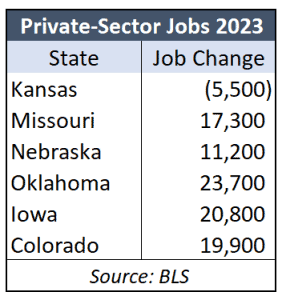

Kansas is the only state in the region that has lost private-sector jobs so far in 2023 according to statistics from the U.S. Bureau of Labor Statistics (BLS).

While Kansas lost 5,500 private-sector jobs since December Oklahoma added almost 24,000. Missouri added 17,300 jobs, Nebraska gained 11,200, Iowa added 20,800 private-sector jobs and Colorado had an increase of almost 20,000.

While Kansas lost 5,500 private-sector jobs since December Oklahoma added almost 24,000. Missouri added 17,300 jobs, Nebraska gained 11,200, Iowa added 20,800 private-sector jobs and Colorado had an increase of almost 20,000.

Neighboring states seem to be benefitting from a much more competitive tax and regulatory environment, while Kansas Governor Laura Kelly vetoed tax relief that would have saved taxpayers about a half billion dollars annually.

While Kansas is ranked #30 for economic outlook in the 2023 edition of “Rich States, Poor States,” released by the American Legislative Exchange Council, Oklahoma is fifth-best in the nation. The economic outlook ranking is based on 15 policy variables that include personal income tax rates, property tax burden, recently legislated tax changes, debt service, size of government, court systems, workers’ compensation costs, and other factors.

Iowa:

For Joe Murphy, President of the Iowa Business Council, the answer is a reduction in tax burden:

“We’ve put in a lot of key policies with respect to workforce development, realigning our workforce development initiatives here at the state level. Most importantly, I think, you’d have to look at the tax reform packages that were passed in 2022, so that gives us a great sense of optimism not just in the short term, but the long term.”

TABOR (Taxpayer Bill of Rights)

The TABOR Amendment, which was approved by voters in 1992, limits the amount of revenue the State of Colorado can retain and spend.1 Specifically, TABOR allows the state to retain and spend an amount based on the prior fiscal year’s actual revenue or limit, whichever was lower, grown by Colorado inflation and population growth and adjusted for any “voter-approved revenue changes.”

- Tax expenditure limits such as the Hancock Amendment, prohibiting state tax revenue from exceeding 5.6% of personal income.

- Property tax credits for Missouri senior citizens and the disabled

“The increase in the leading indicator suggests the economy will grow through the end of 2023,” said economist Eric Thompson, director of the Bureau of Business Research, department chair and K.H. Nelson College Professor of Economics.

The six components of Nebraska’s leading economic indicator are business expectations, building permits for single-family homes, airline passenger counts, initial claims for unemployment insurance, the value of the U.S. dollar and manufacturing hours worked.

Additionally, the Cornhusker State this year passed a six-year, $6.4 billion tax cut package aimed at personal, business, and property taxes, along with child care tax credits.

Conversely, Kansas failed this year to enact a package of personal, business, and food sales tax cuts, as well as a constitutional amendment limiting increases in real property appraisals. The state this year received its lowest score in the Rich States, Poor States survey ranking the economic competitiveness and outlook of states.

Kansas Senate President Ty Masterson called for tax reform in 2024:

“The alarming statistics reveal the reality that Kansas cannot simply buy economic growth and job creation over the long haul via incentives. We must pursue systemic reform, such as the tax package the governor vetoed, that puts Kansans on a glide path toward sustainable prosperity.”