County Commissioner Becky Fast is on record saying affordable housing options are a top concern for her constituents, but odds are that she will effectively vote for a big rent hike this summer. That is symptomatic of what President Reagan called the nine most terrifying words in the English language: I’m from the Government, and I’m here to help.

Government actions like property tax increases and burdensome regulations have a major impact on rents and home prices. Elected officials help create a problem, then they rush in with subsidies and more regulations to ‘solve’ it…and make matters worse in the process.

Johnson County’s proposed budget for 2023 is being ‘sold’ as a small mill rate reduction, but the reality is a property tax hike of more than $16 million.

However, the increase for many residents will be higher than average because home values and apartment values are going up more than the increase for all property classifications. Apartment values shot up 21%, so even with a small levy cut, county commissioners will sock landlords with a 17% tax increase that will quickly result in much higher rents. The average increase for other residential values will be a little over 7%.

Coincidentally, $16 million is also the amount proposed for employee pay increases and a few new hires. That would amount to almost a 9% payroll increase.

County Manager Penny Postoak Ferguson expresses a great desire to reward and retain county employees in the budget presentation, but concern for taxpayers is missing in action. Some residents and business owners are still struggling to recover from the government-imposed shutdowns during the pandemic. Now everyone is being hammered by runaway inflation (caused by ridiculous federal spending and other government action), and Johnson County officials want to add to the burden with an unnecessary tax increase.

The budget predicts an ending balance in the General Fund of $197 million, which is $93 million higher than the County’s ‘Policy Target.’ How can anyone justify voting for a tax increase with that much excess money sitting in the bank?

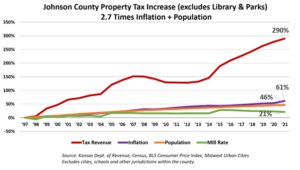

Property tax is already too high in Johnson County. According to the Kansas Department of Revenue, county commissioners have increased property tax by 290% since 1997. That is nearly three times the combined increases in inflation and population.

Paper copies of the proposed budget were provided to The Sentinel by Commissioner Charlotte O’Hara. She asked County Budget Manager Scott Neufeld for an electronic copy, but he told her, “It’s not scanned yet.” That’s just another example of county officials trying to keep taxpayers in the dark, as the documents in the budget book clearly already exist electronically.

The County still had not posted an electronic version of its proposed budget at press time.

It’s time for the game of commissioners hiding behind big valuation jumps so they can pretend to cut taxes to come to an end. County residents should write to each commissioner and ask how they can justify causing big increases in rent and property tax.

Here are their email addresses for your convenience:

ed.eilert@jocogov.org

becky.fast@jocogov.org

jeff.meyers@jocogov.org

charlotte.ohara@jocogov.org

janee.hanzlick@jocogov.org

michael.ashcraft@jocogov.org

Shirley.Allenbrand@jocogov.org