It’s no secret that Kansas Governor Laura Kelly is a tax-and-spender — spending has jumped 31% since she took office in 2019 — but she could at least be honest with her veto of a $1.4 billion tax relief package in SB 169.

Kelly says a flat tax, which costs about $335 million annually, is not fiscally responsible. But her special education funding proposal costs $1.1 billion over the next five years, with an annual cost of $362 million when fully implemented. Kelly is consciously misleading Kansans on the budgetary impact of SB 169, according to Kansas Legislative Research. The state is expected to finish the next fiscal year with a $3 billion surplus AFTER the first year that SB 169 is implemented. She clearly understands that taxes matter, which is why she is so willing to hand out billions in subsidies to companies like Panasonic (and get to take credit for it.)

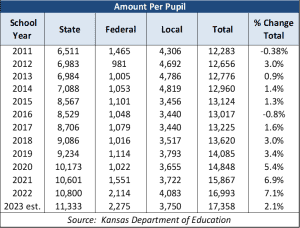

She is also scaremongering and not telling the truth when she claims that “public schools would be the first to take a hit should this bill become law.” School funding didn’t decline (contrary to what media and others claimed) during the Brownback tax cuts, according to the Kansas Department of Education, and it can continue to grow beyond the current $17,000 per student school districts receive. (The small decline in 2016 was due to a KPERS pension payment being deferred to 2017.) What’s more, the only actual cuts to K-12 spending were implemented during Democrat Mark Parkinson’s administration, which Governor Brownback inherited.

She is also scaremongering and not telling the truth when she claims that “public schools would be the first to take a hit should this bill become law.” School funding didn’t decline (contrary to what media and others claimed) during the Brownback tax cuts, according to the Kansas Department of Education, and it can continue to grow beyond the current $17,000 per student school districts receive. (The small decline in 2016 was due to a KPERS pension payment being deferred to 2017.) What’s more, the only actual cuts to K-12 spending were implemented during Democrat Mark Parkinson’s administration, which Governor Brownback inherited.

General Fund spending, including K-12 funding, can grow at a reasonable pace with SB 169 and still have balanced budgets.

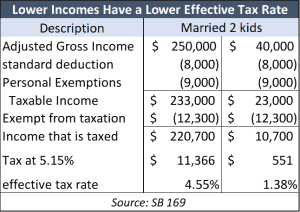

Kelly is also wrong in saying everyone pays the same portion of their income with a flat tax.

A family of four with a $250,000 gross income that takes the standard deduction pays $11,366 in state income tax, which is 4.55% of gross income. That same family with a $40,000 gross income only pays $551 in tax, or 1.38% of gross income. There is still progressivity in the flat tax because those with lower incomes have a higher proportion of their income that is exempt from taxation ($6,150 single and $12,300 married).

A family of four with a $250,000 gross income that takes the standard deduction pays $11,366 in state income tax, which is 4.55% of gross income. That same family with a $40,000 gross income only pays $551 in tax, or 1.38% of gross income. There is still progressivity in the flat tax because those with lower incomes have a higher proportion of their income that is exempt from taxation ($6,150 single and $12,300 married).

Look, Governor Kelly, we get it. You have always wanted higher taxes so you can grow government. Just be honest about it. As they say in rural Kansas, just don’t try to tell us it’s raining while your dog is whizzing on our boots.