Kansas Governor Laura Kelly ranks in the bottom half of governors nationally, but according to the American Legislative Exchange Council, the state of Kansas is also in the bottom half of economic performance rankings.

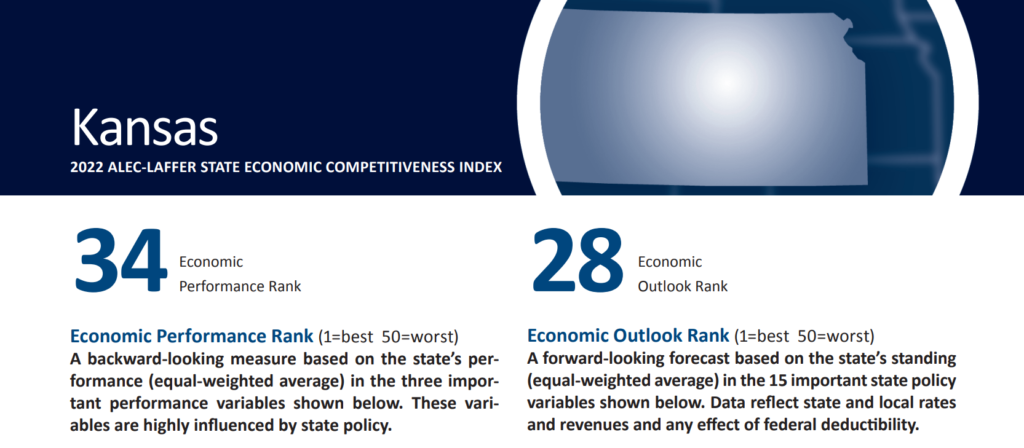

ALEC’s recently released “Rich States, Poor States” report ranks Kansas 34th overall.

This is the 15th year the report has been released, which also includes both an Economic Outlook Ranking based on a state’s current standing in 15 state policy variables.

The Economic Performance Ranking looks backward at a state’s performance in three areas: State Gross Domestic Product, Absolute Domestic Migration, and Non-Farm Payroll Employment — all of which are highly influenced by state policy. This ranking is of the past ten years’ performance of these factors.

Colorado is 6th in overall economic performance in this area, Nebraska 17th, Oklahoma 29th, and Missouri is #32.

Factors hampering the state’s economic performance, according to the report, include a top marginal corporate income tax rate of 7% — 28th highest in the nation and the highest on mature businesses. Kansas also has one of the highest property tax burdens in the nation, ranking 33, one of the highest sales tax burdens in the country — ranking 39th — and the 49th highest number of public employees per capita in the United States, with more than 700 public employees per 10,000 full-time equivalent private employees.

Kansas Policy Institute CEO Dave Trabert says the state’s next-to-last ranking on public employment has a great deal to do with the state’s heavy property and sales tax burdens.

“Kansas is massively over-governed. Just the extra local government employees costs taxpayers more than $2 billion in extra taxes compared to the national average of per-capita government employment. That equates to more than a third of all property tax.”

KPI is The Sentinel’s parent company.

According to the ALEC website, each factor is influenced directly by state lawmakers through the legislative process.

“Generally speaking, states that spend less — especially on income transfer programs — and states that tax less — particularly on productive activities such as working or investing — experience higher growth rates than states that tax and spend more,” the site reads.

The only state with more public employees per capita is Wyoming — with a population roughly one-fifth the size spread over a state some 8.5% larger.

States that tax less have a better economic outlook

Rich States, Poor States also ranks states’ economic outlook using 15 metrics. Here, Kansas is ranked a little better at #28 because it is a right-to-work state, has no estate tax, and adheres to the federal minimum wage.

Meanwhile, Utah is No. 1 this year — a position the state has held since at least 2015 — partly because of a far lower tax burden.

Utah’s top marginal rates for both personal and corporate income taxes are set at 4.95% — as compared to a 5.7% top personal tax rate and the 7% top corporate rate in Kansas — and much lower property and sales tax burdens and ranks 17th in the number of public employees per capita.

In a conference call before the release of the report last week, one of the authors, ALEC Chief Economist Jonathan Williams, noted that the 15 metrics used to produce the economic outlook rankings are directly correlated to states whose economies are more robust.

“There’s a huge meaningful correlation here,” Williams said. “And that’s robust between these rankings and future economic performance, whether it’s migration, whether it’s income growth, whether it’s GDP growth, the things that matter for the real well being and the performance of the state.”

Oklahoma ranked 4th, Colorado 22nd, and Missouri and Nebraska ranked 29th and 36th, respectively.

Kansas’ Economic Outlook ranking has dropped from 18th in 2015 to 27th in 2016 and hasn’t been higher than 25th.

Study co-author Steven Moore pointed out that multiple states have shown that the sort of high tax burden Kansas imposes is not necessary to maintain public services.

“It’d be one thing if there were no states that didn’t have an income tax, but we do have nine prosperous states that are able to pay their bills and provide good schools and roads without having an income tax,” Moore said. “So it can be done.

“It should be done.”