Curt Skoog, a candidate for Overland Park mayor, made some false claims about Kansas Policy Institute and me personally at a candidate forum hosted by the Shawnee Mission Post. Some false claims may not have been deliberate – he may have just been repeating what he had heard – but the record needs to be set straight nonetheless.

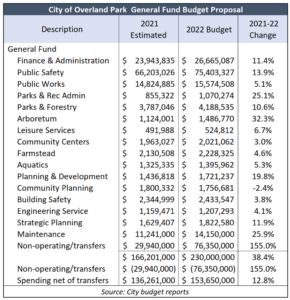

Mike Czinege, Skoog’s opponent, said the city could have avoided a 10% property tax increase if the budget didn’t include double-digit spending increases in areas like Finance & Administration, and Planning & Development. Czinege said a resident made those suggestions at the revenue-neutral property tax hearing, but City Council ignored them.

Skoog’s response, at about the 15:50 mark, was to attack me and Kansas Policy Institute.

“The person he is referring to is the Kansas Policy Institute. The Kansas Policy Institute is the ultra-conservative think tank in Topeka that was the advisor to Sam Brownback when he almost drove our state into bankruptcy. The reason we didn’t respond is because his numbers are biased.”

I won’t bother addressing the ‘ultra-conservative’ label, other than to say everyone is entitled to their own interpretation. But let’s unpack the false accusations, starting with the first sentence.

- Our office and my residence are in Overland Park, not Topeka. KPI doesn’t have a Topeka office.

- KPI did not advise Governor Brownback on his tax plan. As we documented in What was Really the Matter with the Kansas Tax Plan, the plan was developed by Brownback’s staff and KPI disagreed with the plan structure. We testified that the way to cut taxes was to simply reduce marginal tax rates for everyone and pay for the revenue reduction by operating more efficiently.

- Brownback had a lot of help from Democrats and some Republicans in creating the budget issues. They increased spending — setting several new records — and shunned many cost-saving opportunities.

The numbers I presented in the adjacent table are not biased; that is government-speak for ‘I don’t like what the numbers show.’ The numbers come from the Overland Park budget document and show double-digit increases budgeted over this year’s estimated spending, like an 11% increase in Finance & Administration, a 20% increase in Planning & Development, and a 12% increase in Strategic Planning.

The numbers I presented in the adjacent table are not biased; that is government-speak for ‘I don’t like what the numbers show.’ The numbers come from the Overland Park budget document and show double-digit increases budgeted over this year’s estimated spending, like an 11% increase in Finance & Administration, a 20% increase in Planning & Development, and a 12% increase in Strategic Planning.

The city could have shaved those large increases to keep property tax flat, and the city would still have an 8% General Fund spending hike…including the new initiatives proposed for mental health, police, and cybersecurity.

Residents weren’t supposed to know about the big spending increases in many departments. Skoog and others on City Council said the 10% property tax increase was necessary to pay for the new initiatives, and they didn’t appreciate the truth being told at the hearing.

If council members believe double-digit increases in back-office functions are critical, they should explain their rationale. They do themselves and their constituents a disservice when they try to cover up spending hikes by attacking people who ask questions.