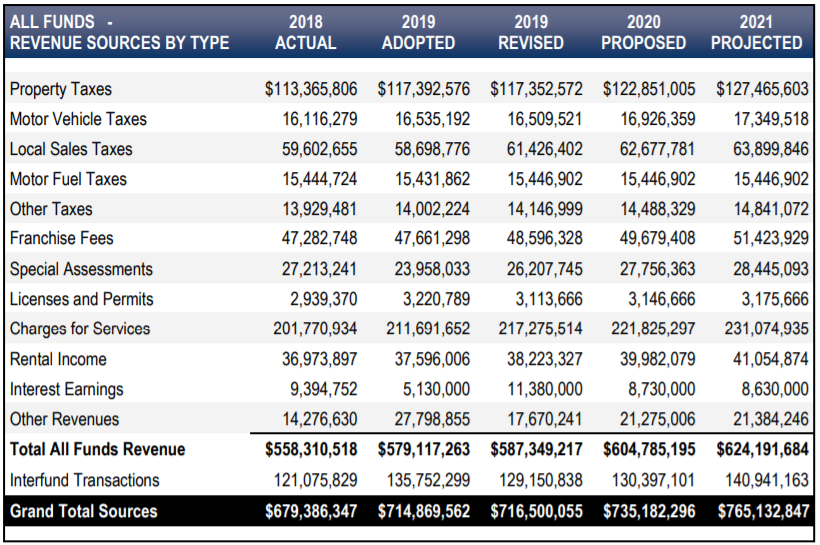

The City of Wichita presented the 2020 city budget to City Council on Tuesday but didn’t mention that the budget includes a $5.5 million increase in property tax revenue. The presentation focused on the mill rate remaining flat, but valuation increases are causing property tax revenue to increase by 4.7%, from $117.4 million to $122.9 million. The budget also anticipates a 3.8% property tax increase next year, to $127.5 million. Inflation was below 2% last year and this year.

Sales tax revenue is only projected to increase by 2%, indicating city officials think taxable retail activity will show little if any, real growth above inflation.

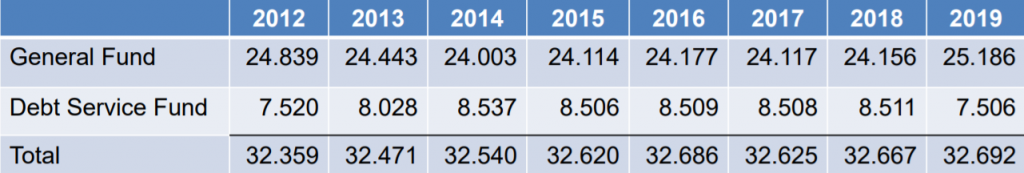

The presentation also included the capital improvement budget for the next ten years. In voting unanimously to adopt the proposal, city councilors approved a property tax rate of 32.692 mills. According to City Manager, Robert Layton, the Council’s vote on property tax had a purpose.

“You will be locking in the dollar amount for the budget,” says Layton. “At the next hearing, if you decide to add expenditures, you will need to offset that with reductions.”

Despite tax and other revenue increases, the city is projected General Fund deficits in the near future; $1.7 million in 2021, $1.6 million in 2022, and $2.4 million in 2023.

According to Mark Manning, Budget Officer for the City of Wichita admitted that debt is likely to increase.

“We do expect our debt levels to increase and our metric to increase over the next several years, but we do expect to be within the benchmark level,” said Manning.

According to the budget presentation property tax of 32.692is about the same rate for 2019. The tax rate for the general fund is 25.186, with 7.506 mill levy going toward debt service. The total mill rate is just 0.1% higher, but the portion allocated to General Fund spending is 4.3% higher; the amount allocated to debt service is reduced to keep the overall rate about the same, but that cut is part of the reason the city’s outstanding debt is likely to increase.

Before putting together this year’s budget, the city released an online budget simulator on the city’s website for residents to provide input about where they would prefer how city money is spent. There were 1,400 respondents. The results were focused on increased spending for fire and police. To that end, the city is allocating more money in the budget and capital improvement plan (CIP).

The police budget is increasing to add 20 officers and 11 civilians. CIP spending includes $93 million for police and fire, including $28 million for rebuilding four police stations, $10.1 million for rebuilding three fire stations. This is in line with the community response to the budget simulator.

“This is a priority we consistently hear from residents,” says Manning.

The city did overhaul some areas to save $1,000,000 by upgrading computers instead of replacing, and changing pensions management fees, outsourcing mowing in the park department and rebuilding fire apparatus instead of purchasing new.

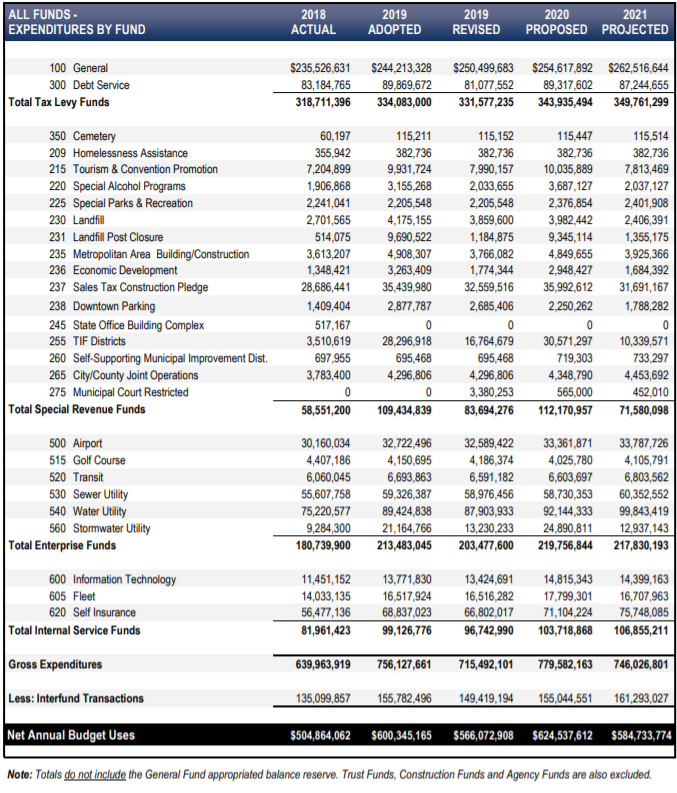

Total expenditures proposed for 2020 is $624.5 million; that’s a 10.3% increase over this year’s estimated $566.1 million, which would be 12.1% higher than 2018 actual spending of $504.9 million.

The next steps for the budget are an August 6th hearing and August 13th adoption at the City Council.