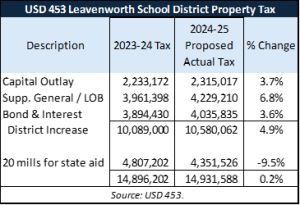

At its July board meeting, the USD 453 Leavenworth school board was shown a revenue-neutral rate chart that appears to be a 0.2% tax increase, but the district is really proposing a 4.9% property tax increase.

The amount collected on the mandatory 20 mills supplement to state aid is declining because the Legislature raised the homestead exemption from about $42,000 to $75,00. However, the district doesn’t get less money because the legislature makes that up in the state aid calculation.

The amount collected on the mandatory 20 mills supplement to state aid is declining because the Legislature raised the homestead exemption from about $42,000 to $75,00. However, the district doesn’t get less money because the legislature makes that up in the state aid calculation.

The Leavenworth school board’s proposed property tax rates would produce a 3.7% increase for Capital Outlay, a 6.8% increase in the Local Option Budget tax, and a 3.6% increase for Bond & Interest payments. The school board will take in almost $500,000 more in property tax on the mill rates it sets.

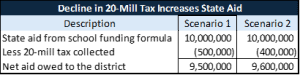

20 mills property tax impact on the school funding formula

The school funding formula determines the amount of aid each district receives. The 20 mills of property tax the district receives is deducted from the aid total, and the balance is sent to the district.

The 20 mills of property tax have no bearing on the amount of aid each district receives. Because of the Legislature’s action, districts will collect less this year from that tax, but that amount will be offset by collecting more in state aid.

For example, if a school district gets $10 million in state aid and it collects $500,000 in property tax from the 20-mill assessment, the state sends $9.5 million. The state will send $9.6 million if the 20-mill assessment drops to $400,000

For example, if a school district gets $10 million in state aid and it collects $500,000 in property tax from the 20-mill assessment, the state sends $9.5 million. The state will send $9.6 million if the 20-mill assessment drops to $400,000

Taxpayers should be on the lookout for other school districts trying to take credit for the Legislature’s work to cut property taxes.