantially more volatile source of revenue, are far more complex to comply with and administer, and are far more economically harmful because they reduce returns to labor and investment.

“Another advantage of property taxes as a source of local revenue is that taxes paid based on the value of real property relate closely with local services received. Additionally, local services that are funded by property taxes—like local roads and schools, law enforcement services, public libraries, parks, and other local amenities—help preserve or enhance the value of taxpayers’ real property. Meanwhile, when weak relationships exist between taxes paid and benefits received, deadweight loss and government inefficiency is more likely to occur, which, in turn, leads to more tax increases over time.

“The property tax is the best available tool to fund local government services, followed by the sales tax, and Kansas already generates its local revenue in a relatively structurally sound way by relying most heavily on local property taxes and supplementing those property tax collections with local sales taxes. Creating a new local income tax would negatively affect labor, investment, and economic growth in Kansas, and substantially increasing the sales tax rate would lead to more cross-border shopping that would also negatively affect businesses in Kansas.

“The best way to alleviate property tax burdens is to limit the overall growth in property tax collections over time by keeping government spending in check. Instead of abandoning the property tax altogether, a far better solution would be to tighten the existing property tax lid to limit growth in overall property tax collections over time.”

If approved in committee, SB 79 will be considered on the Senate floor.