The Wyandotte County 2023 budget presentation touts a half-mill reduction as property tax “savings” and “tax relief,” but in reality, county commissioners are proposing a whopping  13.6% tax hike. Dishonesty of this nature prompted legislators in 2021 to pass Truth in Taxation legislation, which requires elected officials to inform taxpayers of their intended property tax hikes, hold a public hearing, and then vote for the entire tax increase they impose.

13.6% tax hike. Dishonesty of this nature prompted legislators in 2021 to pass Truth in Taxation legislation, which requires elected officials to inform taxpayers of their intended property tax hikes, hold a public hearing, and then vote for the entire tax increase they impose.

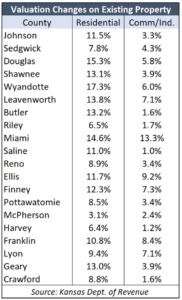

The impact on each homeowner varies based on each property’s valuation change. The average residential increase in Wyandotte County is a whopping 17%, while Commercial and Industrial property jumped 6%.

A Wyandotte County property owner shared the revenue neutral notice sent by the county, which also shows a 13.8% increase for Kansas City, 13.6% for the Kansas City Kansas Community College, a 10.9% hike for the county library system, and a 6% increase for the Kansas City school district.

Wyandotte County has not provided information for all taxing authorities in the county; the information was not on its website at press time, and the County Clerk has not yet fulfilled an Open Records request submitted about four weeks ago by Kansas Policy Institute.

Large residential value increases across Kansas

The average residential value increase across the state is 11%, which is more than double the increase in recent years.

Homeowners in Anderson County are being hit with the largest increase in home values, at 28%. Four other counties have more than a 20% increase in residential values – Russell (24%), Linn (23%), Osborne (22%), and Scott (20%).

Homeowners in Anderson County are being hit with the largest increase in home values, at 28%. Four other counties have more than a 20% increase in residential values – Russell (24%), Linn (23%), Osborne (22%), and Scott (20%).

The adjacent table shows the changes in residential and C/I for the 20 largest counties in Kansas.

In addition to Wyandotte County, 11 of the other large counties have double-digit residential value increases – Johnson, Douglas, Shawnee, Leavenworth, Butler, Miami, Saline, Ellis, Finney, Franklin, and Geary.

Taxpayers should have received their revenue-neutral notices by now, which, by law, must be mailed at least ten days before any hearings. Revenue Neutral Rate hearings will be held between August 20 and September 20. Kansas Policy Institute has a database of hearings across Kansas, which is updated as county clerks fulfill Open Records requests sent in mid-July.