Local elected officials and bureaucrats routinely fib about property tax increases, and most often, those who know that their constituents are being misled sit quietly by. But not Edgerton city councilman Ron Conus.

During discussions of the 2022 budget this summer, Conus questioned a chart showing that property taxes allegedly declined in Edgerton between 2011 and 2021. He says he showed the city manager how his own taxes had increased and was told that that was because the value of his home jumped. Conus says the city would not back off the claim that they were cutting taxes, so he tells The Sentinel he resigned.

“It seemed to me they crossed a line in publishing that graph. No jurisdiction in my neck of the woods seemed concerned about the revenue-neutral rate and as a matter of fact, quickly published their intents to exceed it.”

For the record, Edgerton passed a budget that exceeds its revenue-neutral rate by 3.3%, according to the Johnson County Clerk. Only in government-speak is that considered a tax cut.

For the record, Edgerton passed a budget that exceeds its revenue-neutral rate by 3.3%, according to the Johnson County Clerk. Only in government-speak is that considered a tax cut.

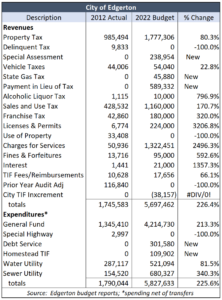

Edgerton does not publish its full 2022 budget on the city website, but The Sentinel obtained it through an Open Records request. Compared to 2012 actual amounts, property tax will increase 80% and total revenue will be 226% higher. The city also has about $873,000 in new revenue from a Special Assessment, State Gas Tax, and Payments in Lieu of Taxes. Other taxes – Liquor, Sales and Use, and Franchise – jumped by $877,000 and Charges for Services are $1.2 million higher.

Edgerton’s population declined from about 1,800 in 2012 to an estimated 1,750 now. The revenue growth comes from Logistics Park KC, which is a huge distribution and warehouse development.

As is most often the case, however, the taxpayer-subsidized LPKC has not benefitted Edgerton residents. The $4 million revenue jump has been used to increase the size of the city government.

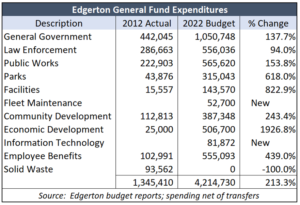

General Fund spending accounts for most of the 226% increase in total spending.

Despite no increase in population, General Government expenditures jumped 138% over the last ten years. The city doesn’t publish employment data in its budget, but a 439% increase in Employee Benefits costs indicates that city officials added a number of new employees.

Despite no increase in population, General Government expenditures jumped 138% over the last ten years. The city doesn’t publish employment data in its budget, but a 439% increase in Employee Benefits costs indicates that city officials added a number of new employees.

Economic Development is the next largest increase (in money), going from just $25,000 to more than $500,000.

The Sentinel asked city officials to comment on the large spending and revenue increases and the decline in population, but they did not respond.

False claims from local officials about property tax and spending increases are more the norm than an exception in Kansas, and especially so in Johnson County. Overland Park officials, for example, tried to cover up a huge spending increase in its 2022 budget, partially paid for with a 10% property tax hike.

Johnson County property tax jumps 65% under Ed Eilert

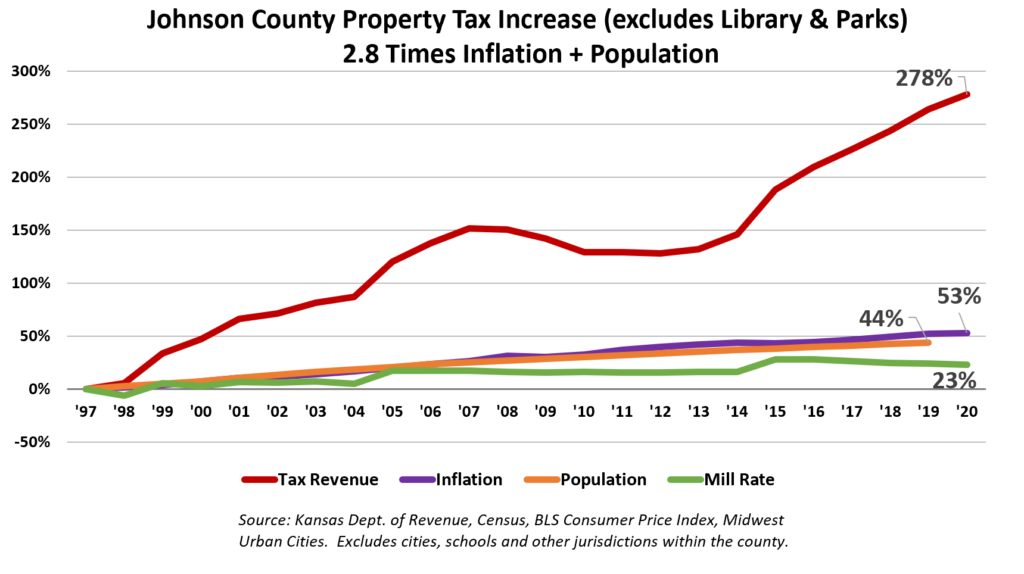

Johnson County Commission Chair Ed Eilert perennially misleads taxpayers about property tax increases. He is quoted in the county’s taxpayer-funded magazine saying, “we are again in a position to return some resources back to taxpayers through mill levy reductions.” Johnson County didn’t return anything; the county is taking more from taxpayers, having voted to increase property tax revenue by 3.5%.

Like many local officials, Eilert ignores the back door tax hikes imposed through valuation increases and pretends that mill rate changes are the sole determinant of whether taxes increased.

But people pay their taxes with dollars, not mill rates, and they’ve been writing bigger checks every year.

Property taxes exploded by 65% between 2011, when Eilert became Chairman, and 2020. At the same time, inflation was only 12% and the population grew 10%.

False claims like these from local officials in Johnson County prompted the Kansas Legislature to pass the Truth in Taxation Act, which requires local officials to vote for the entire property tax increase they impose. Preliminary results show that hundreds of local taxing authorities decided to not increase property tax next year.

(Editor’s Note: the original version of this story reported a larger property tax increase for 2022, which was based on the revenue-neutral rate from the Johnson County Clerk. Edgerton officials said Johnson County informed them that they made a mistake in calculating the rate.)