If Osage City School Board President Jay Bailey can convince a few other board members, the district may slightly decrease property taxes in next year’s budget. The state’s new Truth in Taxation law requires school boards and other local government officials to vote on the entire property tax increase they impose, and they must announce their intentions by July 20.

Mill rates now automatically decline so that new property valuations produce the same dollar amount of property tax. County clerks have calculated each Revenue Neutral Rate (RNR) and property tax revenue for each local unit of government will remain the same as this year unless officials vote for an increase.

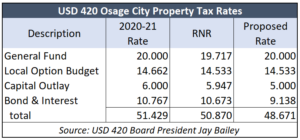

Most school districts have two to four property tax rates, and by law, board members must take a separate public vote on each rate if they want to increase. Every district must charge 20 mills for their General Fund. The Osage City RNR General Fund rate is 19.71 and board members must vote to raise it to 20, but they can offset that increase with declines elsewhere.

Jay Bailey, who is both a county commissioner and the school board president, says taxpayers deserve a break from excessive taxation.

“Osage City USD 420 should take the lead and do what is right and reduce the property  taxes. We need to lead by example and then maybe other entities of government will follow. The Osage County Commissioners have already signed on not to go above the RNR, it only makes sense for all the other entities to follow.”

taxes. We need to lead by example and then maybe other entities of government will follow. The Osage County Commissioners have already signed on not to go above the RNR, it only makes sense for all the other entities to follow.”

Bailey’s intention is to reduce the Capital Outlay rate to 5 mills; it is 6 mills this year and the revenue neutral rate is 5.947. He wants to reduce the Local Option Budget mill rate from 14.662 to the revenue neutral rate of 14.533, and he wants the Bond & Interest to drop from 10.767 to 9.138, which is lower than the revenue neutral rate.

Concurrent hearings for school property tax rates

Some districts have questioned whether they need to have a single RNR hearing for one overall rate or for each separate tax rate.

Craig Neuenswander, Deputy Commissioner of Finance for the Department of Education, confirmed in an email to USD 420 Superintendent Troy Hutton, that a vote must be taken on each mill rate.

“HB 2104 does imply one revenue neutral rate for each taxing subdivision. However, since school districts have different assessed valuations for some funds (such as the general fund) it does not work to provide one revenue neutral rate. As a result, county clerks and the state municipal accounting division made the decision to provide multiple revenue neutral rates for school districts.”

The revenue neutral rate hearings can be held concurrently, but there must be separate discussions and votes for every school district property tax rate.