Tony Botello, the self-described ‘left-leaning’ brain behind the Tony’s KC blog, describes the Kansas City Star’s latest resurrection of the Brownback bogeyman in their attack of the flat tax proposal as “hyperbole and scare tactics.” That’s true, and even worse, the Star and guest columnist Dr. Donna Ginther ignore the facts in calling the flat tax proposal “the second coming of Sam Brownback’s disastrous experiment.”

House Bill 2061 exempts the first $15,000 (single) and $30,000 (married) from income tax. Currently, that income is taxed at 3.1%, and since zero is less than 3.1%, that is a tax reduction. The next $15,000 single /$30,000 married is currently taxed at 5.25%, and income above those levels is taxed at 5.7%. The flat tax proposal taxes all income above the $15/$30k level at 5%, so again, all of that income is taxed less.

But the Star and Ginther ignore the truth, saying the flat tax proposal is “Robin Hood in reverse, cutting taxes for the rich while increasing taxes on middle- and lower-income taxpayers.” They must know that not to be true, but they say it anyway.

Then they shift to hyperbole and scare tactics with knowingly deceptive claims about the Brownback plan and the flat tax impact on the state budget. It’s true that the fully-implemented proposal would reduce taxes by about $1.5 billion, which could lead to budget deficits after two years if spending continues to increase as it has the last few years. But this is where the Star and Ginther depart from the facts.

What was really the matter with the Kansas tax plan

Many claims about Governor Brownback’s tax plan are based on incomplete or inaccurate data, but Kansas did have serious budget challenges…and most of that was avoidable. There were a lot of mistakes made, and there were also other circumstances at play that created budget issues, including a very toxic political environment.

Spending increased

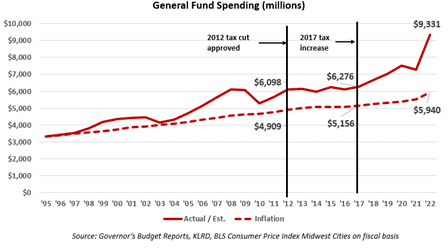

One of the major mistakes during the Brownback era was simultaneously implementing a large tax cut and spending increases. General Fund spending increased from about $6.1 billion in FY 2012 to $6.3 billion in FY 2017, when the Legislature imposed the largest tax increase in state history.

Claims that spending was drastically reduced simply are not accurate. Spending didn’t increase as fast as many people desired, and in government parlance, that is a ‘cut.’

No plan to balance the budget

Brownback’s original tax cut proposal was about $350 million over five years, but it ballooned to $3.5 billion by the time it left the Senate. Interviews with Governor Brownback revealed that there was never a plan to structurally balance the budget. Analysis by The Sentinel’s parent company, Kansas Policy Institute, showed that small spending reductions (2% to 3%) over three years would have balanced the budget and allowed spending to increase as revenues grew, and that could have been accomplished by enacting multiple efficiency opportunities. Unfortunately, Brownback, the Democrats, and some Republicans would not take advantage of those opportunities. Everyone knew the budget would go bust two years after tax cuts were implemented, but it was allowed to happen.

No promise that tax cuts will pay for themselves

Governor Brownback didn’t say that tax cuts would pay for themselves, but that didn’t stop the opposition from making the claim to discourage efforts in Kansas and other states.

His statement that tax cuts would be “a shot of adrenaline” to the economy may have given the impression that tax cuts would pay for themselves, but that was merely political exuberance, as politicians in both parties are known to do.

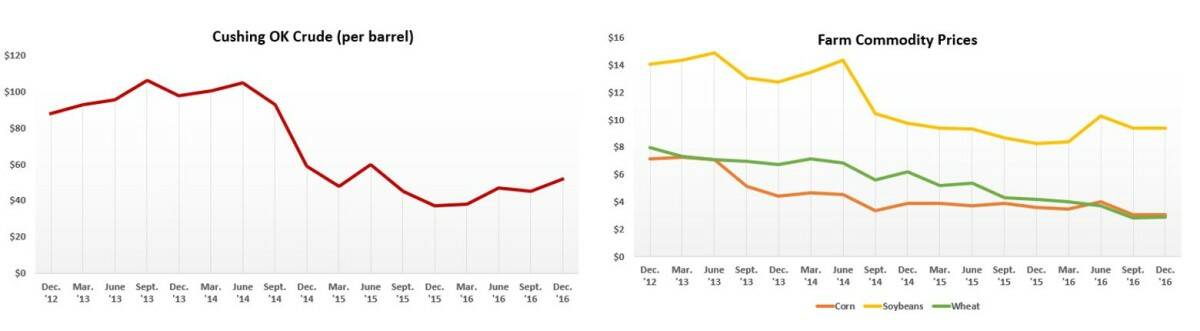

Oil and farm commodity prices plunged at the worst time

Just as the budget deficits were allowed to surface, prices of oil, corn, soybeans, and wheat dropped precipitously. That caused severe declines in severance tax and also sales and income tax related to agriculture.

Conclusion

Governor Kelly says she is ‘middle-of-the-road’ and wants bi-partisan conversations. This tax debate gives her an opportunity to ignore the hyperbole and call on both parties to develop a plan that rationally reduces the income tax burden on everyone.

There are many ways to ensure that a move to a flat tax is implemented in a responsible, sustainable manner that gives everyone a tax cut, and tax relief is very much needed.

Kansas is in its fifth straight decade of economic stagnation, and that cycle won’t be broken with an uncompetitive tax structure. To wit,

- Kiplinger

says Kansas is the third-worst state for taxation on retirees.

says Kansas is the third-worst state for taxation on retirees. - Kansas was one of just 18 states that lost population in the 12 months ended July 1, 2022.

- Many states already have lower income tax rates than Kansas, and others, including Iowa, are cutting rates.

- The gap in private-sector non-farm earnings in recent years is especially troubling. The adjacent chart shows that Kansas grew with the national average in 2013. The near-simultaneous plunge in oil and farm commodity prices in 2014 and 2015 created a growth gap that grew significantly worse after the Legislature imposed the largest tax increase in state history, and it has gotten much worse in the last two years.

Kansas has ample reserves to provide much-needed income tax relief now and use excess future revenue to trigger further tax cuts. Tax relief must be done responsibly, as other states have done successfully, but it must happen to break the economic stagnation cycle.