Senate Bill 280 would require local governments such as counties, cities and school districts to get voter approval to raise property tax increases on previously-existing property exceeds the rate of inflation. The measure to address the contentious issue of property taxes was recently discussed in the Senate Committee on Assessment and Taxation.

The legislation would exclude new home construction from the property tax calculation and would not affect the 20-mill levy set aside for K-12 schools.

SB 280 goes beyond the four-year-old Truth in Taxation law, also known as Revenue-Neutral, in seeking to curb the growth in property taxes among local governments. While Revenue-Neutral requires the legislative bodies of local entities, such as a board of commissioners, to hold a public hearing and vote to increase property taxes above that of the previous year, the SB 280 would mandate local governments pay to hold an election in which their constituents would decide the question.

Dave Trabert, CEO of The Kansas Policy Institute and owner of The Sentinel, was among those testifying in support of the reform measure. He showed data from the Kansas Department of Revenue indicating property taxes have increased 230% since 1997, nearly two-and-a-half times the rate of inflation (85%) and population growth (12%).

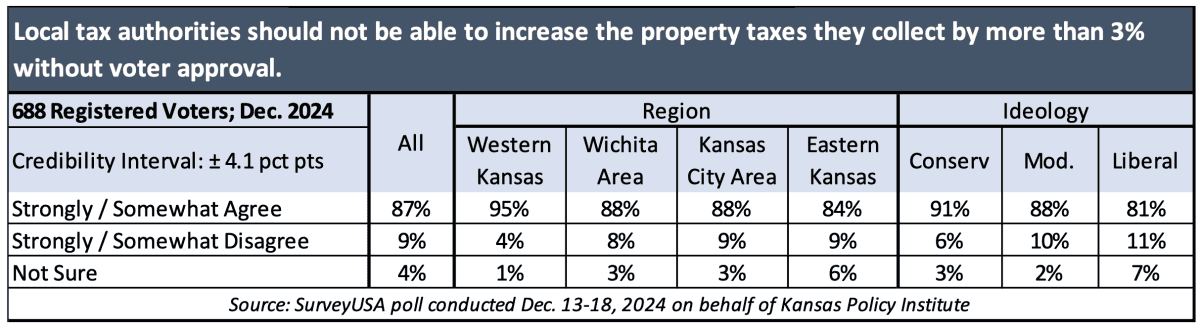

Trabert also noted that public polling shows 87% of Kansans want a 3% limit on property tax increases without voter approval.

Tanner Tempel of Americans for Prosperity testified the bill has several advantages over other reform efforts:

SB 280 avoids mistakes from previous tax lid attempts

“Kansas implemented a property tax lid from 2017 to 2020 to control property tax increases by requiring public votes for specific hikes. However, the legislature repealed the lid in 2021 due to numerous exemptions that undermined its effectiveness in curbing property tax growth.

The Tax Foundation noted that the prior tax lid was “riddled with exemptions that rendered it ineffective at constraining property tax collections growth as desired. Senate Bill No. 280 addresses these shortcomings by proposing a more straightforward and enforceable mechanism, thereby avoiding the pitfalls of the previous policy.”

SB 280 alignment with inflation rates better protects taxpayers

“Linking property tax increases to the annual inflation rate ensures that tax burdens do not outpace taxpayers’ ability to pay. Between 2020 and 2023, the Consumer Price Index for Midwest cities increased by 17.8%. 2 By tying property tax increases to inflation, this bill ensures that tax hikes remain reasonable and predictable, safeguarding taxpayers from sudden and disproportionate financial pressures.”

Jay Hall, with the Kansas Association of Counties, counters that his organization feels the legislation puts an undue hardship on local governments:

“First and foremost, the timing of any election as would be required under SB 280 would be difficult given other timelines required by statute. A revenue-neutral hearing cannot be held until August 20. Budgets must be submitted no later than October 1. This means any election would have to take place between those two dates. Under KSA 10-120, such an election requires at least 21 days notice, making timelines to hold an election very tight. Additionally, there is extra cost associated with holding such an election, which works counter to the goal of reducing property taxes.

“This election is also in addition to the provisions for the revenue neutral rate. This adds an additional layer of confusion for taxpayers, as well as additional administrative steps for local officials.

“This could also have a large impact for county election officials, who may have to put together multiple elections in a short period of time depending on when notices for elections are made, when revenue neutral rate hearings take place, and which local entities are exceeding their budget. All of this would be taking place between a primary and general election cycle, which could impact turnout and lead to even more voter confusion.

The City of Derby also opposes the legislation. City Manager Kiel Mangus says local control of government would be restricted by SB 280:

“Derby utilizes property taxes to pay for critical services such as firefighters, police officers, street maintenance, parks, and other pertinent local services. Cities should be left to make local decisions on how much fire protection or law enforcement are desired and needed in their community. Local elected officials are best positioned to understand the overall budget picture and make difficult decisions concerning critical services, capital projects, and infrastructure maintenance requirements.

“However, these decisions are not made in a vacuum. Derby works diligently to engage its residents in setting and understanding fiscal priorities. Derby has actively utilized local surveys to assist elected officials in making decisions. Based upon local surveys in Derby, residents have shown they greatly support parks and want more. The city has supported parks through increased maintenance efforts and sales tax initiatives passed by local voters. Those are local decisions that impact budgets and mill levies and should be left to locally elected officials to understand and determine that appropriate level.”