Kansas Policy Institute today asked Governor Laura Kelly to follow the lead of Idaho Governor Brad Little, who is leveraging federal COVID-19 stimulus funding to provide much-needed property tax relief to beleaguered taxpayers in his state.

Little and the Idaho legislature will provide up to $200 million in property tax relief, giving cities and counties the ability to pass the savings on to their taxpayers.

Today, Kansas Policy Institute CEO Dave Trabert called on Kansas Governor Laura Kelly to use federal stimulus funds to provide relief as well.

KPI owns the Sentinel.

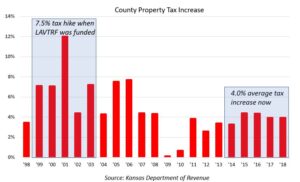

In a letter to Kelly, Trabert noted Kansans have been hit with enormous property tax increases over the last twenty years. Property tax on real estate jumped 222% since 1997, which is more than four times the rate of inflation, and Kansas now has some of the highest effective property tax rates in the nation.

Trabert also noted that Governor Little’s effort relies on cities and counties to ‘promise’ to pass on the savings didn’t work when it was tried in Kansas.

“Kansas tried this with the Local Ad Valorem Tax Reduction Program (LAVTR) but there were still big tax increases during those years,” Trabert wrote.

However, he said, there is a solution.

In the letter, Trabert stated Kelly could guarantee property tax relief in Kansas and greatly simplify the process by authorizing a one-time reduction in the 20 mills of property tax collected for schools.

“The Governor’s Budget Report estimates that the 20 mills will bring in $733 million in Fiscal 2021, or about $36.65 million for each mill of property tax,” Trabert wrote. “You could instruct county treasurers to reduce the school property tax by 6.8 mills and provide $250 million in property tax relief, backfilling the education fund with federal coronavirus relief funds.”

Tax Relief Critical for Kansans

Such relief is critical, in part because Kelly has repeatedly vetoed bills which would have provided both an easing of the burden and transparency in property tax.

Kelly vetoed Kansas House Bill 2702 which would have allowed taxpayers to pay their property taxes as late as August 10. In killing the bill, Kelly argued, in essence, that governments needed the money more than taxpayers who may be out of work.

“Local governments rely heavily on property taxes to fund essential programs and services, but by allowing property tax payments to be made as late as August 10, 2020, with no penalties or interest, House Bill 2702 would potentially deprive local governments of essential funding at a time it is needed the most,” Kelly said. “Local governments cannot meet increased demand for police, fire, emergency medical, and other services if a primary funding source for local governments is withdrawn. Additionally, HB 2702 places significant administrative burdens on local governments when local officials should be focused on addressing the threats and challenges of COVID-19 in their communities.”

Included in that bill was the “Truth in Taxation” bill, which would have required city and county officials to vote on the entirety of any tax increase they wish to impose, rather than hiding increases behind valuation increases and mill rate tricks.

Not only did the bill pass with bipartisan supermajorities — in both chambers — but was supported by 75% of Kansas voters in a recent poll.

Meanwhile, counties are using taxpayer money to fight reforms like the Truth in Taxation bill, and the City of Overland Park is proposing a 6 percent property tax increase.

Trabert said the federal stimulus money provides the opportunity to give property tax relief.

“You’ve already allocated $400 million of the $1.25 billion received from Congress to local governments,” he wrote in his letter. “Giving $250 million in much-needed property tax relief would still leave $650 million for the state to spend.

“Homeowners and business owners need a break in these stressful economic times. You have the authority and the federal stimulus funds to make life a bit easier for millions of people.”