There is not much positive effect a state tax policy can have on industries like agriculture and energy, the two heavy hitters in Kansas, but on new businesses the effect can be significant.

According to Kansas Secretary of State Kris Kobach, new business filings set a record in 2016, and the total number of business enterprises set a record as well.

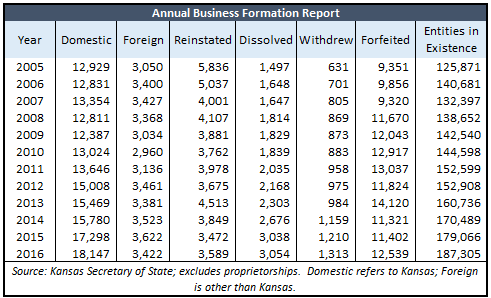

The numbers tell an interesting tale. In the years before Sam Brownback took office in 2011, new business creation in Kansas had essentially flatlined. In 2010, there were 13,024 new business filings, only 95 more filings than in 2005. During that six-year period, Kansas added fewer than 20,000 new businesses.

Since tax relief passed in 2012, the numbers picked up dramatically. 2016 numbers exceeded 2011 numbers by 4,500 and 2012 numbers by more than 3,000. In each year since 2012, the numbers have gone up. Today, there are 35,000 more business entities in existence than there were in 2012, for a total of more than 187,000 such enterprises.

As studies have shown, new business formation drives job growth. Optimism here must be tempered, however, by the shift in political winds. As the Kansas Policy Institute observes, “Legislative efforts to repeal the exemption on pass-through income for small business and significantly increase income taxes on individuals will likely derail business formation and negatively impact the economy.”