County appraisers hiked home values by 5.2% last year across Kansas. The average increase on homes that existed the prior year jumped by about 4.2% and new construction added another 1%. Appraised values on existing homes declined in 17 counties but homeowners in several counties received outsized hikes on average.

Gove (9.8%) and Washington (9.5%) had the largest increases on existing home values among counties. Other counties with large increases include Wyandotte (7.6%), Linn (7.4%), Franklin (6.8%), Cheyenne (6.3%), Miami (6.2%), Lyon (5.8%), Osage (5.7%), Sedgwick (5.4%), and Johnson (5.1%).

Some taxing authorities reduced their mill levies, so taxes on residential homes went up 4.5% on average.

Some taxing authorities reduced their mill levies, so taxes on residential homes went up 4.5% on average.

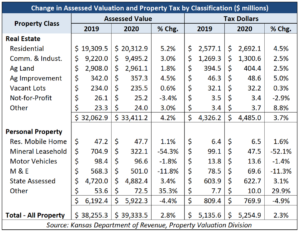

Residential is the largest property class in Kansas, followed by Commercial & Industrial. Values in the C&I class went up by 3% on average (including new construction) and those property owners will pay 2.5% more in tax this year. The 2020 taxes levied will be paid in 2021.

Real estate taxes this year will be about $4.5 billion across all classes, or 3.7% higher than last year. Precipitous declines in the Mineral Leasehold class (Oil & Gas) averaging 54% resulted in a net decline of 4.4% in Personal Property valuations and a 4.9% drop in tax.

Local government and education breakouts

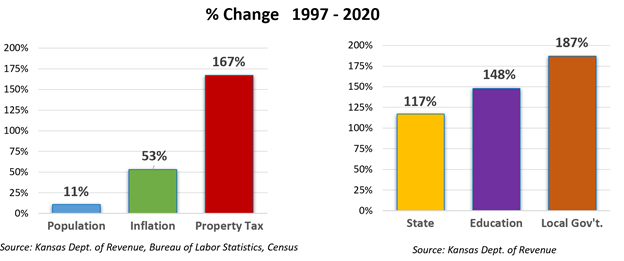

The Property Valuation Division of the Kansas Department of Revenue is the source of the data. PVD also publishes tax totals by the type of taxing authority. Local governmental units – mostly cities, counties, townships, libraries, parks, and fire districts – charged $2.86 billion in property tax, accounting for 55% of the $5.25 billion total.

Education – mostly school districts, community colleges – charged $2.33 billion, accounting for 44% of the total. The State of Kansas only collects $59 million from 1.5 mills levied for the higher education and state building funds.

Local government units raised taxes the most since 1997, going up 187%. Education property tax jumped 148% and state property taxes increased by 117%. All told, property taxes are 167% higher while inflation was 53% and the population grew by 11%

County-by-county allocations between local tax, education tax, and state tax are available here at KansasOpenGov.org. .

It will be interesting to see how the new Truth in Taxation legislation will affect property tax increases this year. When valuations are finalized in June, mill levies will be automatically reduced so the new valuations deliver the same dollar amount of property tax as the 2020 valuations. If education and local officials want to collect more tax, they must first notify taxpayers of their intent, hold a public hearing for taxpayer comment, and then vote on the entire increase.

No longer will local officials be able to claim to ‘hold the line’ on property taxes, referring just to the mill levy, while raking in large increases from valuation changes.