Kansas Governor Laura Kelly’s likely illegal attempt to collect sales tax on the first dollar of all internet and catalog sales made by out-of-state businesses is hurting small businesses in other states, and Kansas companies selling out-of-state could be harmed by other states’ seeking taxes from them.

The 2018 South Dakota v. Wayfair decision was touted by the states — including Kansas — as necessary, since they were, according to the states, “losing” billions of dollars in sales tax revenue a year.

For decades, only businesses that had a physical location in the state were required to collect sales tax on out-of-state purchases. Amazon, for example, has a distribution center in Kansas, so it was required to collect sales tax on purchases by Kansans. But catalog and online retailers like Wayfair with no physical presence in Kansas didn’t have to collect and remit sales tax to the state; in those instances, Kansans were supposed to remit a use tax for everything they bought online or from a catalog. But states say most individuals who make out-of-state purchases don’t remit the use tax.

In its Wayfair ruling, the Supreme Court said states should do as South Dakota did, and create a threshold under which small retailers would not be required to collect sales taxes.

Ironically, Kansas lawmakers passed legislation that would have conformed with Wayfair and used the extra sales tax revenue to reduce the sales tax on food but Kelly vetoed the bill twice because the legislation also would have reduced other taxes.

Speaker of the House Ron Ryckman in October called Kelly’s tax memo an unlawful tax mandate, and state Sen. Susan Wagle, both Republicans, warned that Kelly’s executive remote sales tax increase could open the state up to litigation.

One small company’s story

Small businesses — in Kansas as well as other states — are now required to try to keep track of not just the few hundred taxing districts in their state, but more than twelve thousand nationwide.

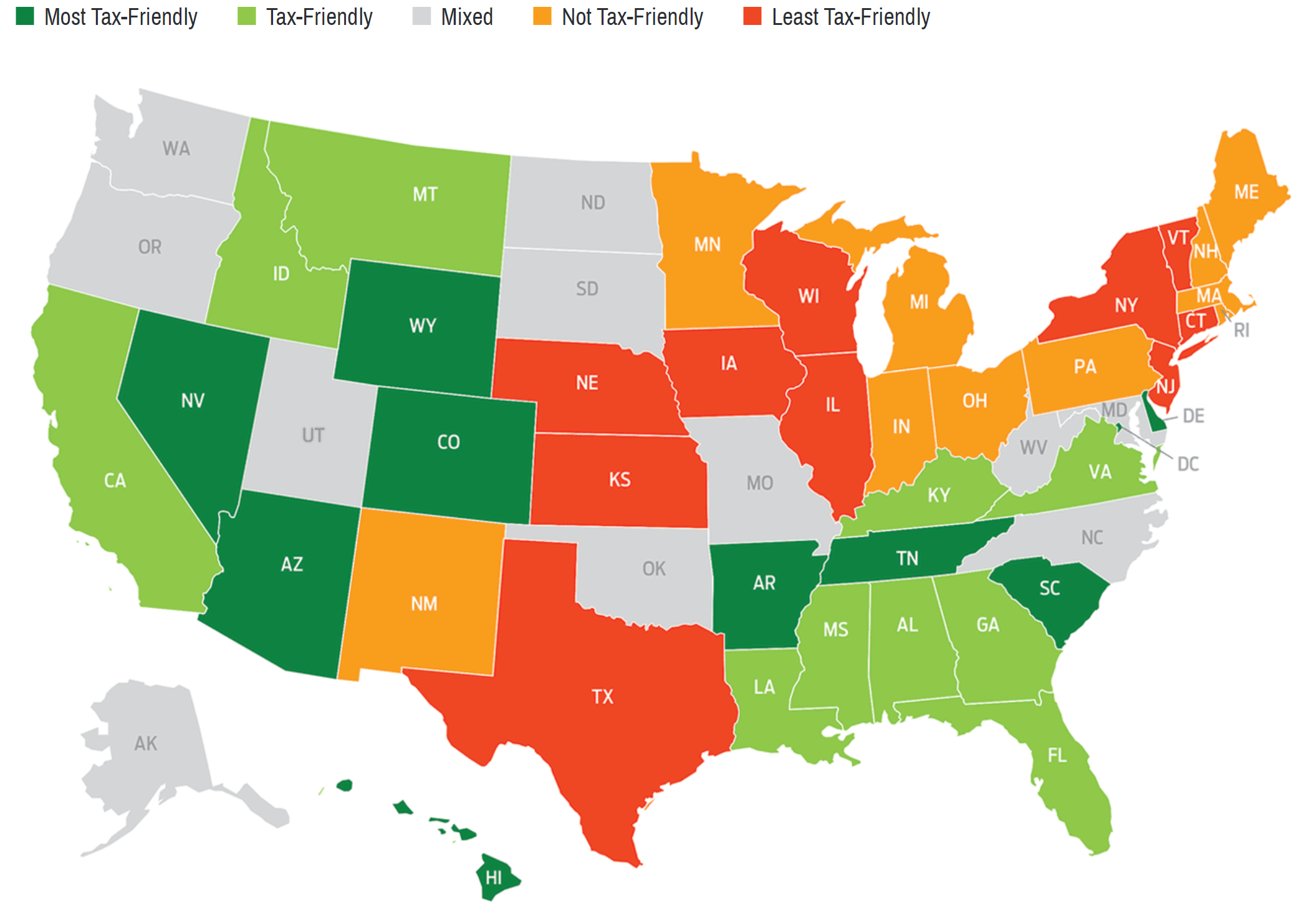

It’s a daunting task, according to Bradley Scott, whose wife is the president of their family-owned wholesale jewelry company Halstead Beads in Prescott, Arizona.

Halstead is a small company with only about $6 million in annual gross revenues from sales across all 50 states, most of which is wholesale, but often to smaller retailers who don’t have exemption certificates.

According to documents provided to The Sentinel, the cost of Wayfair compliance implementation to the 29-employee company in the last 17 months has been $162,266 to collect just $67,968 in sales tax.

Scott estimates he, personally, has spent more than 3,300 hours personally on compliance issues.

The cost of compliance for his company moving forward is in excess of $70,000 a year — enough to hire one or two more employees.

“It’s a lot of states, and it’s a lot of sets of different regulations,” he said. “Unfortunately for a company our size we have the bandwidth to deal with a few sets of regulations but when we’re dealing with 50 different states and the federal government it becomes an overwhelming task.”

Worse, Scott said, sales taxes are much like student loans — they are not dischargeable in bankruptcy.

“If you fail to collect and you don’t know you’re supposed to be collecting, you, as the … affected party, face enormous exposure because the resources that your business has ultimately become collateralized against that sales tax revenue that you were supposed to collect,” he said “And as the owner of the business, if the assets of the business are not enough to offset that expectation from the state then your personal assets also become collateralized.

In short, the states can seize your business assets, and if those are insufficient to cover the “debt,” they can then seize your house, your car, your retirement account or your children’s college savings accounts.

In fact, Scott said, two states have tried to either put a lien against his wife’s business or seize it outright over mistakes made by the software.

“Tennessee and Wyoming have threatened us with seizures and legal action due to TaxCloud (software) sales tax errors that took 5 months to resolve,” Scott said in a document given to the Sentinel. “The amounts in questions were less than $100 combined.

“Our homes, our retirement accounts, our children’s college funds, those all become targets for the states to collect against sales tax expectations,” he said in a phone interview. “So the liabilities are enormous for this. It’s a lot like student loan debt. You cannot escape it, you’re basically in a situation where restitution is your only out.”

Unfortunately, the federal government not only failed to act when it had a chance but in the year-and-a-half since Wayfair has continued to ignore the problem.

“The federal government had decades to address this issue,” Scott said. “They relied on the ‘physical presence’ standard of Quill, they just left things stand.

Legislation back in 2013 would have addressed a lot of this. It passed in the Senate and failed in the House, so it went nowhere.”

Scott said his company was fortunate, in that they were somewhat prepared.

“My wife has two master’s degrees and she runs the $6 million company more like a fortune 500 company,” he said. “So we’re fortunate in that she was paying attention to this court case, long before it made it to the Supreme Court.

“She knew about the fast-tracking of it to South Dakota. She was paying attention to it and the entire time I thought, “there’s the way this is going to pass the Supreme Court. I was wrong. “And we are fortunate and that we were aware of it on the 21st of June (2018). When the decision was released, we were reading it within minutes of that decision being publicized in the media, so we were aware of it.

” I’m sure, if we were really audited, they might find a few small discrepancies in what we’re doing, and maybe we’d have a small fine.”

It’s not the family business Scott says he’s concerned about at this point, but rather other small businesses.

“We’re really concerned about our suppliers and our customers, and about all the other small and medium-sized businesses out there that are run much more in the way that I would have run it,” He said. “In which case … I would not know that we have a sales tax obligation to 44 other states and the District of Columbia.”

Many small companies are looking at complete financial ruin, but don’t know it, Scott said.

One solution, of course, is for the small micro retailers who make up a lot of Halstead’s customer base is to go to a facilitator like Amazon which collects the sales tax for them.

There are problems with that solution as well, Scott said.

“When you go to the marketplace facilitator, they take control of your inventory and they take control of your customer list, they take control of your terms of sale, effectively forfeiting ownership of your business while you’re paying an annual subscription,” he said. At this point in time, the states are picking winners and losers. The winners are the software companies or the large marketplace facilitators, and the losers are small and medium-sized businesses, they can’t handle this burden without the assistance of one of these other providers.”

Editor’s Note: The second part of this series will focus on how these changes are impacting catalog retailers.