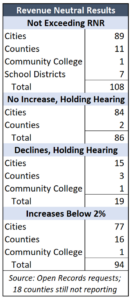

Now that local officials have to be honest about the entire property tax increase they  impose on residents and businesses, more than 100 cities, counties, school districts, and a community college have decided to not raise property tax next year.

impose on residents and businesses, more than 100 cities, counties, school districts, and a community college have decided to not raise property tax next year.

Individual property owners may see increases but those entities will collect the same dollar amount of property tax next year as this year. Another 86 entities are hoping to hold property tax flat but are holding revenue-neutral hearings between August 20 and September 20 in case they change their minds.

The new Truth in Taxation law automatically reduces mill rates so that new valuation totals produce the same amount of property tax as the prior year. Any entity that wants to take in more property tax – from either valuations or mill rate increases – must notify the county clerk of their intent to exceed the revenue-neutral rate and provide information about the public hearing to be held between August 20 and September 20.

Next year, taxpayers will receive notice in the mail of any proposed tax increases but this year, taxing authorities just have to post it to their websites. Kansas Policy Institute, which owns the Sentinel, sent Open Records requests to every county to provide a single source for information on cities, counties, community colleges, and school districts at KansasOpenGov.org. Nearly 3,000 more taxing authorities – townships, fire districts, cemetery districts, and other small taxing authorities – are also subject to Truth in Taxation but are not included in the database.

Senate Tax Committee Chair Caryn Tyson says KPI’s effort provides the Legislature with more than transparency.

“This effort is exposing that some government bodies that are not following the law. This is critical because the governing body has to return the increased taxes if they do not follow the property tax transparency law, SB 13.”

Transparency battles and other legal issues

Our research disclosed that a lot of taxing authorities did not follow the July 20 requirement. Some that did meet the deadline still haven’t provided all of the required information, which is noted as ‘not provided’ in the database.

Some entities are holding their hearings sooner than the August 20 date established in state law, and they may have to issue rebates if they don’t follow the law.

There are still 17 county clerks who have not provided any of the information requested as of Monday afternoon, August 16. Some of them are withholding this critical public information while waiting for a check from KPI to arrive; the vast majority of county clerks graciously did not charge a fee for the information, telling KPI it took very little effort.

Many county clerks were very polite and readily willing to provide the information. But others were rude and exhibited disdain for Truth in Taxation and transparency. Some ignored the Open Records request and others are trying to impose conditions not required by state law, so there are several KORA complaints still pending with county attorneys and the Attorney General.

Trying to force a Kansas citizen to sign a form of their design is the most common complaint, even though state law only requires someone to identify themselves and describe the information being requested. A few tried to impose fees beyond those allowed in state law. In one situation, the Lane County Attorney agreed that the County Clerk cannot require a form to be completed but then demanded that I provide a copy of my driver’s license; a new complaint is pending with the State Attorney General on that issue.

Attend the public meetings to stop property tax increases

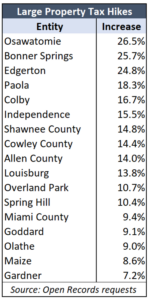

Truth in Taxation hearings provide a great opportunity for taxpayers to demand efficiency and lower taxes. Some local officials are finally giving Kansans a break, but there are  some who are planning very large increases. The examples in the table below are just that – examples; check the listings at KansasOpenGov.org to see all of the large increases.

some who are planning very large increases. The examples in the table below are just that – examples; check the listings at KansasOpenGov.org to see all of the large increases.

Miami County residents and businesses are being set up for huge tax hikes by the county and the cities of Osawatomie, Paola, and Louisburg.

Some of the more egregious increases in Johnson County include Overland Park, Edgerton, Spring Hill, Olathe, and Gardner.

The City of Colby is proposing a 16.7% property tax hike. Shawnee County, Cowley County, and Allen County each want double-digit increases, as well as some other counties.

Sedgwick County residents of Goddard and Maize are looking at increases of about 9%.

State funding of public schools will jump by about $250 million this fall, but some school districts are also choosing to impose large, unnecessary property tax increases for their Local Option Budgets and Capital Outlay. Superintendent Troy Hutton in Osage City told board members last week that the district didn’t need to increase their LOB property tax this year, but board members Cory Linton, Kat Bellinger, and David Williams rammed through a 10% increase over the objection of board president Jay Bailey. This is just one example of local officials not needing more money but taking from taxpayers anyway.

Truth in Taxation hearings give taxpayers a chance to make local officials justify their tax increases before they vote on them. Don’t waste that opportunity. And pay close attention to the scheduled hearing dates and times. A taxing authority could make changes from what was provided to Kansas Policy Institute in early August, so be sure to look for revisions on the county websites.