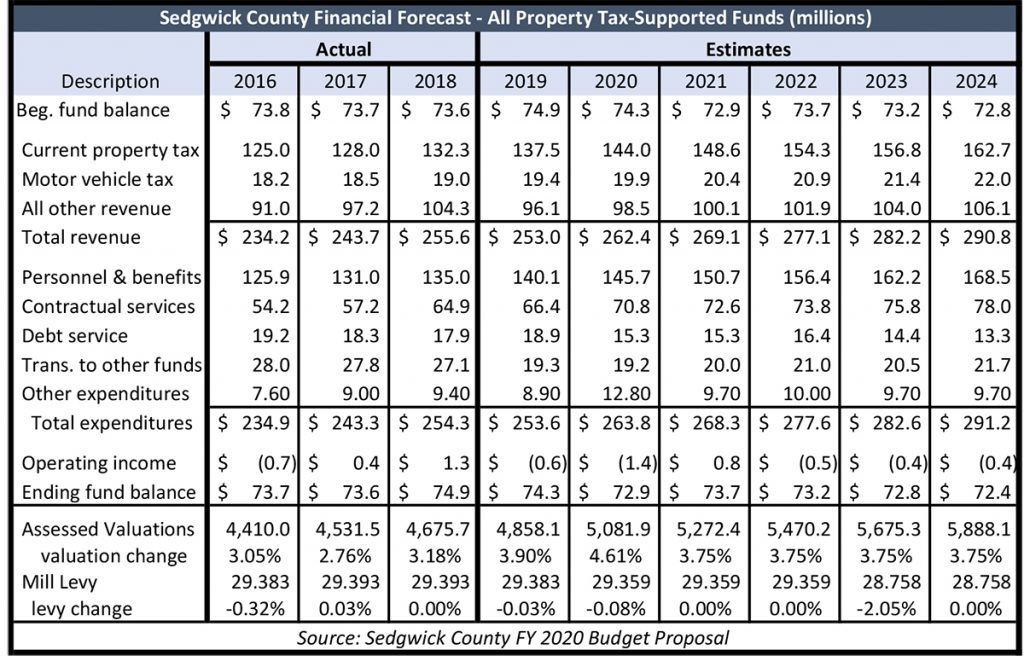

With inflation holding steady below 2% annually, Sedgwick County’s proposed 2020 budget predicts an 18% property tax increase over the next five years (2019-2024) and a 20% jump in personnel and benefits. The property tax increase would come from anticipated valuation changes of roughly 4% per year, including new construction and not much change in the mill rate.

Sedgwick County’s Chief Financial Officer Lindsay Poe Rousseau trumpeted the county’s ability to stay under the state-mandated tax lid but did not reference the increase in property valuations.

“Sedgwick County Finance produces a five-year financial forecast. County staff is not able to validate the 30% increase in taxes over eight years [2016 to 2024]. The County’s five-year forecast currently includes a projection of a lowered tax rate in 2023 and 2024,” said Rousseau. “In 2015 and 2016, the Sedgwick County Commission advocated for the State Legislature to implement a property tax lid, which limited the amount that property taxes could increase to an adjusted Consumer Price Index rate, the most common measure of inflation, with some exceptions for things like State and Federal mandates, certain public safety expenses, and a few others.”

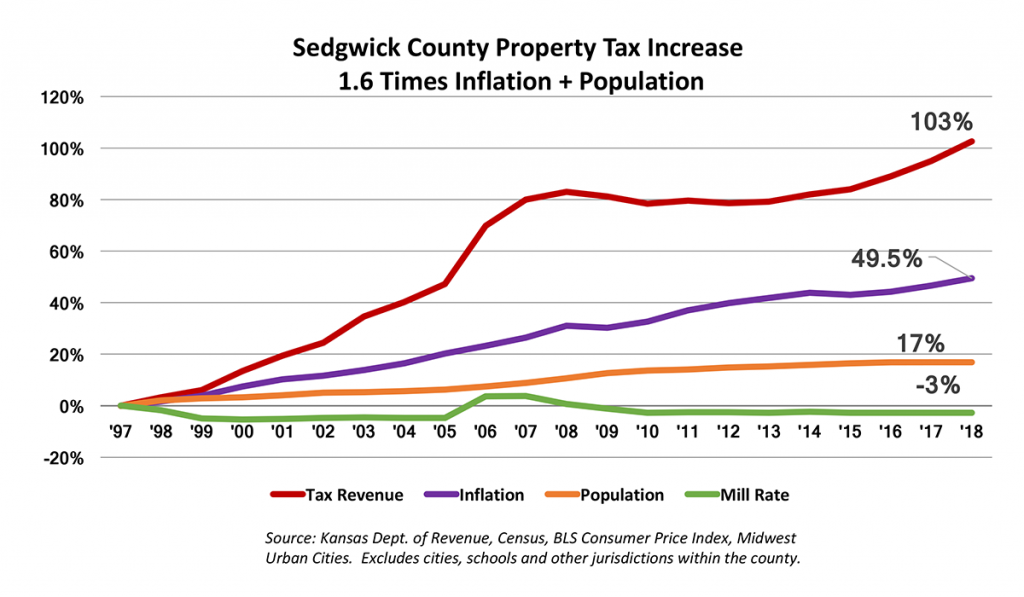

Property tax revenue from new construction is also exempt from the lid, which requires voter approval to exceed. Sedgwick County has stayed below the lid limits, but property tax is still growing fast. Between 1997 and 2018, property tax climbed 103%, or 1.6 times the combined rates of inflation (49.5%) and population (17%).

Sedgwick County property tax rates aren’t very competitive, according to the Lincoln Land Institute, Their latest 50-state comparison of effective property tax rates (property tax as a percentage of appraised value) shows commercial property owners pay the 14th highest ETR in the nation among the 50 states; their analysis compares rates in the largest cities of each state. Homeowners pay the 28th highest rate. Commercial property pays a higher rate because it is assessed at 25% of the appraised value, versus 11.5% for residential.

The budget report says, “While the economy continues to improve, the County will continue to be challenged by expenses that exceed revenues.” Elsewhere, the report says, “In other words, the county will continue to spend more than it has.” And yet, spending on pay and benefits this year of $140 million is 11% higher than in 2016 while inflation is about half that much. The county also projects pay and benefits hitting $168.5 million in 2024 or 20% more than this year.

The warning about overspending is notable given the county consistently has more than $70 million in unencumbered cash reserves each year. Yet, at the recent Sedgwick County Commissioners meeting which saw the introduction of the budget, several people spoke about the decrease in funding to community programs such as Meals on Wheels, which helps deliver hot meals to seniors and those with disabilities. The program is one of the accreted value within the community. Derby resident Jim Burgess appreciates continued funding of the senior center but does not understand the cuts to needed programs.

“It does puzzle me however why you choose not to include funding that was requested in the amount of $31,798 for meals on wheels in Wichita when there are people in the city who cannot be served through the lack of funding,” says Burgess.