Tag: flat tax

SB 259 promises income tax reductions based on increases in state revenue

Senate Bill 259 proposes a path to a flat income tax in Kansas based on increases in state revenues above…

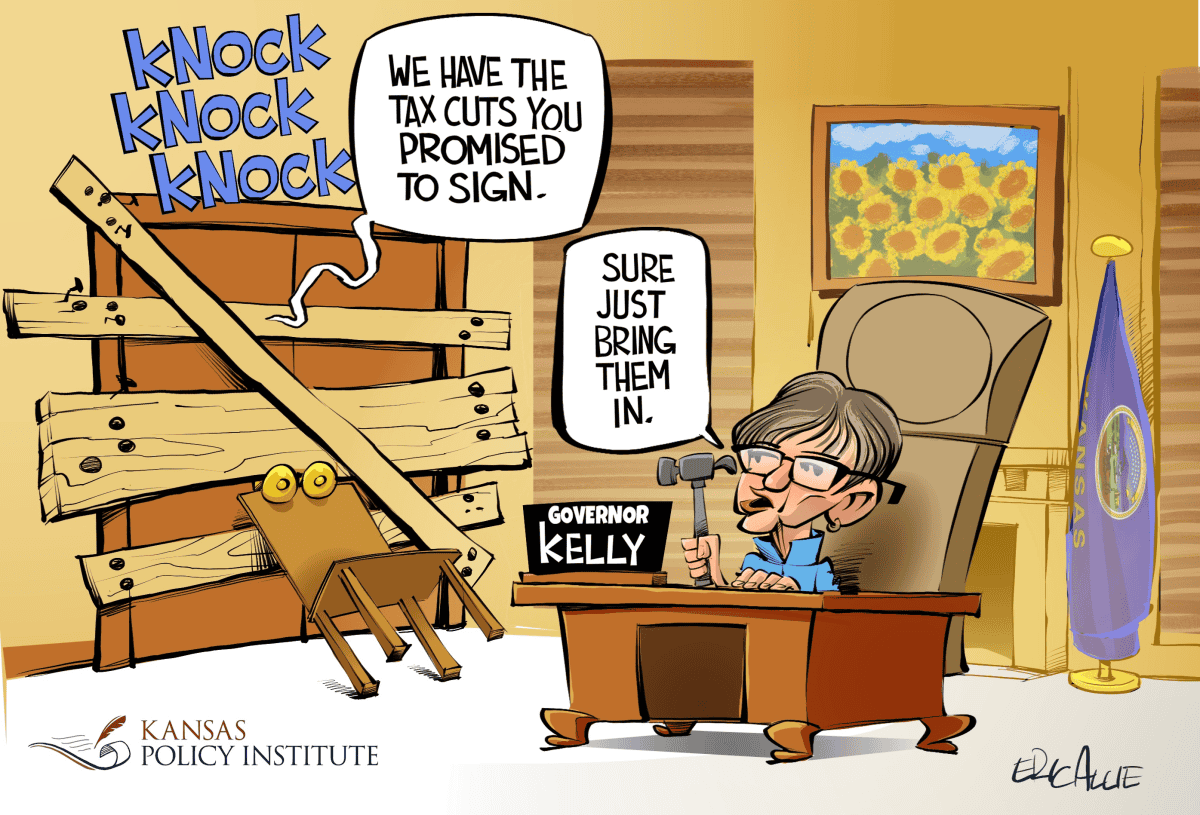

Kelly veto of HB 2036 shows disdain for taxpayers and the state’s economy

Kansas Governor Laura Kelly’s veto of HB 2036 was entirely predictable. We’ve heard the same excuses as she vetoed every…

Low-income earners benefit most under new flat tax compromise in SB 539

The Senate Assessment and Taxation Committee held a hearing today on a new flat tax bill that is a compromise…

Sen. Rob Olson rebate proposal exposes his flat tax hypocrisy

State Senator Rob Olson (R-Olathe) has said he opposes the flat tax because it gives too much relief to high-income…

Exposing Governor Kelly’s pants-on-fire claim that the flat tax creates budget deficits

Governor Kelly’s budget director, Adam Proffitt, tells legislators that the flat tax in HB 2284 puts the state into budget…

Nearly 60% of Kansans favor single tax rate: poll

Americans for Prosperity – Kansas (AFP-KS) has released a poll showing a bipartisan coalition of taxpayers strongly supports replacing the…

Low-income families save more on the flat tax proposal than with Gov. Kelly’s plan

Low-income families fare much better under the flat tax proposed this week by the Kansas House and Senate leadership team…

House, Senate leaders look ahead to 2024 Kansas legislative session

Will Kansans see a flat tax, property tax reform, and school choice in 2024? How about Medicaid expansion? What to…

Flat tax in SB 169 is good for Kansas taxpayers

by Grover Norquist and Dave Trabert It was clear from the very beginning. Despite winning reelection on a message of…

Gov. Kelly’s false claims in veto of income, property, and sales tax relief

It’s no secret that Kansas Governor Laura Kelly is a tax-and-spender — spending has jumped 31% since she took office…

Kansas Legislature passes $1.4 billion tax relief bill in SB 169

Unless Governor Laura Kelly wields her veto pen on SB 169, Kansas taxpayers can look forward to $1.4 billion in…

Kansas Reflector makes false claims on flat tax, ESAs

The Kansas City Star earlier this month deceived readers about education, and now the Kansas Reflector is making false claims…

More efficient spending keeps taxes low in other states

Every state provides the same basket of services, but some of them have an efficient spending mentality and that allows…

KC Star, KU prof consciously deceive Kansans on the flat tax

Tony Botello, the self-described ‘left-leaning’ brain behind the Tony’s KC blog, describes the Kansas City Star’s latest resurrection of the…

Mississippi becomes third state this year to move to flat tax

While Governor Kelly’s handpicked Tax Council recommends adding a fourth income tax bracket as suggested by her Council on Racial…

Senate Torpedoes Flat Tax Proposal

Senators torpedoed a flat tax bill that would have created one, 4.6 percent income tax rate. Members of the Senate…

Governor Blesses Senate Flat Tax Proposal

Gov. Sam Brownback told Senate leadership he would support a flat tax proposal. A flat tax bill in the Kansas…

Flat Tax Proposal Headed to House Floor

The Kansas House will consider a flat tax. The proposal increases taxes across the board to 5 percent. Currently, single Kansans are…