Senate Bill 259 proposes a path to a flat income tax in Kansas based on increases in state revenues above those adjusted for inflation. The measure was discussed at a recent hearing in the Senate Committee on Assessment and Taxation.

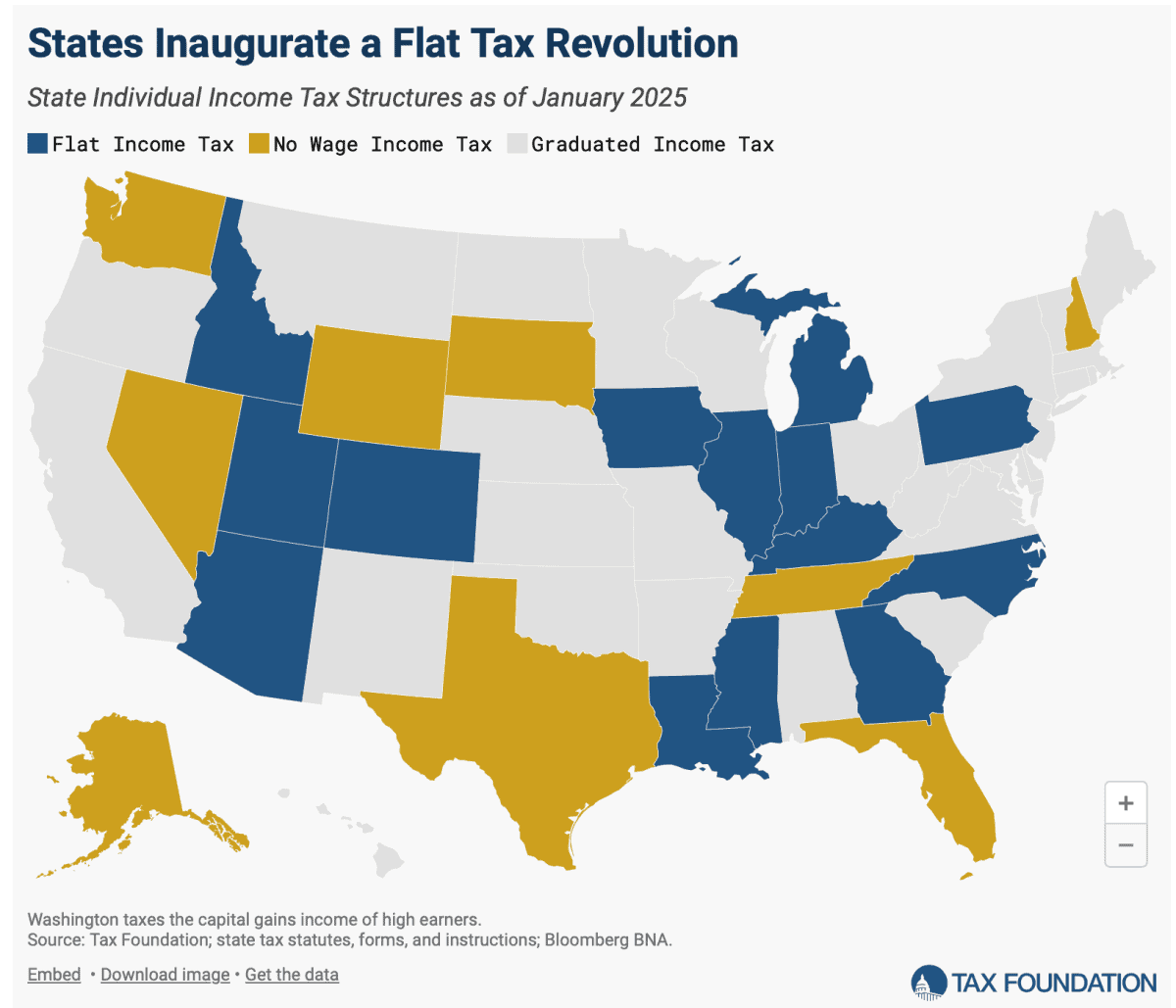

Currently, 14 states have single rate individual tax structures. Kansas has two rates; 5.2% increasing to 5.58% for joint filers with over $46,000 in income.

The legislation would mandate each August 15th that the director of the budget, along with the Kansas Legislative Research Department, determine if state revenues, aside from any adjustment for inflation, exceeded the inflation-adjusted revenues from the previous year. If so, they would report their findings to the director of revenue, triggering a reduction in the tax rate in each bracket based on the excess revenues. When the lower rate of 5.2% was eventually reduced to 4.5%, no further reductions to the lower bracket would be calculated; future reductions would be applied to the higher bracket until it, too, was reduced to 4.5%, resulting in Kansas joining the flat tax states.

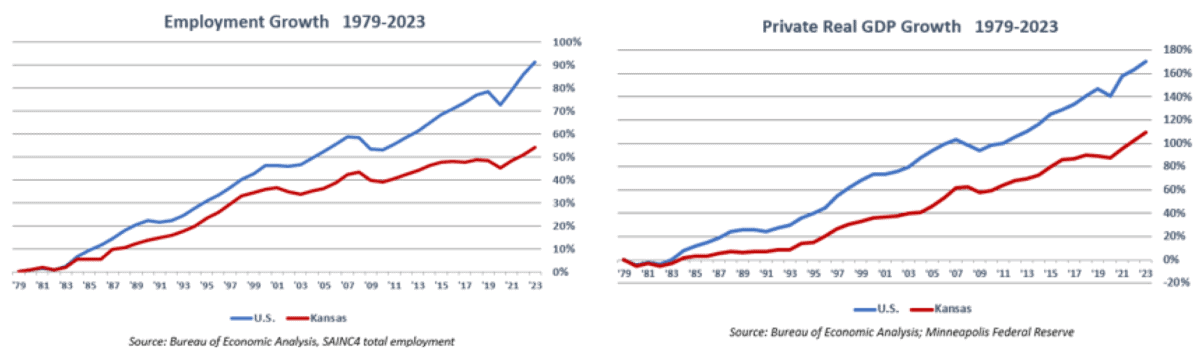

Dave Trabert, CEO of the Kansas Policy Institute, which owns The Sentinel, included two charts in testimony supporting SB 259 that show Kansas has lagged behind the rest of the country for the last four decades in job growth and real private growth in Gross Domestic Product, the amount of goods and services produced in the state’s economy.

Trabert added:

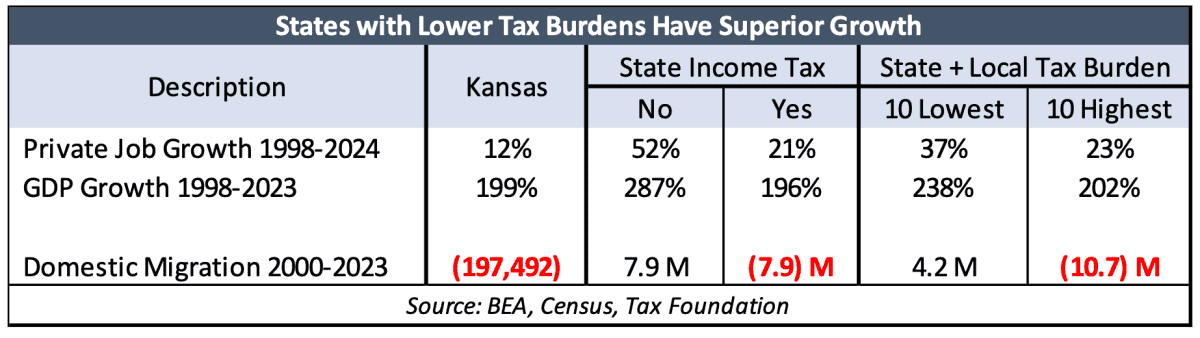

“The table below shows that the states without an income tax recorded a collective 52% increase in private-sector jobs between 1998 and 2024, while the rest of the country grew by just 21%. The ten states with the lowest state and local tax burden have a similar advantage, outpacing the ten states with the largest combined tax burden by a 37%—23% margin.”

Grover Norquist, President of Americans for Tax Reform, urged the legislature to join the movement toward lower taxes:

“The tax-cutting trend shows no sign of slowing in 2025, especially under a President determined to enact a sweeping national tax cut of his own. No less than 10 states are expected to enact some form of income tax rate reduction in 2025. Some of these states, such as Missouri, are looking to implement revenue triggers such as the ones before you today, which guarantee permanent income tax cuts whenever spending exceeds a certain amount. But even in (the) absence of major budget surpluses, conservative leaders around the country remain laser-focused on delivering permanent, structural income tax reform by keeping spending in check.

“SB 259 presents a historic opportunity for Kansas to gain a regional economic advantage. The proposed cut would not raise taxes on a single Kansan; on the contrary, the triggers would guarantee a tax cut for every Kansan whenever the budget can handle it. And as the rate continues to creep lower, individuals and families can contemplate a move to Kansas with the confidence that their tax bill is on a trajectory downwards.”