Former USD 469 Lansing school board member Beth Stevenson is telling the community that holding revenue neutral on local property tax  will cause the district to collect less money than the current year, but that is not true.

will cause the district to collect less money than the current year, but that is not true.

First, ‘revenue-neutral’ means the local property tax revenue budgeted this year will be the same amount collected next year if the school board votes to accept the revenue-neutral rate. The 2021 legislation sets the process; after new valuations come in, the county clerk reduces mill rates so that the new (higher) valuations produce the same amount of property tax revenue. If elected officials wish to take in more revenue, they must notify taxpayers in writing of their intent, hold a public hearing to get input from taxpayers, and then they have to vote on the entire tax increase they impose.

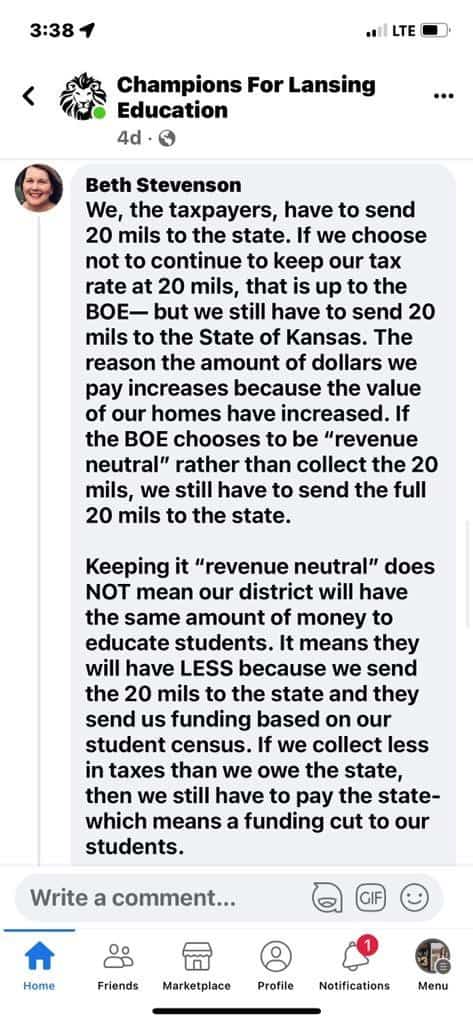

Stevenson, who was elected to the Lansing school board in 2005 according to her LinkedIn page, posted a comment to the Champions For Lansing Education Facebook page. Her comment only addresses the state-mandated 20 mills that each district must collect, but for unknown reasons, she said nothing about the local property tax mill rates imposed by USD 469. Attempts to correct inaccurate statements on that page have been blocked by the Champs group.

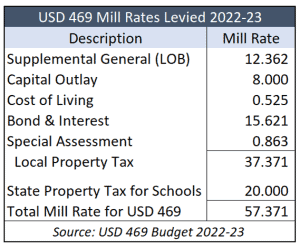

The Lansing budget for this school year shows five local mill rates imposed by the district – Supplemental General Local Option Budget (12.362), Capital Outlay (8), Cost of Living (0.525), Bond & Interest (15.621), and Special Assessment (0.863) – totaling 37.371 mills.

The board technically votes on the state-mandated 20 mills, but contrary to Stevenson’s claim, it must be 20 mills in each district by law. Her statement that “if we collect less in (20 mills) taxes than we owe the state, then we will have to pay the state – which means a funding cut to our students” is simply not true.

By the way, the district doesn’t collect and send the 20 mills of property tax to the state as Stevenson  says. The district legally must impose the tax, but the County Treasurer collects that tax and remits it to the state.

says. The district legally must impose the tax, but the County Treasurer collects that tax and remits it to the state.

Local property taxes are different, in that school districts are not legally obligated to impose a specific number of mills. Property tax for Bond & Interest payments must be sufficient to meet each year’s debt service, so unless there is a mandatory payment increase from one year to the next, the revenue generated this year would be enough to make next year’s payments. Put differently, the Bond & Interest mill rate can be held at revenue neutral unless the district is required to make higher payments in the coming year.