The Truth in Taxation transparency measure vetoed by Gov. Laura Kelly last year is back as SB 13, which requires city and county officials to be honest about the property tax increase they impose. Lawmakers didn’t have a chance to attempt a veto override due to a COVID-related shortened legislative session in 2020.

On only the second day of the 2021 legislative session, a hurried Senate Assessment and Taxation committee hosted a hearing on SB 13, which would also require local governments to publish notice and host public hearings prior to increasing property taxes.

Currently, local officials vote to approve budgets–not tax rates. Once a city or county adopts a budget, the city clerk calculates the tax rate required to generate enough money to cover the budget.

Eric Stafford, Vice President of Government Affairs at the Kansas Chamber, told the committee that city and county officials can increase taxes without voting to do so by relying on increased property valuations.

“It’s a stealth tax increase that’s been happening in our state for decades,” Stafford told the committee.

Advocates urge closing the ‘honesty gap’

Dave Trabert, CEO of Kansas Policy Institute (which owns the Sentinel), called it an “honesty gap.” In his written testimony on SB 13, he said the current rules allow county and city officials to say they’re holding the line on taxes even when property owners are paying more year-over-year in property taxes.

KPI analyzed tax rates in 50 of the largest cities and counties to reveal an average property taxes increase of almost 4% this year, which is about four times the inflation rate. But local officials insist they aren’t raising taxes. For example, Johnson County touts a small reduction in the mill levy rate in its budget message to taxpayers, but there’s a 4.3% tax increase buried in the budget.

“This is a 6% honesty gap,” Trabert said. “Elected officials are pretending taxes are going down 1.7% when it’s really a 4.3% increase. And these are not isolated incidents.”

Douglas County’s 2021 budget book boasts a flat mill levy rate in recognition that COVID-19 resulted in economic hardship for its residents. But in a classic ‘bait-and-switch,’ Douglas County will collect 4.8% more from property taxes.

“Taxpayers deserve better,” Trabert said. “Douglas county points out their mill levy remains flat. But that doesn’t mean they aren’t raising property taxes. This is the epitome of the Kansas property tax honesty gap. Local officials speak only of mill rate changes, but ignore the backdoor increase from valuation changes on property.”

The 1997 to 2019 honesty gaps for every county and many cities are at KansasOpenGov.org.

SB 13 is modeled after Utah, Tennessee laws

The Truth in Transparency legislation is modeled after laws in Utah and Tennessee, where similar laws have existed for more than three decades.

Trabert says the laws have helped both states maintain and even lower property tax rates. Utah’s effective property tax rate dipped by 7.5% between 2000 and 2018. During the same timeframe, Kansas’s effective property tax rate climbed by 22%.

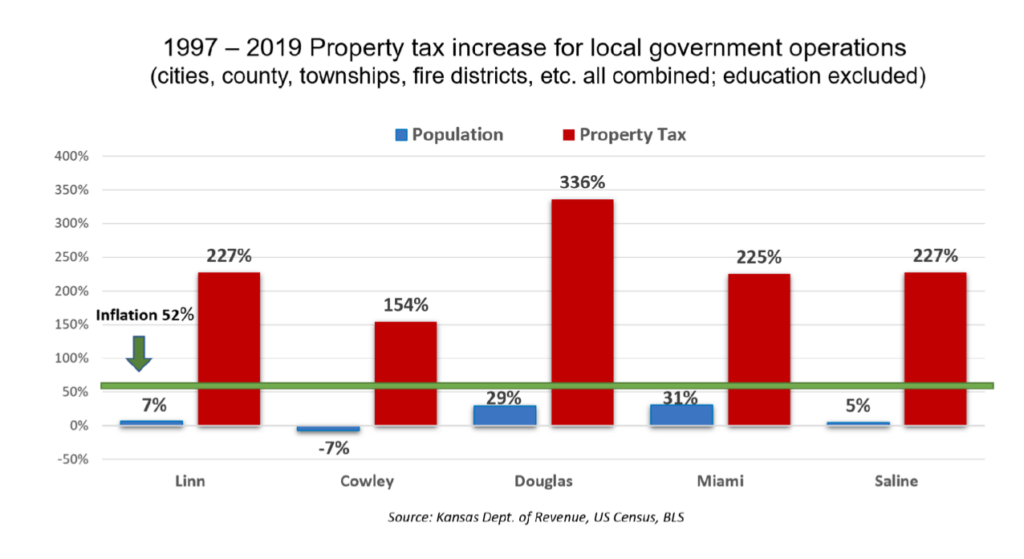

The long-term economic impact on individuals and businesses is devastating. Property tax for local government operations in Saline County jumped 227% between 1997 and 2019 while inflation was 52% and the population was only 5% higher.

The proposal doesn’t prevent cities and counties from raising taxes. However, it does require local elected officials to vote on the entire property tax increase, whether the increase is the result of higher property values or higher mill levy rates.

“If they want to raise revenue-neutral mill rate, they must notify taxpayers of their intent and hold public Truth in Taxation hearings to accept taxpayer input,” Trabert said. “Afterward they must vote on the entire tax increase they decide to impose. This is one of the most important issues Kansans are facing right now. They want to be heard. Our legislators need to listen.”

KPI created a ‘bee honest’ website and a petition urging lawmakers to quickly revisit the Truth and Transparency legislation this session. The nonprofit hopes to put the bill on Gov. Kelly’s desk early so lawmakers have time to override her veto.

Others testifying in support of SB 13 include Americans for Prosperity, the National Federation of Independent Businesses, and the Kansas Realtors. The League of Kansas Municipalities testified neutral and there were no opponents.

Kelly’s veto related to burdening local officials

Kelly said in her veto message last year that the legislation would “place significant administrative burdens on local governments when local officials should be focused on addressing the threats and challenges of COVID-19 in their communities.”

“Now is not the time to create more problems and burdens for local governments,” Kelly said.

Trabert hopes Kelly will prioritize taxpayers’ needs this time around and not veto SB 13.

Chair of the Senate Assessment and Taxation Committee, Sen. Caryn Tyson, a Parker Republican, anticipates the legislation advancing swiftly this session.

“It is language we’ve heard before. This passed by both chambers by a supermajority. It was vetoed by the Governor, and we’re going to take a second run at it,” she said.