USD 469 Lansing last week published on its website an advertisement entitled “Revenue Neutral Rate Explained” designed to encourage support for a 12% property tax increase later this year that made several false and misleading claims. But when asked to substantiate those claims by the Sentinel, Superintendent Dan Wessel would not respond.

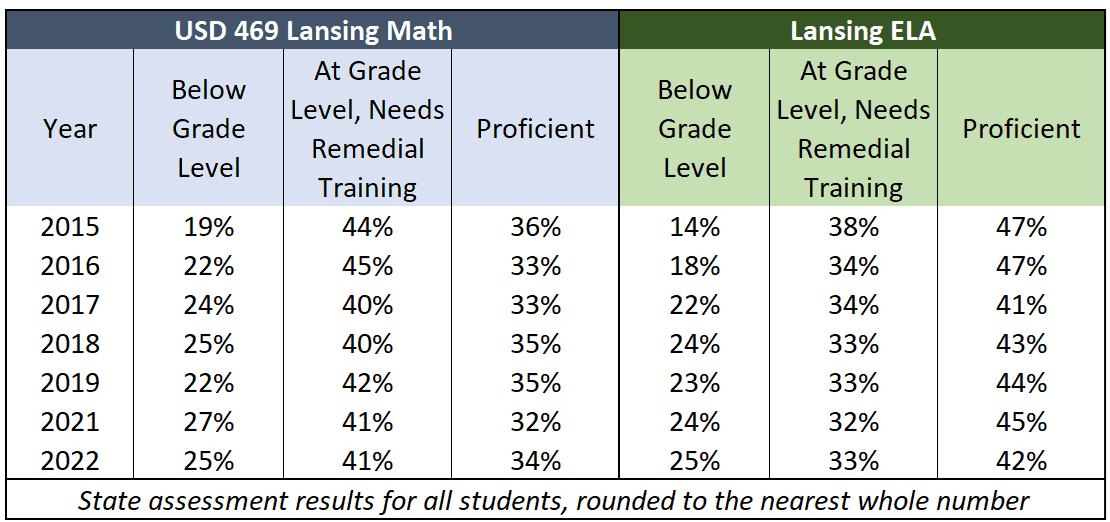

One claim in the ad says, “Property values are directly tied to the success and achievements of the school district. Our home values here in Lansing are high due to how amazing Lansing USD469 (sic) for students.” That simply is not true. Home values for property tax purposes are determined by the County Appraiser based on market conditions, not student achievement results. Further, state assessment results for USD 469 are relatively low and declining. A quarter of all students are below grade level in reading and math, only a third are proficient in math and just 42% are proficient in reading.

One claim in the ad says, “Property values are directly tied to the success and achievements of the school district. Our home values here in Lansing are high due to how amazing Lansing USD469 (sic) for students.” That simply is not true. Home values for property tax purposes are determined by the County Appraiser based on market conditions, not student achievement results. Further, state assessment results for USD 469 are relatively low and declining. A quarter of all students are below grade level in reading and math, only a third are proficient in math and just 42% are proficient in reading.

Bollin responded, saying, “I believe the health and success of a school district does help raise and sustain property values. One of the top factors people look at when making a move is the school district. That being said there are many other factors that affect property values as well.”

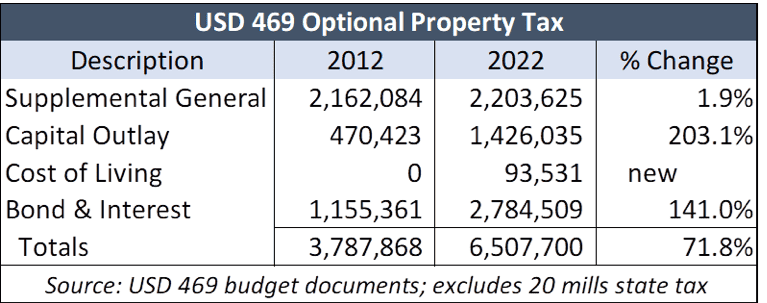

Text associated with the ad says the district is “proud” to hold its mill rate flat “for many years,” but that statement obscures large property tax increases imposed by the school board. District budget documents show a 72% local property tax increase over the last ten years.

The Local Option Budget tax is only 2% higher, but the Capital Outlay tax jumped 203% and there is a 141% tax increase to make bond and interest payments.

The Local Option Budget tax is only 2% higher, but the Capital Outlay tax jumped 203% and there is a 141% tax increase to make bond and interest payments.

Bollin confirmed that the mill rate has been flat and also said, “The increase of 72% in property taxes is based off property valuations which the school district does not control.”

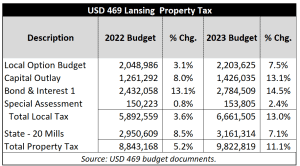

School districts don’t control valuations, but they do control the amount of property tax they impose. Last year, for example, the USD 469 board voted to increase local property tax by 13%. School districts are required to impose a 20 mill tax for state funding, and that tax increased 7.1%.

The basic tenant of the RNR law, passed in bipartisan fashion in 2021, prohibits local governments, including school districts, from increasing property taxes and spending more money year to year without holding a public hearing and explaining their decision and voting on the increases. The law’s intent is to keep local officials honest about the tax increases they impose.

In June, county clerks calculate the revenue neutral rate for each local taxing subdivision. Mill rates are automatically reduced so that new valuations produce the same dollar amount of property tax. If elected officials want to collect more property tax, they must notify taxpayers of the proposed tax increase, hold a public hearing and then vote.

The Lansing ad says, “If the board votes to exceed the revenue neutral rate, the increase in all other funds will be approximately $769,555 (.003871 mills X 198,800,000).” But the vote is not “to exceed the revenue neutral rate;” it is to impose specific mill rates and property tax increases. County Clerk Janet Klasinski notified the district that valuations used for the LOB, capital outlay, cost of living, and debt service increased 11.7% to $199,126,268. Holding the mill rates flat, which is what the ad actually proposes, is therefore an 11.7% property tax increase.

Wessel has also said the district would lose state aid if it doesn’t increase local property tax, but that is also not true.

The Sentinel also asked Superintendent Wessel and Board President Jeff Bollin if the advertisement, now taken down from the USD 469 website, had been vetted and approved by the board. Wessel didn’t respond but Bollin said the board had no input on the ad. Board Vice-President Amy Cawvey, who was also copied on the Sentinel’s email, was critical of Wessel’s action:

“This was not board approved. We knew nothing about it. Or at least most of the board didn’t. I have asked our board president. In my opinion, this is trying to usurp the role of the board.”

The Leavenworth Times reports that Wessel is leaving later this month to be superintendent of USD 341 Oskaloosa, a district with much smaller enrollment.

Editor’s Note: this article has been updated to include comments from Jeff Bollin provided to the Sentinel on June 19, 2023.