City and county officials often justify tax increases as being necessary to provide services demanded by residents. But if they oppose a service you want (like property tax relief), they use your money to fight legislation requiring it, as they did with Senate Bill 294.

SB 294 required cities and counties to vote on the entire property tax increase they impose, whether from mill levies or valuation hikes. At least 75% of voters supported having local officials be honest, but even after the bill unanimously passed the Senate, 36 counties and 13 cities, along with the League of Kansas Municipalities and the Kansas Association of Counties submitted opponent testimony in the House Taxation Committee.

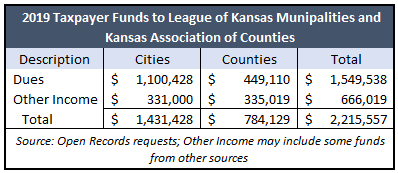

The League of Kansas Municipalities and the Kansas Association of Counties provide policy and lobbying services for their members, and they’re funded with more than $2 million in dues and other fees from cities and counties — money they collected from taxpayers. Cities paid $1.1 million in dues to the League last year and counties paid almost $450,000 in dues. Both organizations provided the data in response to Open Records requests and said some of the Other Income may not all be from cities and counties.

The League of Kansas Municipalities and the Kansas Association of Counties provide policy and lobbying services for their members, and they’re funded with more than $2 million in dues and other fees from cities and counties — money they collected from taxpayers. Cities paid $1.1 million in dues to the League last year and counties paid almost $450,000 in dues. Both organizations provided the data in response to Open Records requests and said some of the Other Income may not all be from cities and counties.

Senate Tax Committee Chair Caryn Tyson (R-Parker) said Governor Kelly bailed out cities and counties when their lobbying efforts failed.

“Taxpayer dollars were used to pay for lobbyists who advocated against property tax transparency – exposing the shell game of ‘why did my property taxes increase’. The lobbyists were unsuccessful when a bi-partisan supermajority of legislators voted in the best interest of the taxpayer. The Governor disregarded taxpayers and legislators when she sided with the taxpayer-funded lobbyists by vetoing the bill.”

Representative Ken Corbet (R-Topeka) minced no words in his criticism of the process.

“When the Governor sided with the lobbyists to keep Kansas property taxpayers from getting the tax breaks, it’s like the old song says … the lobbyist for the municipalities and counties got the gold mine and the taxpayers got the shaft…growing government and NOT Kansas. Money walks. This is one of the big reasons Kansas Ranks # 5 for Outward Migration.”

Not all local officials lobbied against taxpayer interests, however. Linn County Commissioner Rick James, Sedwick County Commissioners Jim Howell and Pete Meitzner, and Sheridan County Commissioner Wes Bainter testified in support of property tax relief.

Bainter says too many elected officials feel entitled to more tax dollars and don’t hesitate to trample on taxpayers to get their way.

“The arrogance of our governor is unbelievable! The taxpayers in Kansas have been and continue to be thrown under the bus. The problem with this unbridled arrogance is that these officials vested with the power to tax never never never ever get enough tax dollars!

“When do the taxpayers receive fair and equitable treatment? And now to add insult to injury our tax dollars are used to pay lobbyists to get even more tax dollars.”

Local elected officials opposed other forms of property tax relief, including:

- SB 295, which would have prevented valuation increases on homeowners solely for routine maintenance and replacement.

- SB 272, prohibiting county appraisers and the state board of tax appeals (BOTA) from increasing the valuation of county appraised property in valuation appeals.

- SB 266, requiring appraisal courses for county appraisers and BOTA members to be approved by the Kansas real estate appraisal board.

SB 295 was in the bill that passed both chambers of the legislature but was vetoed by Governor Kelly. The others were approved by the Senate but died in the House Tax Committee, which also attempted to scuttle Truth in Taxation because the majority of members didn’t want to impose extra work on local government.