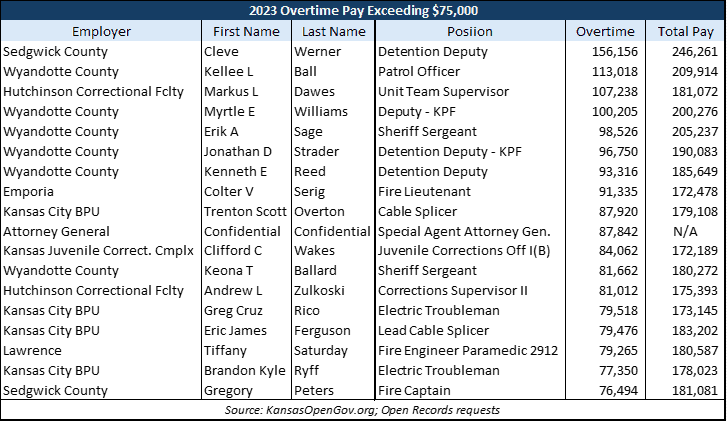

More than $50,000 in overtime was paid to 33 municipal employees in Kansas in 2023. There were 28 county workers, primarily in law enforcement, who cleared the $50,000 level in OT last year, with three of them topping $100,000, according to research available on kansasopengov.org. The State of Kansas had 34 employees collecting more than $50,000.

The number of hours worked to accumulate these additional incomes raises questions about employee “burnout” and its effect on workers and public safety. It also raises costs to taxpayers, including future pension liabilities, if these amounts occur in the final years of an employee’s career when retirement income is determined.

The Kansas City Board of Public Utilities had 18 of the employees earning $50,000 or more. We asked Nick Moreno, BPU’s Communications Coordinator, how much control the agency exercises over additional hours worked:

“Any overtime must go through a formal approval process and be approved by reporting managers and/or senior staff. The majority of BPU workers identified are Journeyman Lineman. Due to nationwide lineman shortages and a tight labor market, utility companies must offer competitive wages to attract and maintain an experienced, competent labor force in this niche area. Widespread outage events caused by severe weather (e.g., wind, hail, tornadoes, ice, etc.) or other factors may require significant amounts of overtime during certain extended periods to ensure the quick, safe restoration of power in our community. Additionally, BPU provides mutual aid to other communities experiencing widespread power outages – and many of these linemen volunteer to serve these other communities when BPU is called upon to assist. While linemen receive overtime for this community service in other parts of the country, wages and expenses are paid and reimbursed to the BPU by FEMA.”

What about worker safety with the additional hours on the job?

“The public is aware of the critical role BPU plays in providing dependable and reliable electric and water service to our community, including the efforts that BPU takes to restore power during and following major outage events. BPU operates within its approved budget and is conscious to use rate funding appropriately.”

The Johnson County Sheriff’s Department had the most employees listed at the $50,000-and-above level. We asked Public Information Officer McKenzi Davis what role vacancies in the ranks of law enforcement play in overtime amounts:

“Historically, the Sheriff’s Office has experienced a significant portion of its overtime burden due to unfilled vacancies. However, we are now approaching a nearly fully staffed posture. Currently, most of the overtime is attributable to various standard management issues, including:

- Vacation

- Training

- FMLA

- Sick Leave

- Military Leave

“For instance, state statute mandates that all Kansas commissioned law enforcement officers complete 40 hours of in-service training annually. Nearly 500 of our 713 staff members require this training. Additionally, most of these commissioned deputies work in 24/7 assignments, necessitating their positions to be backfilled with overtime while they are training.

“There is always a risk of burnout in law enforcement work, and overtime undoubtedly exacerbates this risk. The optimal solution for our staff and our taxpayers’ resources would involve creating a “relief factor”— essentially overstaffing positions to manage these vacancies with regular wage hours instead of overtime. The Sheriff is actively discussing this agenda with our Board of County Commissioners.”

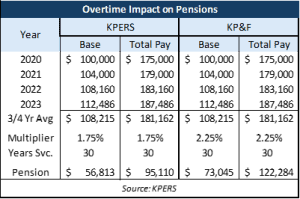

Overtime significantly increases pension costs

Excessive overtime and deferred income also significantly increase pension costs that taxpayers must fund.

Pensions paid through the Kansas Public Employees Retirement System (KPERS) and the Kansas Police & Fire Retirement System (KP&F) are determined by a formula using the retiree’s final three or four years of earnings. Retirees hired before 1993 can use a 3-year average of final average salary or a 4-year average of total pay.

Pensions paid through the Kansas Public Employees Retirement System (KPERS) and the Kansas Police & Fire Retirement System (KP&F) are determined by a formula using the retiree’s final three or four years of earnings. Retirees hired before 1993 can use a 3-year average of final average salary or a 4-year average of total pay.

The adjacent table shows how $75,000 in overtime impacts the calculation. A KPERS retiree who earned $100,000 in base pay in 2020 and 4% annual increases in their last three years of work would get a pension $56,813 ($108,215 average earnings in the last three years times a multiplier of 1.75% times 30 years of services). The pension jumps 67% to $95,110 if the employee collected $75,000 in overtime each year and used the four-year earnings average.

KP&F pensions are calculated with a multiplier of 2.25%.