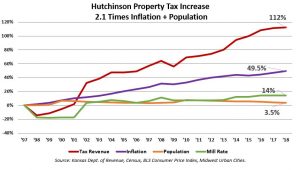

Property tax collections in Hutchinson jumped 112% between 1997 and 2018 – more than twice the combined rates of inflation and population – and city manager John Deardoff is proposing another property tax increase next year. The Hutchinson News says Deardoff’s proposal comes after a small decline in assessed valuations this year would reduce property tax revenue by $95,000. Deardoff recommended the city council increase the tax rate by one mill, generating about $307,000 in revenue to fund a $35.3 million annual budget next year.

Data from the Kansas Department of Revenue Property Valuation Division, U.S. Census Bureau, and the Bureau of Labor Statistics Consumer Price Index posted at KansasOpenGov.org show the cumulative changes in mill rates, population, and inflation since 1997. The data shows property tax collections 112 percent while inflation was 49.5 percent and population is 3.5 percent higher; the mill rate increased by 14.4 percent. Hutchinson’s population is higher than in 1997 but has declined each year since 2010.

Options to avoid a tax increase

Fortunately for residents and business owners, the city seems to have multiple options to avoid a property tax increase.

The city’s General Fund budget of $35.3 million includes $33.1 million in direct expenditures and $2.2 million in General Fund transfers “…to subsidize Special Street, Special Parks and Recreation, Animal Shelter, Airport and Golf Course funds.” Expenditures budgeted in those subsidized funds total $3.8 million, so combined with General Fund direct expenditures, the city has about $37 million in expenditures to find $307,000 in savings to avoid the mill rate increase. For context, budgeted expenditures would need to decline by less than one percent.

City officials could also tap the General Fund unencumbered cash reserve, which is expected to have $4.7 million at the end of 2019.